Both corporations and users continue to lengthen their PC refresh rates, prolonging the PC market slide, says Jon Peddie Research (JPR). Once again, the gaming market (which uses high-end GPUs) was the stand-out segment for the market in Q1. The overall PC market was down 10.6% YoY and 15.1% QoQ.

Notebooks were responsible for holding back PC market results., with YoY GPU shipments falling 22%. Desktop GPU shipments were down just 6%, by comparison, for a total overall GPU fall of 16%. On a quarterly basis, GPU shipments were down 15% (below the 10-year average of 3.6% for Q1). AMD fell 5%, Nvidia fell 15% and Intel was down 17%.

The attach rate of GPUs (including both integrated and discrete) was 139%, down 0.2% QoQ. Discrete GPUs were in 32.8% of PCs, which is up 1.5%.

GPUs, which are built into every PC before it is shipped, are a leading indicator of the PC market. Most PC vendors are guiding cautiously for Q2’16.

| Top Vendors’ GPU Market Shares, Q1’16 | ||||

|---|---|---|---|---|

| Vendor | Q1’16 Share | Q4’15 Share | QoQ Share Change | Q1’15 QoQ Share Change |

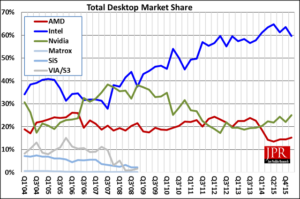

| AMD | 13.2% | 11.8% | 1.5% | 0.4% |

| Intel | 70.1% | 71.6% | -1.5% | -2.1% |

| Nvidia | 16.7% | 16.6% | 0.0% | 1.7% |

| Others | 0.0% | 0.0% | 0.0% | 0.0% |

| Source: JPR | ||||

AMD’s shipments of desktop heterogenous GPUs/CPUs (APUs) was down 16.8% QoQ for desktops, but flat in notebooks. Desktop discrete GPUs rose 12.9% and notebooks fell 9.1%.

Intel’s desktop processor embedded graphics (EPG) shipments were down 14.8% QoQ; notebooks were down 18.1%. Total PC shipments fell 16.9%.

Nvidia’s desktop discrete GPU shipments rose 2.7% QoQ, while discrete notebook GPU shipments fell 34.9%. Total PC shipments were down 15.1%.

Total discrete GPU shipments fell 11.2% QoQ and 4.4% YoY. Overall, JPR reports that the CAGR of discrete GPUs from 2014 to 2017 is now -8%.