Alibaba has a lot to say about the display industry to its B2B customers, and the substance of that message is worth paying close attention to. The company publishes market intelligence across dozens of industries as part of its broader effort to attract high-value buyers and sellers to its platform, and its 2026 LED TV backlight report is one of the more substantive entries in that catalog. For display industry watchers, the findings offer a useful window into how the MiniLED versus QD-OLED debate looks when filtered through the lens of China’s manufacturing ecosystem and the commercial interests of the world’s largest cross-border electronics marketplace.

The Central Argument: The Backlight Is Now the Value Story

The report’s most provocative claim is that backlight engineering, not panel type, has become the decisive economic battleground in high-end televisions. By 2026, Alibaba asserts, backlight innovation accounts for 38% of the total value uplift in premium TVs, and MiniLED full-array local dimming backlights now capture 63% of backlight revenue in the segment above roughly $1,200, which Alibaba identifies as the highest-volume slice of the premium market.

Contested figures should be cross-checked against independent analyst disclosure before use in financial modeling.

This is a significant reframing. Most mainstream LCD versus OLED narratives treat the backlight as a secondary specification, something measured in zone counts and HDR tier ratings rather than as a primary value driver. Alibaba is telling its customers that the backlight is where the money is being made and where competitive differentiation is being won or lost. That is a more aggressive position than anything mainstream analysts have explicitly quantified, though it is broadly consistent with Omdia’s language describing MiniLED and quantum dots as the main levers enabling LCD to challenge OLED dominance.

The supply side, in Alibaba’s telling, is highly consolidated. Four companies, Samsung Display, BOE, AUO, and Innolux, control roughly 87% of MiniLED backlight unit shipments. Samsung leads on average selling price rather than volume, with its integrated quantum-dot MiniLED modules carrying an estimated 34% price premium over standard MiniLED configurations, driven by tighter luminance tolerances and the integration of QD layers. MiniLED backlight shipments overall are projected to grow 42% year over year in 2026, while quantum-dot enhancement film adoption stabilizes at 71% of mid-to-high-tier TV models.

Reframing the MiniLED vs. QD-OLED Debate

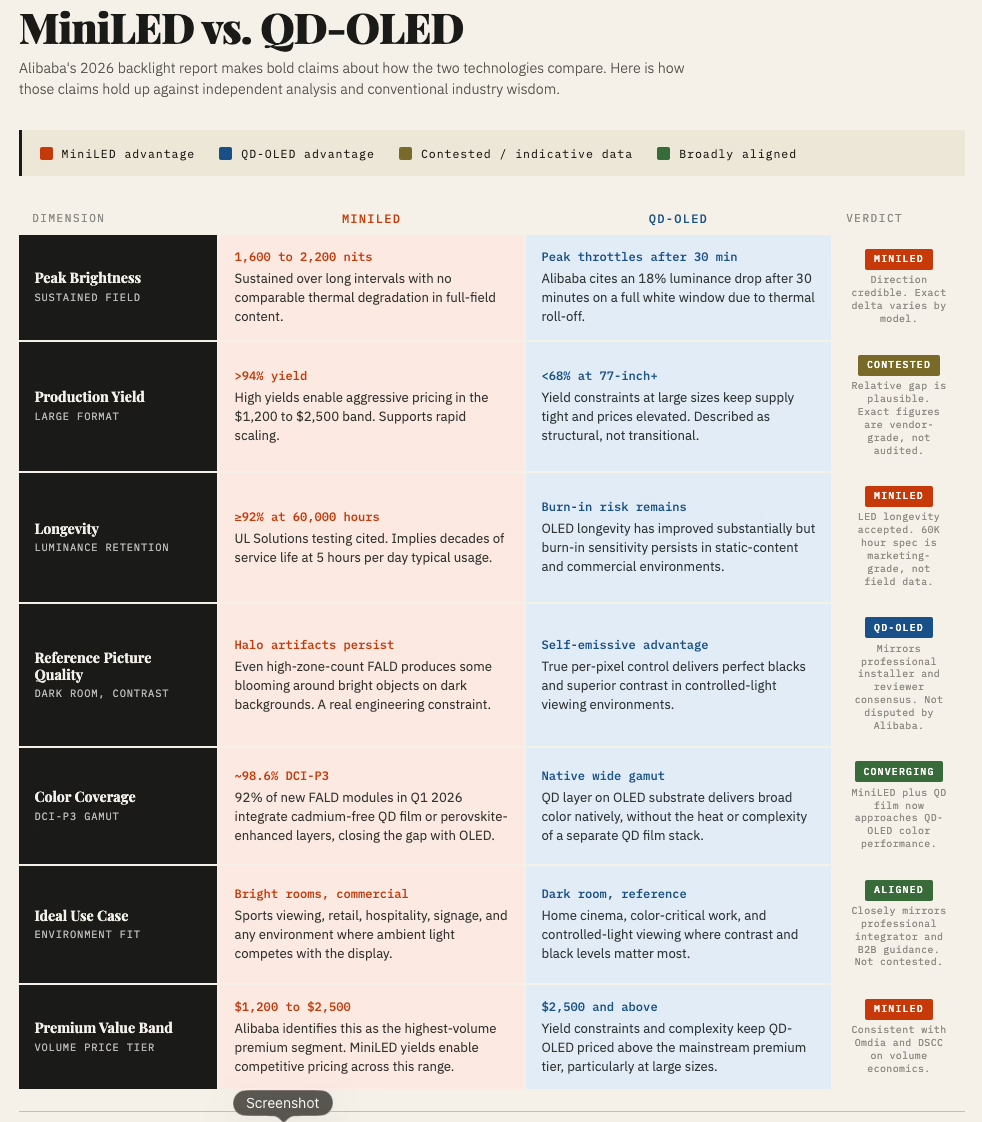

On the question that has dominated premium TV discussions for the past two years, Alibaba takes a clear and commercially purposeful position. Rather than treating QD-OLED as the unambiguous picture-quality leader and MiniLED as a capable but clearly second-tier alternative, the report argues that the two technologies are segmenting into distinct use cases rather than competing in a zero-sum fight.

