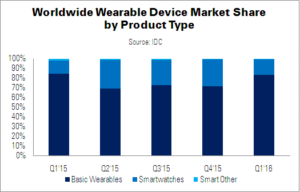

The Q1’16 wearable device market was defined by a combination of new product releases, price reductions and company rationalisations, says IDC. Total shipment volumes were up 67.2% YoY, from 11.8 million units shipped in Q1’15 to 19.7 million units.

New product releases and price reductions served to entice consumers to spend on wearables. However, several start-ups announced layoffs or entire shut downs, underlining how competitive the market has become.

“The wearables that we see today are several steps ahead of what we saw when this market began, increasingly taking their cues from form, function, and fashion,” said IDC analyst Ramon Llamas. “That keeps them relevant. The downside is that it is becoming a crowded market, and not everyone is guaranteed success.”

There are two areas where the market shows continued growth: smartwatches and basic wearables (which do not run third-party apps), such as fitness trackers. “It’s shortsighted to think that basic wearables and smart watches are in competition with each other,” commented IDC’s Jitesh Ubrani. “Right now, we see both as essential to expand the overall market.”

Fitbit remained the ‘undisputed leader’ of the wearables market; its new Alta and Blaze products both exceeded 1 million unit shipments, while the previously successful Surge, Charge, Charge HR and Flex product lines declined – marking the rise of fashion-oriented wearables.

Xiaomi came in second place, replacing Apple, which fell to third. The Chinese company produced new, low-cost fitness trackers, but remained ‘locked’ within China. IDC expects that expanding outside of its home market will be Xiaomi’s biggest challenge in the future.

The Apple Watch has “met the company’s expectations” said Apple CEO Tim Cook – although it trails well behind products like the iPhone and iPad. It appears that Apple will update its Watch bands to keep the product relevant, until the release of the next generation device.

Garmin was ahead of Samsung/BBK (in joint fifth place), but only slightly. Its wristbands and watches appeal to a wide range of athletes, and the company has now launched two new fitness trackers and its first eye-worn device, the Varia Vision In-Sight Display, for cyclists. (Garmin Boasts of Always-on Watch)

The Gear S2 and S2 Classic smartwatches secured fifth place for Samsung. The cellular connectivity of the S2 set it apart from other smartwatches, and the fact that it can be used with Android smartphones other than Samsung’s own was well-received. However, the app selection is far behind that available for Android Wear and Apple’s WatchOS.

BBK tied with Samsung for fifth place – the second time that the company made it into the top five wearable vendors.

| Top Five Wearables Vendors, Shipments, Market Share and Year-Over-Year Growth, Q1’16 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’16 Shipments | Q1’15 Shipments | Q1’16 Share | Q1’15 Share | YoY Change |

| Fitbit | 4.8 | 3.8 | 24.5% | 32.6% | 25.4% |

| Xiaomi | 3.7 | 2.6 | 19.0% | 22.4% | 41.8% |

| Apple | 1.5 | N/A | 7.5% | 0.0% | N/A |

| Garmin | 0.9 | 0.7 | 4.6% | 6.1% | 27.8% |

| Samsung | 0.7 | 0.7 | 3.6% | 5.8% | 4.5% |

| BBK | 0.7 | N/A | 3.6% | 0.0% | N/A |

| Others | 7.3 | 3.9 | 37.2% | 33.1% | 87.9% |

| Total | 19.7 | 11.8 | 100.0% | 100.0% | 67.2% |

| Source: IDC | |||||

| Top Five Smartwatch Vendors’ Shipments, Share and Growth, Q1’16 (Millions) | |||||

|---|---|---|---|---|---|

| Vendor | Q1’16 Shipments | Q1’15 Shipments | Q1’16 Share | Q1’15 Share | YoY Change |

| Apple | 4.5 | N/A | 46.0% | 0.0% | N/A |

| Samsung | 0.7 | 0.5 | 20.9% | 29.8% | 40.5% |

| Motorola | 0.4 | 0.2 | 10.9% | 11.0% | 98.2% |

| Huawei | 0.2 | N/A | 4.7% | 0.0% | N/A |

| Garmin | 0.1 | 0.1 | 3.0% | 7.2% | -17.3% |

| Others | 0.5 | 0.8 | 14.5% | 52.0% | -44.2% |

| Total | 3.2 | 1.6 | 100.0% | 100.0% | 100.2% |

| Source: IDC | |||||