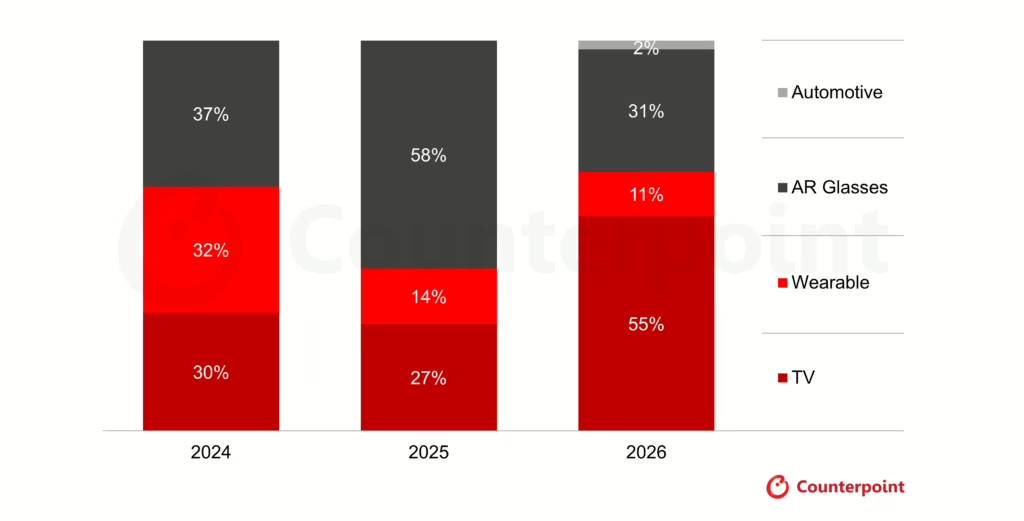

MicroLED display revenues grew 150% year-over-year in 2025, according to Counterpoint Research’s latest MicroLED Display Technology and Market Outlook Report. The growth was driven primarily by augmented reality smart glasses, which accounted for 58% of total MicroLED revenues, making AR the technology’s largest application segment for the year.

The AR segment’s strength came from the commercial launch of several smart glasses incorporating MicroLED light engines, which produced a significant increase in shipments. In the wearables category, the Garmin fēnix 8 Pro became the first MicroLED smartwatch to reach market, a milestone that Counterpoint views as validation that panel maker AUO can meet OEM production requirements.

In televisions, MicroLED remains a niche technology that cannot yet compete on cost with LCD or OLED. Counterpoint notes that premium pricing in both the TV and wearables segments is justified by MicroLED’s superior brightness, excellent contrast, and the promise of longer lifetime than OLED. Samsung has led the MicroLED TV category for several years but now faces competition from TCL and Hisense. Counterpoint expects this competition to drive prices down and increase sales, though MicroLED TVs will continue to sit in a price band well above OLED and MiniLED alternatives.

For 2026, Counterpoint projects the TV segment will capture the largest share of MicroLED revenues. Automotive applications are also expected to begin, with first panel shipments anticipated this year and a projected 2% share of revenues. Panel makers have already demonstrated proof-of-concept designs using transparent MicroLED displays and high-brightness head-up displays, leveraging MicroLED’s design flexibility and better reliability compared to OLED.

“Two years ago, Apple’s decision to cancel the mass production of MicroLED panels sent a shockwave across the industry,” said Guillaume Chansin, Associate Director at Counterpoint Research. “After a period of consolidation, the remaining players are now proving that MicroLED still has a future. The focus is less on volume and more on value proposition and differentiation.”