The AMOLED evaporation materials market is on track for significant growth, with revenues expected to surge 24% year-over-year to $2.12 billion in 2024, according to the latest update from DSCC. This growth is set against the backdrop of a 6% compound annual growth rate (CAGR) projected from 2024 to 2028.

Chinese materials manufacturers are poised to increase their market share, with an anticipated growth rate of 16% CAGR. This surge is largely driven by successful localization efforts extending to key materials such as host and dopant materials, a trend that started in 2023.

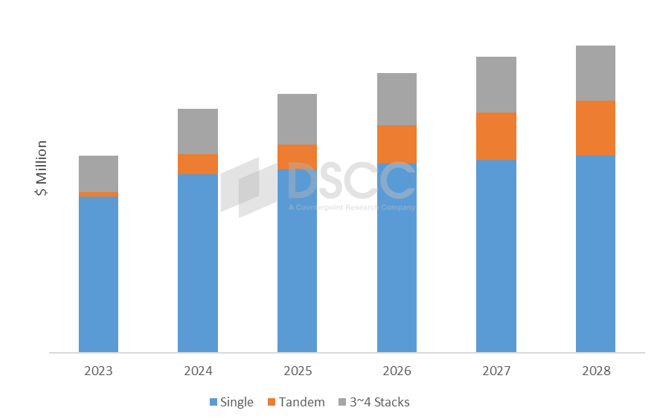

The report highlights that revenues from the tandem structure are expected to grow at an impressive 30% CAGR from 2024 to 2028. In comparison, revenues from single stack and three-four stack structures are expected to see more modest growth rates of 2% to 5% CAGR. The adoption of tandem structures is expanding beyond automotive applications to include tablet and notebook PC products, showcasing significant growth potential.

Universal Display Corporation (UDC), DuPont, LG Chemical, and Samsung SDI are projected to dominate the industry, capturing 51% of revenues in 2024. These companies are anticipated to maintain around 50% of the market share in the coming years.

Phosphorescent blue is identified as the key next-generation material in the OLED evaporation material industry. Despite UDC’s production targets for phosphorescent blue set for 2022, practical applications are not expected until at least the end of 2025 due to the material’s short lifespan. The development of new blue dopants remains a focal point, aiming to enhance lifespan and promote industry growth.