Demand for LCD panels from South Korean and Chinese TV makers was strong in the fourth quarter of 2017, but implementation of their panel purchasing strategies for the first quarter of 2018 may result in a correction as demand expectations change according to IHS Markit. While some TV brands are expected to maintain their panel purchasing plans, others are forecast to reduce demand in the first quarter as it is a traditionally slow season and some demand was pulled into the last quarter.

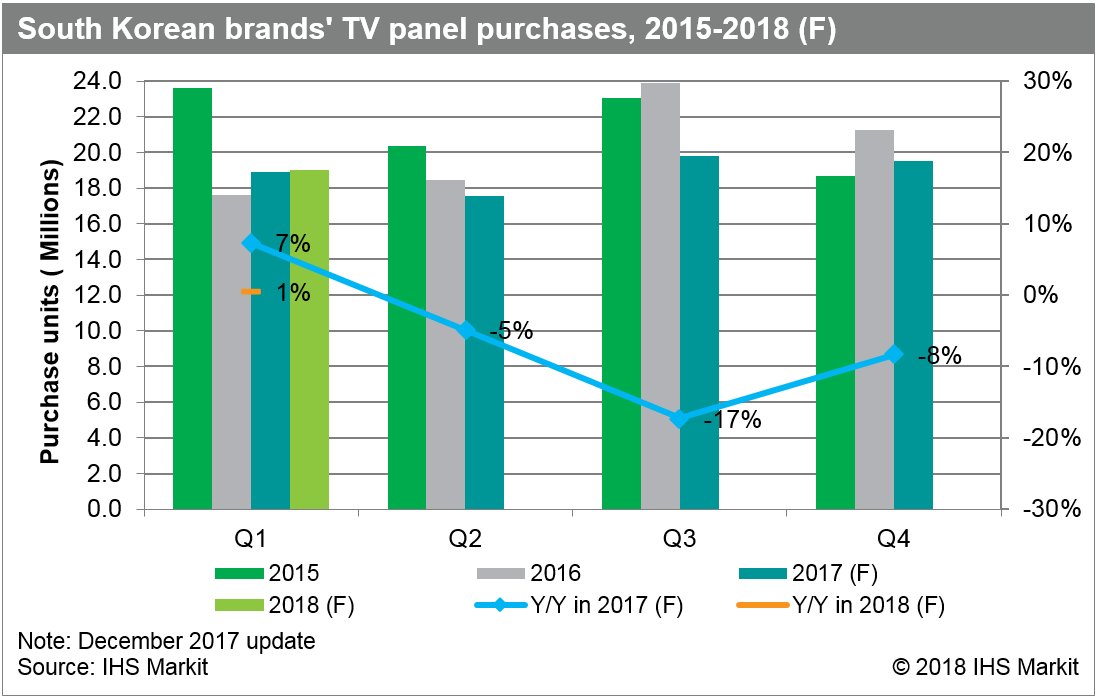

South Korean TV makers are expected to reduce LCD panel purchasing volumes by 3% in the first quarter of 2018 compared to the previous quarter, an increase of 1% compared to the same period last year. Deborah Yang, Director of the Display Supply Chain at IHS Markit, said:

“There is risk of a correction in demand as panel purchasing plans get underway, given that a sufficient supply chain buffer is already factored in for the first quarter. These manufacturers will likely continue to use their plans as a negotiating tactic for more competitive prices. This has been one of the most critical swing factors for the LCD panel supply and demand”.

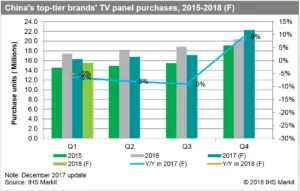

China’s top six TV makers—ChangHong, Haier, Hisense, Konka, Skyworth and TCL—are forecast to cut their LCD panel purchasing volumes in the first quarter of 2018 by 30% compared to the fourth quarter of 2017, and 5% year-on-year. Yang continued:

“It is estimated that the Chinese brands carried relatively higher level of inventories as of the end of December 2017, as they have been preparing for the upcoming promotional seasons in early January and the Chinese New Year holidays in February. Given this, they are in no rush to secure more panel supplies in the first quarter and may want to negotiate for lower prices”.

Yang also said:

“Due to a coming slow season, the bargaining power seems to be with TV makers. However, uncertainties about a stable supply of feature-rich premium and larger panels will have the top-tier TV brands concerned. Chinese panel makers have yet to prove that they will actually start mass-producing 65″ LCD panels from the world’s first 10.5G fabs in the first quarter.

The top-tier TV brands will want to make sure they can secure sufficient panel supplies of 65″ and larger panels. At the same time, they also seek to attain better bargains on large and ultra-large panels in 2018 and beyond”.

Panel makers, however, have not agreed to offer more price concessions. Some panel makers are scheduled to remodel fabs in the first quarter and this will eventually cause an unstable supply of LCD TV panels, particularly for larger sizes. Yang concluded:

“All this points to the likelihood that the TV panel market will see chaotic swings in demand in the first quarter of 2018”.