Sigmaintell Research of China has released its summary of the global LCD TV panel market in the first half of 2018. Trade friction between big countries and political and economic upheaval is on the rise, while Chinese economic growth is slowing down.

In addition, the fluctuation of the exchange rate has impacted the performance of the major TV markets. Sell-in was lower than expected but the volume of shipments pushed by panel manufacturers still increased considerably compared with the same period last year.

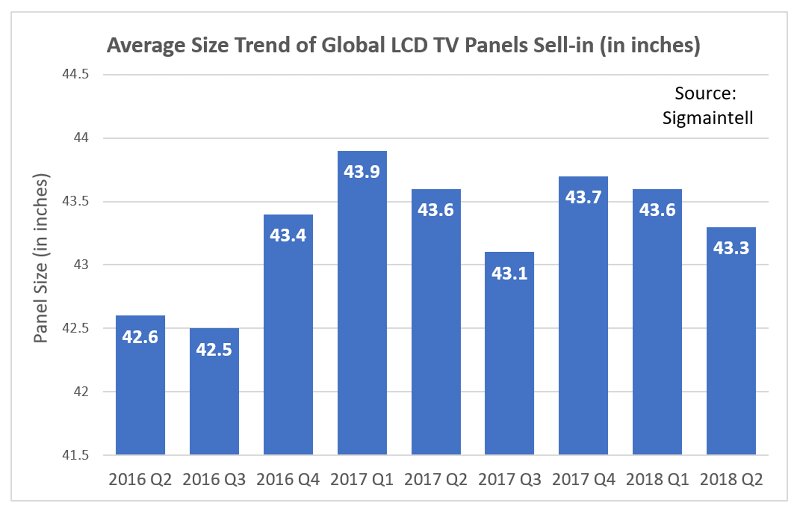

In the first half of 2018, shipments of LCD TV panels reached 135 million units, a decrease of 3.7% compared to the second half of 2017 but an increase of 10.6% from the first half of 2017. Analysts also say that the trend to larger sizes continues to slow.

Driven by the World Cup, overseas market demand continues to strengthen, which has led to a significant increase in small and medium-size panel shipments. According to Sigmaintell, in the first half of 2018, 32″ panel sell-in grew by 25% over the same period in 2017, accounting for 32% of total global LCD TV panel sales.

Sell-in of 39″ – 45″ sizes increased by 11% year-on-year, accounting for 24.4% of the total. In contrast, sell-in of 65″ panels decreased by 4%. While the proportion of small-size products increased, the proportion of large sizes was not significantly improved. In the first half of the year, the global average size of LCD TV panels actually dropped to 43.6″, a decrease of 0.1″. In the second quarter of 2018, it dropped further to 43.3″.

Therefore, the growth of average panel size is lower than expected, which analysts say is one of the important factors in the imbalance of supply and demand within the LCD market during the first half of the year.

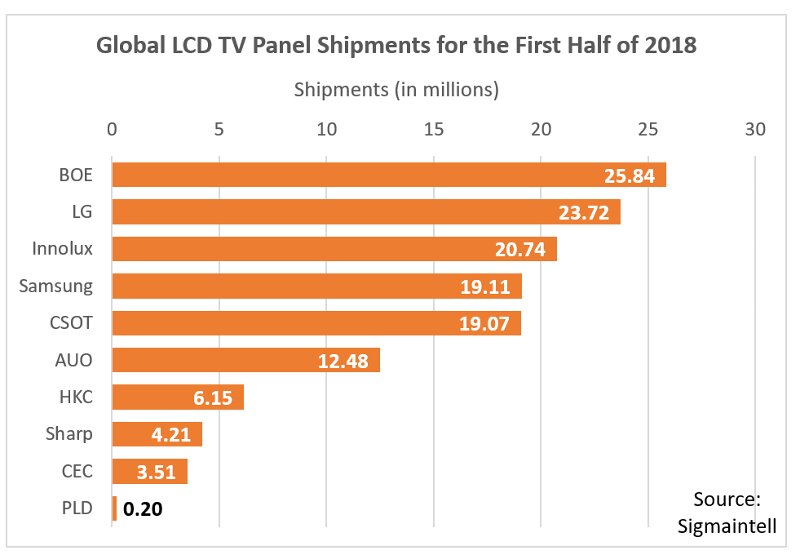

As a result of their continuous expansion of production capacity, the overall competitiveness and market share of Chinese manufacturers has increased significantly. In the first half of 2018, BOE, LG and Innolux were the top-three panel makers respectively, with Samsung fourth and CSOT fifth.

In the first half of 2018, BOE shipped 25.84 million units. This year, the company’s 8.5G line in Fuqing, China reached full capacity and the world’s first 10.5G line commenced mass production.

