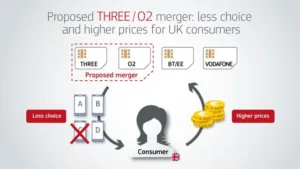

The Commission has blocked the proposed acquisition of O2 by Hutchison under the EU Merger Regulation. It had strong concerns that UK mobile customers would have had less choice and paid higher prices as a result of the takeover, and that the deal would have harmed innovation in the mobile sector.

Today’s decision follows an in-depth investigation by the Commission of the deal, which would have combined Telefónica UK’s “O2” and Hutchison 3G UK’s “Three”, creating a new market leader in the UK mobile market. The takeover would have removed an important competitor, leaving only two mobile network operators, Vodafone and BT’s Everything Everywhere (EE), to challenge the merged entity. The significantly reduced competition in the market would likely have resulted in higher prices for mobile services in the UK and less choice for consumers than without the deal. The takeover would also likely have had a negative impact on quality of service for UK consumers by hampering the development of mobile network infrastructure in the UK. Finally, the takeover would have reduced the number of mobile network operators willing to host other mobile operators on their networks.

The remedies proposed by Hutchison failed to adequately address the serious concerns raised by the takeover.

Commissioner Margrethe Vestager, in charge of competition policy, said: “We want the mobile telecoms sector to be competitive, so that consumers can enjoy innovative mobile services at fair prices and high network quality. The goal of EU merger control is to ensure that tie-ups do not weaken competition at the expense of consumers and businesses.

Allowing Hutchison to takeover O2 at the terms they proposed would have been bad for UK consumers and bad for the UK mobile sector. We had strong concerns that consumers would have had less choice finding a mobile package that suits their needs and paid more than without the deal. It would also have hampered innovation and the development of network infrastructure in the UK, which is a serious concern especially for fast moving markets. The remedies offered by Hutchison were not sufficient to prevent this.”

The UK mobile market

The UK mobile market is currently competitive – retail mobile prices are among the lowest in the entire EU. The UK is also one of the most advanced countries in the EU in terms of roll-out of 4G technology and take-up of 4G services.

There are currently four mobile network operators in the UK – BT’s mobile business EE, Telefónica’s O2, Vodafone and Hutchison’s Three.

EE and Three have combined their networks as “Mobile Broadband Network Limited” – MBNL. Similarly, Vodafone and O2 combined their networks to set up Beacon. This allows EE / Three, and Vodafone / O2 respectively, to share the costs of rolling out their networks but they continue to compete with each other for retail customers.

In addition to the four mobile network operators, there are a number of mobile “virtual” operators active in the UK retail mobile market, such as Virgin Media, Talk Talk and Dixons Carphone’s iD. These mobile virtual operators do not own the networks they use to provide mobile services to UK consumers. Instead, they entered agreements with one of the mobile network operators to access their network at wholesale rates.

The Commission’s competition concerns

The Commission had serious concerns that the takeover would have reduced competition in the market, hampered the development of the UK mobile network infrastructure as well as the ability of mobile virtual operators to compete.

- Less competition leads to higher prices and reduced choice and quality for consumers:The takeover would have eliminated competition between two strong players in the UK mobile market. Three is the latest market entrant and has been an important driver of competition in the UK mobile market. O2 has a strong position with high brand value and reputation. It is the second largest mobile operator by revenues and the largest in terms of subscribers (if its share in the Tesco Mobile joint venture is included). Combined, Three and O2 would have been the market leader with a share of more than 40%. They would have had much less incentive to compete with Vodafone and EE. This would have reduced choice and quality of service for UK consumers. The Commission’s analysis also showed that with the takeover retail mobile prices would have been higher for all UK operators than without.

- Future development of entire UK mobile network infrastructure hampered: The merged entity would have been part of both network sharing arrangements, MBNL and Beacon. It would have had a full overview of the network plans of both remaining competitors, Vodafone and EE. Its role in both networks would have weakened EE and Vodafone and hampered the future development of mobile infrastructure in the UK, for example with respect to the roll-out of next generation technology (5G), to the detriment of UK consumers and businesses.

- Reduced number of mobile network operators effectively willing to host virtual operators: The transaction would have reduced the number of mobile network operators willing to host other mobile operators on their networks. Mobile virtual operators rely on access to the infrastructure to provide mobile services to consumers. The reduced number of host mobile networks would have left prospective and existing mobile virtual operators in a weaker negotiating position to obtain favourable wholesale access terms.

Proposed remedies

To address the Commission’s competition concerns, Hutchison offered remedies, which however did not adequately address the Commission’s competition concerns.

In short, the proposed remedies did not resolve the structural problems created by thedisruption to the current network sharing agreements in the UK. They were also not capable of replacing the weakened competition in the retail and wholesale mobile telecoms markets as a result of the takeover. Furthermore, the largely behavioural measures raised significant uncertainty as regards their effective implementation and monitoring, also because they were difficult to define precisely and some depended on the agreement of others:

- As regards the Commission’s first concern (regarding the loss of competition between Three and O2), Hutchison proposed a set of measures aimed at strengthening the development of existing mobile virtual operators or supporting the market entry of new ones, including:

o Hutchison proposed to give access to a share of the merged entity’s network capacity to one or two mobile virtual operators.

o Hutchison proposed to divest O2’s stake in the Tesco Mobile joint venture, and to offer a wholesale agreement for a share of its network capacity to Tesco Mobile.

o Hutchison proposed to offer a wholesale agreement for a share of its network capacity to Virgin Media.

Even if those offers were taken up, the mobile virtual operators would have been commercially and technically dependent on the merged entity, with limited ability or incentive to differentiate their offerings, including in terms of network quality.

- As regards the Commission’s second concern (regarding the UK network sharing agreements), Hutchison offered certain behavioural remedies, which would have been difficult to implement and monitor effectively. Three and O2 would have kept their respective stakes in the two network sharing agreements, MBNL and Beacon.

- As regards the Commission’s third concern (regarding the takeover’s effect on mobile virtual operators), Hutchison offered a set of behavioural measures aimed at granting mobile virtual operators access to 4G and future technologies. These were commercially unattractive for the mobile virtual operators and raised significant uncertainty as regards effective implementation.

The Commission therefore concluded that the proposed remedies would not have been able to prevent the likely negative impact on prices, quality of service and network innovation in the UK mobile sector as a result of the takeover, which is why it decided to block the proposed transaction to protect UK customers and businesses.

Merger control rules and procedures

For background on the UK mobile market and the Commission’s approach to assessing mergers in the mobile telecoms sector, please see Factsheet.

The Commission has the duty to assess mergers and acquisitions involving companies with a turnover above certain thresholds (see Article 1 of the Merger Regulation) and to prevent concentrations that would significantly impede effective competition in the EEA or any substantial part of it.

The vast majority of notified mergers do not pose competition problems and are cleared after a routine review. From the moment a transaction is notified, the Commission generally has a total of 25 working days to decide whether to grant approval (Phase I) or to start an in-depth investigation (Phase II). There are three on-going phase II merger investigations:

- The proposed acquisition of Arianespace by Airbus Safran Launchers (ASL), with a decision deadline on 10 August 2016

- The proposed joint venture between the telecommunications activities of Hutchison and VimpelCom in Italy, with a decision deadline on 18 August 2016 and

- The proposed acquisition of the Greek gas transmission system operator DESFA by the Azeri state oil company SOCAR.

More information will be available on the competition website, in the Commission’s public case register under the case number M.7612.