MiniLED, in this framing, is the rational default for bright-room viewing, commercial installations, and value-focused premium buyers. QD-OLED serves a dark-room, reference picture-quality niche. To support this, the report cites yield constraints on large-format QD-OLED panels, below 68% for 77-inch-plus sizes, and thermal luminance roll-off after sustained bright-field content, described as structural limitations rather than transitional engineering challenges. After 30 minutes of a full white window, QD-OLED peak luminance is said to fall 18% due to thermal roll-off. MiniLED, by contrast, sustains 1,600 to 2,200 nits over longer intervals without comparable degradation.

On longevity, the report cites UL Solutions testing suggesting MiniLED backlights retain at least 92% luminance after 60,000 hours at 70% brightness, implying service lives measured in decades at typical usage patterns. MiniLED backlight production yields exceed 94%, enabling aggressive pricing in the $1,200 to $2,500 band.

The segmentation narrative, MiniLED for bright rooms and value, QD-OLED for dark-room reference quality, is in fact closely aligned with how professional integrators and B2B display selectors have described the trade-off for several years. That alignment lends the framing credibility, even if the specific data points are drawn from vendor-friendly methodology rather than fully independent third-party measurement.

Software Is Now a Competitive Dimension

One of the report’s more forward-looking themes is the shift of backlight control from fixed-function hardware to firmware-updatable intelligent systems. The report cites a TCL firmware update introducing dynamic zone merging, which groups adjacent zones in static scenes to cut power consumption by 11% without visible contrast loss, as an example of how algorithm and IP differentiation around zone control is becoming nearly as important as the underlying LED and quantum-dot stack. The EU’s updated ErP rules, which took effect in January 2026 and require standby power below 0.2 watts along with explicit luminance reporting, are pushing adoption of adaptive backlight scaling schemes that can reduce annual energy use by up to 22% in real-world viewing conditions.

For OEMs, this means that firmware and software investment are now material to both perceived picture quality and regulatory compliance, not merely a differentiating feature at the margin.

The Chinese Industry Angle

None of this analysis exists in a commercial vacuum, and the report’s structure reflects a very specific strategic logic that aligns tightly with China’s broader approach to the display industry.

China’s display sector has spent the better part of a decade building dominant scale in LCD and MiniLED manufacturing. BOE, TCL, and Hisense have invested heavily in high-zone-count MiniLED production and QD film integration, and Chinese manufacturers now hold cost and yield advantages that are structural rather than temporary. The technology that Alibaba’s report identifies as the rational default for mainstream premium TVs, high-zone MiniLED plus QD film, is precisely the technology stack where Chinese manufacturers are most competitive.

The report’s emphasis on MiniLED yield advantages, QD-OLED yield constraints at large sizes, and the value of the $1,200 to $2,500 price band maps almost perfectly onto the strategic position of BOE, TCL, and Hisense. It validates their investment thesis, provides language they can use when pitching to overseas OEMs and channel partners, and implicitly positions OLED-centric strategies, which favor Korean manufacturers, as serving a narrower and more constrained market segment.

This is consistent with a pattern visible across China’s approach to the display industry more broadly. Rather than competing directly on OLED, where Samsung Display and LG Display hold IP and process advantages, Chinese manufacturers have chosen to make the argument that OLED’s superiority is situational and that the LCD and MiniLED ecosystem they dominate is a durable premium tier rather than a transitional technology. Alibaba’s report is, among other things, a sophisticated piece of that argument, addressed to the global B2B audience of OEMs, module vendors, and component suppliers who transact on its platform.

How to Read the Numbers

The directional findings of the report are broadly credible. That MiniLED yields are strong, that QD-OLED large-format yields are constrained, that the two technologies are diverging into distinct market segments, and that CES 2026 saw MiniLED dominate the show floor with shipments projected to exceed 20 million units this year, these conclusions align with mainstream analyst projections from Omdia and DSCC.

The specific quantitative claims deserve more scrutiny. The 38% value-uplift figure, the exact revenue shares, the yield percentages and luminance data are drawn from DisplaySearch citations and vendor-level testing rather than independent third-party measurement. They are best treated as indicative inputs to scenario analysis rather than base-case modeling facts, and cross-checking against Omdia, DSCC, and brand financial disclosures is advisable before relying on the specific numbers.

What does not require cross-checking is the broader signal: Alibaba is telling the global B2B display industry that MiniLED is the durable center of premium TV, that the backlight is the value layer, and that the supply chain best positioned to win is the one concentrated in China and Taiwan. That message is commercially motivated, but it is not wrong. And the fact that Alibaba is delivering it to millions of B2B customers worldwide is itself a development worth noting.