According to the IDC Worldwide Quarterly Wearable Tracker for the first quarter of 2017, total shipments for wearables in India were 612,000. This included smart wearables that can run third-party apps, and basic wearables which cannot run third-party apps. Basic wearables accounted for almost 90% of total wearable shipments, and in addition consumers are now getting better value from these devices as the category now offers advanced features. Features such as heart rate, sleep monitor are becoming must-have features even in the entry level segment of under $50.

The less than $50 segment continues to dominate the category accounting for 78.6% of total wearable shipments. This segment was led by GoQii followed by Xiaomi, although new entrants like Titan, with aggressive marketing, have entered the Indian wearable market in March which further increased the competition in this cluttered segment.

The offline share of wearables shipments stood at 36.2% in the quarter, which is up from 24.3% for the first quarter of 2016. Key new entrants like include Fossil, Titan and others, entered the Indian wearable market primarily through retail stores. In addition, certain online vendors like Xiaomi and GoQii are also exploring offline channels to expand their customer base.

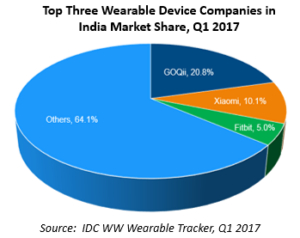

GOQii maintained its leadership in the Indian wearable market with 20.8% share with shipments increasing 21.0% compared to the previous quarter, driven by fresh demand for its newly launched GoQii HR and promotional upgrade offer. It is gradually migrating from online only to hybrid channel to increase its offline presence.

Xiaomi slipped to the second position with 10.1% vendor share as shipments declined 30.6% in the quarter compared to the previous quarter. Increasing competition and limited supply of its Mi Band 2 led to the decline.

Fitbit maintained its third place even though shipments declined 42.7% compared to the previous quarter. The newly launched Alta HR and product launches in the second quarter are expected to push up the shipments.

Top three wearable device companies in India for Q12017

The wearable market is expected to grow at a double-digit rate in Q2 2017. To further intensify competition, a few new vendors primarily China-based are expected to make inroads into the Indian wearable market especially in the sub $50 segment. “Currently, primary use-case of wearables are focused on the specific niche market like fitness and health. Hence, to sustain volume and existence in long run, wearables should evolve to appeal to a wider consumer segment resulting in either to be a mainstream device or an essential product of a broader ecosystem.” said Navkendar Singh, Senior Research Manager, IDC India.