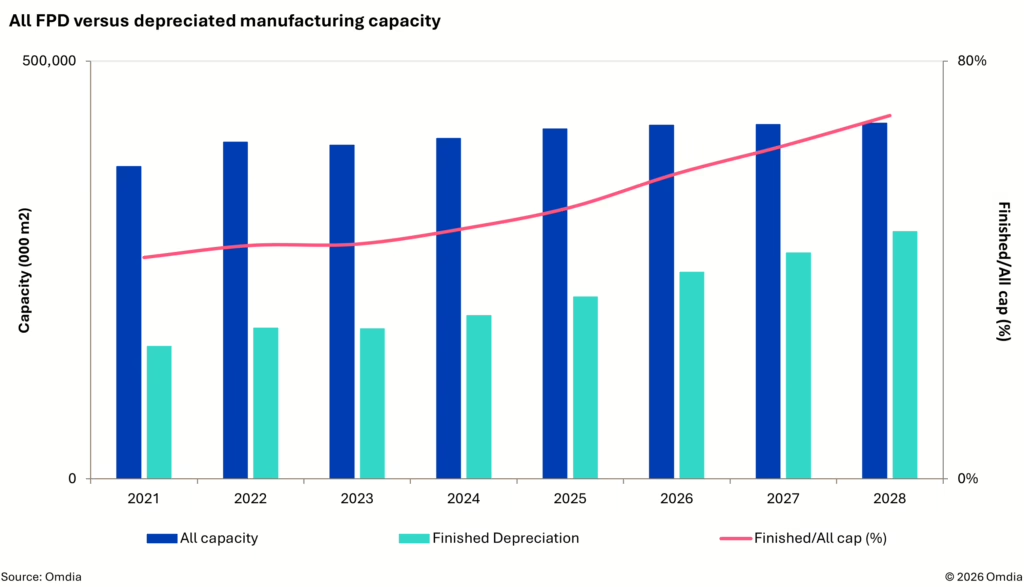

The depreciation of flat panel display manufacturing equipment is accelerating, according to new research from Omdia. The firm forecasts that depreciation will increase at a compound annual growth rate of 9.3% between 2021 and 2028, with fully depreciated global FPD manufacturing capacity nearly doubling over that period, from approximately 160 million square meters to almost 300 million.

The trend matters because FPD factories require multi-billion-dollar investments, and depreciation can account for up to one-third of total manufacturing costs across a wide range of applications, from Gen 6 OLED smartphone modules to 75-inch LCD televisions produced at Gen 10.5 facilities.

LCD capacity, which accounts for roughly two-thirds of all FPD production, is seeing depreciated capacity expand by 60% between 2021 and 2028. The driver is the wave of Gen 10.5 factories built between 2017 and 2022. Depreciated Gen 10.5 assets will jump from zero in 2024 to near 80% by 2028.

A parallel trend is playing out in large-area OLED. Korean White OLED and Quantum Dot OLED production facilities are expected to reach near full depreciation by 2028. “These factories are expected to reach near full depreciation by 2028, significantly reducing operating expenses and enabling their large-area OLED TV and monitor businesses to achieve sustainable profitability,” said Charles Annis, Chief Analyst in Omdia’s Display Research group.

Smaller-substrate RGB Fine Metal Mask OLED capacity, primarily used for smartphone panels, will shift from less than 10% depreciated in 2021 to more than 60% by 2028.

As investment in new LCD and OLED factories has moderated in recent years, declining depreciation costs are enabling FPD makers to run factories at lower utilization rates, produce a wider range of applications, and maintain profitability in a cost-competitive market.

The notable exception is the new Gen 8.6 RGB OLED factories now being built in Korea and China. As Annis noted, “These facilities will not benefit from even partial depreciation until after 2030. This will encourage makers to diversify production and maintain elevated factory utilization to distribute their high fixed costs across a greater number of panels.”