Pay TV revenues in the MENA region will reach $3.62 billion in 2023, up by only 7.8% on 2017, according to Digital TV Research. Revenues will fall in 2018 and will be flat in 2019, before starting a slow recovery, the firm believes.

Within the region’s Arabic-speaking countries, revenues will grow by 24% from $1.18 billion in 2017 to $1.46 billion in 2023, despite subscriptions rising by 47% over the same period to 5.84 million. If subscriptions are growing faster than revenues, then ARPUs must be falling.

Simon Murray, Principal Analyst at Digital TV Research, said:

“The region has always been difficult for pay TV, with many homes receiving many FTA channels and rampant piracy being commonplace. beIN is shaking up the market with its strong slate of exclusive sports rights and is now providing more entertainment content”.

beIN’s moves have hit long-established rival OSN, which benefits from exclusive long-term deals with all of the Hollywood studios. However, it has struggled to push its subscriber base much beyond 1 million subscribers. Murray continued:

“Competition is increasing, not only from beIN but also from the multitude of SVOD platforms that have launched in recent years. These platforms compete more directly against OSN than beIN, due to their emphasis on drama. No SVOD platforms can compete against beIN with live sports provision.

OSN’s reaction was to cut its subscription prices substantially in February 2017. Digital TV Research believes that further cuts will be made as OSN struggles to hold on to its subscriber base, until its fees are just above beIN’s”.

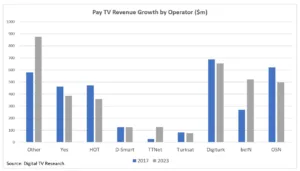

OSN’s revenues will reach $498 million in 2023, down from $700 million in 2015. beIN’s revenues will exceed OSN’s in 2022, doubling between 2016 and 2023.

beIN will overtake OSN by subscriber numbers in 2018 and is forecast to have 1.87 million satellite TV subscribers by 2023, ahead of OSN’s 1.46 million (excluding subscribers to their channels on other platforms such as IPTV and cable).

beIN’s sister company Digiturk will retain regional market leadership, despite more intense competition in Turkey.

Israel will experience cord-cutting, losing 27,000 subs between 2017 to 2023. Digital TV Research forecasts that Israeli pay TV revenues will fall from more than $1 billion in 2015 to $767 million in 2023, as cheaper OTT platforms force traditional pay TV operators to lower their fees.