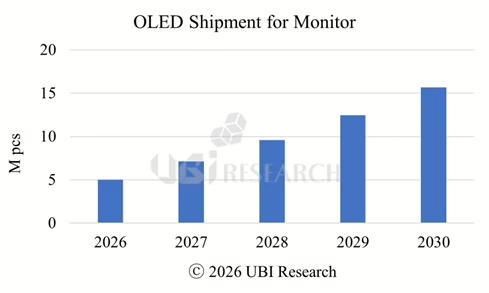

Global OLED monitor shipments reached approximately 3.2 million units in 2025, a 64% year-on-year increase from 1.95 million units in 2024, according to UBI Research’s Medium & Large OLED Display Market Tracker. Growth exceeding 50% is forecast for 2026, positioning OLED monitors as the fastest-expanding application segment within the mid- to large-sized OLED industry.

The acceleration reflects a strategic recalibration by panel makers who increasingly view monitors, not televisions, as the preferred destination for OLED capacity.

The pivot from TV to monitor panels traces to production efficiency and profitability fundamentals that favor IT-standard display sizes. On 8.5-generation glass substrates, TV panels typically achieve utilization rates of 60–70%, and even with Multi Model Glass technology applied, utilization often remains near 80%. Monitor panels based on IT-standard sizes, primarily 27-inch and 34-inch formats, can be laid out to achieve utilization rates exceeding 90%.

The margin picture reinforces the capacity allocation logic. On a price-per-area basis, OLED monitor panels offer relatively higher profitability than TV panels, making monitors attractive on both line efficiency and margin dimensions. For panel makers operating expensive OLED fabs, the combination of better substrate utilization and stronger unit economics creates a compelling case for prioritizing monitor shipments.

Samsung Display is focusing expansion efforts on OLED panels for monitors, centered on its QD-OLED mass production lines where unit prices and profitability exceed TV panel economics. As QD-OLED adoption expands across premium gaming monitors and creator-focused products, monitors are claiming an increasing share of Samsung Display’s mid- to large-sized OLED strategy.

The QD-OLED technology’s color volume and brightness characteristics have found strong reception in the gaming segment, where refresh rates and response times complement the technology’s visual performance advantages. Creator-focused monitors represent a second growth vector, with color accuracy and HDR capability driving adoption among professional users.

LG Display is maintaining its WOLED TV panel supply while intensifying efforts to expand OLED monitor shipments. The company’s monitor trajectory shows consistent scaling: shipments began at approximately 100,000 units in 2023, doubled to roughly 200,000 units in 2024, and reached an estimated 400,000 units in 2025.

Shipments are expected to continue rising in 2026 through new customer acquisitions and improved line utilization. LG Display’s WOLED technology, initially developed for large-screen television applications, has adapted to monitor form factors where the technology’s viewing angle performance and burn-in mitigation features address key user concerns.

The OLED monitor opportunity is attracting Chinese panel makers seeking footholds in the IT OLED market. BOE is gradually increasing IT OLED panel shipments, while TCL CSOT is planning OLED monitor panel shipments based on its in-house inkjet-printed OLED technology.

The inkjet printing approach offers potential cost advantages over vapor deposition processes used by Korean manufacturers, though production maturity and yield performance remain to be demonstrated at commercial scale. Over the medium to long term, Chinese entry is likely to enhance both price competitiveness and product diversity in the OLED monitor market.

Gaming monitors drove initial OLED adoption in the IT segment, with high refresh rates and pixel response times aligning with competitive gaming requirements. The application base is broadening to include creator displays, where color accuracy and HDR performance support professional workflows, and premium general-purpose IT monitors targeting users willing to pay for superior visual quality.

“In the mid- to large-sized OLED market, panel makers’ strategic focus is gradually shifting from TVs to monitors,” said Changwook Han, Vice President of UBI Research. “OLED monitors offer both high glass utilization and a relatively stable profit structure. Not only Korean companies but also Chinese panel makers are actively entering the OLED monitor market with their own technologies, and the OLED monitor segment is expected to continue growing as applications expand across gaming, creator, and premium IT devices.”