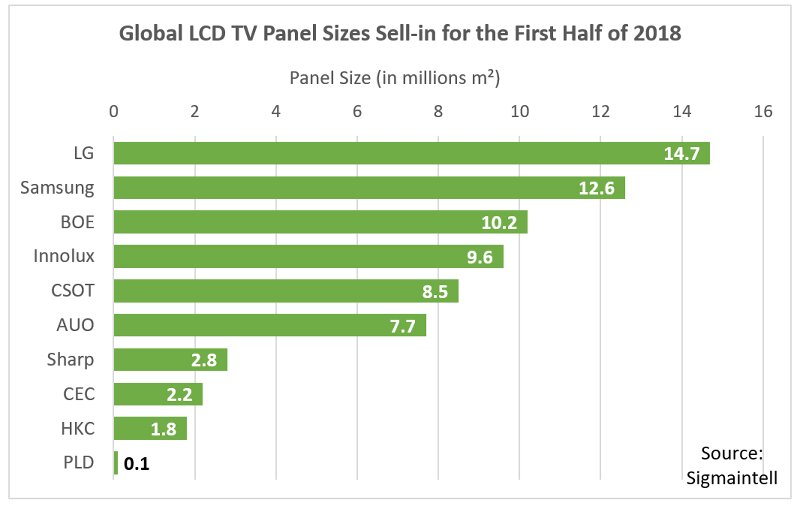

LG shipped 23.72 million LCD TV panels in the first half of 2018, a decrease of 3.4% over the same period in 2017. However, it ranked first in terms of shipment size. The company continues to drive large-sizes and maintains a leading position in large and high-end products in sizes such as 55”, 65” and 75”.

Due to the declining profitability of LCD TV panels, LG has accelerated investment in OLED TV panels. Its OLED production line in Guangzhou, China was officially approved and its Paju P10 facility in South Korea is exclusively producing OLED TV panels. At the same time, the repurposing of 8.5G LCD capacity to OLED is also being accelerated.

Innolux has been running high inventory in the first half of this year. Due to a change of operation strategy, inventory was reduced at the end of the second quarter. In the first half of the year, the company’s total sell-in volume reached 20.74 million, an increase of 7.4% over the same period in 2017, ranking third in quantity and fourth in area.

Samsung is focusing on large-size, high-end products. The scale of 65″ panel production continues to expand and the company also commenced mass production of 8K TV panel during the second quarter. Its overall shipments were relatively stable, ranking fourth, while the company ranked second after LG in terms of shipment by area.

CSOT’s total shipment volume reached 19.1 million in the first half, an increase of 5.6% year-on-year, ranking fifth in terms of amount and area of shipments. In the second quarter, the company’s product structure was adjusted, with output of 32” panels reduced and supply of 43” panels increased.

Affected by the capacity expansion of Chinese manufacturers, AU Optronics’ market share has dropped to less than 10% and the company’s investment is relatively conservative. In the second half of this year, 8.5G capacity expansion will usher in mass production.

Among other panel makers, HKC’s 8.6G line is almost operating at full capacity. Shipments have been maintained steadily, with a focus on 32″ panels. CEC’s two new 8.6G lines have begun mass production, but shipment growth is slow. Meanwhile, Sharp’s panel production line maintained high productivity.

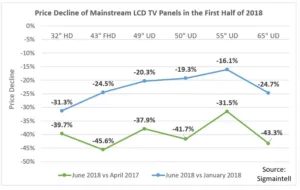

Since the second quarter of 2017, panel prices have dropped. In the first half of this year, the TV market was not performing well and panel prices continued to decline in June, with prices coming close to cost, which caused panel factories to suffer.

Prices of 32″ panels have fallen, opening up the price difference between adjacent sizes. The supply and demand imbalance in the second quarter of this year caused 32″ panel prices to plummet rapidly. According to Sigmaintell, in the first half of 2018, the price of 32” panels decreased by 31%, or almost 40% compared to their peak price point in 2017.

For 39.5″ – 43″ sizes, promotion isn’t active and demand is weak. BOE’s 8.5G line in Fuqing, China has led to an increase in the supply of 43″ panels and a substantial decline in their price. As for 49″ – 50″, new 8.6G lines have greatly enriched 50″ panel supply resources. Price is relatively positive, even with the 49″ price inversion, causing demand to shift from 49” to 50”.

55” is still the “golden child” of the large sizes. Demand continues to be strong and price declines are smaller than those of other sizes. According to Sigmaintell, in the first half of 2018, the price of 55” panels decreased by 16.1%, and nearly 30.5% compared to their peak price point in 2017.

As for 65”, prices began to fall in June 2017. Thanks in part to the smooth production of BOE’s 10.5G line, supply of 65” panels has been greatly increased. In the second quarter of 2018, 65″ panel prices declined by about 25%.

Panel prices rapidly fell below total cost in the second quarter of 2018, causing panel makers to face severe profitability challenges. However, through positive price strategies, panel manufacturers have increased shipment growth and reduced inventory.

Panel makers will have the opportunity to achieve phased business improvement through strategic adjustment but with the continued release of new production capacity, they will face serious competition in the future.

Sigmaintell says panel manufacturers should actively seek to reduce costs, but with the tight supply of key components such as ICs, the scope for product cost reduction is limited. Therefore, it is more important to continuously upgrade technology to enhance overall competitiveness and reduce risk.