Tight supplies of display panel materials and components, such as driver integrated circuits (ICs), glass substrates and polarisers, are expected to slow the decline rate of LCD panel costs, according to IHS Markit.

Supplies of driver ICs are forecast to tighten throughout 2018, estimated to exceed demand by 4%. Foundries have cut their production capacity of cheap driver ICs, while increasing production of high-profit ICs and large-scale integrations (LSIs), mainly to satisfy orders from industries producing Internet of Things (IoT) and automotive technologies.

In addition, large panel driver ICs are mainly produced using 8″ wafers, but no foundries are making further investments into these wafer sizes as they transition into 12″ wafers. Senior analyst Tadashi Uno commented:

“It seems that panel makers ca

n secure driver IC supplies only by offering higher prices”.

The average driver IC price increased by about 10% during the first half of 2018. Tight supply of driver ICs has impacted the prices of IT panels — such as desktop monitors, notebook PC and tablet PC panels — and has also extended into TV and smartphone panel prices since the third quarter of 2018.

Glass substrates have also been in tight supply since the beginning of the third quarter of 2018. The supply-demand glut during the quarter is below 5%, which is considered a tight supply threshold, taking into account later delivery times. Uno continued:

“Major glass makers are investing in glass-melting tanks in China, but the higher glass consumption of Chinese panel makers means they exceed more than double the glass production capacity of the country. Chinese panel makers also import products from Japan, South Korea and Taiwan, but they are stymied by glass production delays and delivery”.

Polarisers are also in short supply as of the third quarter. In July, film makers, such as Dai Nippon Printing and Nitto Denko, stopped operations for more than a week due to heavy rain in Japan. The production facilities are not damaged directly, but damaged infrastructures, such as roads, waterworks and electric facilities, have caused delivery delays. Logistics issues remain even though operations have resumed.

Senior principal analyst Irene Heo added:

“Non-

TAC polarisers, especially acryl polarisers, were already in tight supply, but the recent floods have made the situation worse”.

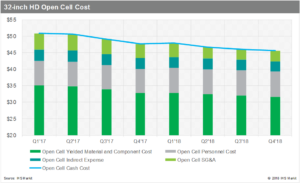

Polariser supply-demand glut is expected to be 4% in the third quarter, below the 5% balance bar. The cash cost of a typical 32″ HD open cell is expected to decline 1.4% year-on-year in the third quarter of 2018. The contraction rate has slowed from 2.9% in the same period last year. Uno concluded:

“The main reason for the slow cost reduction is the increasing price of driver ICs. However, glass substrate and polariser price reductions have been relatively stable”.