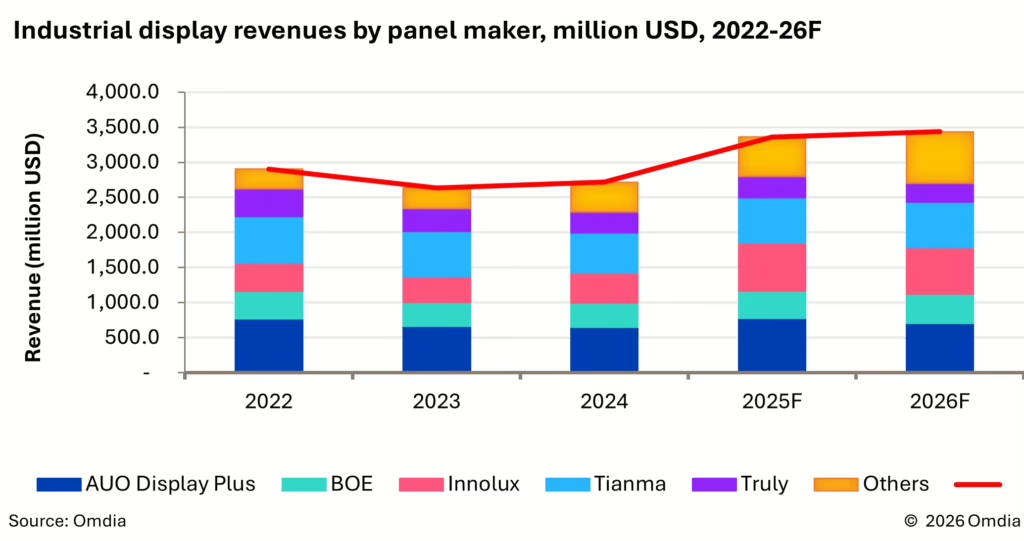

Global industrial display panel makers posted revenues of $3.4 billion in 2025, a 24% year-on-year increase despite unit shipments declining 0.4%, according to Omdia’s Industrial and Public Display & OEM Intelligence Service. The divergence between revenue growth and flat unit volumes underscores the industrial segment’s defining characteristic: diverse applications with relatively small shipment volumes where average selling price expansion, not unit growth, drives performance.

The slight unit decline traces partly to regulatory headwinds, specifically the gradual ban on disposable e-cigarettes across European markets, which had been a meaningful volume category.

AUO Display Plus captured the top revenue position in industrial displays, with point-of-sale products anchoring its portfolio. Innolux secured second place on the strength of gaming console displays, while Tianma ranked third with a diversified base spanning human-machine interface panels, handheld devices, home appliances, and home medical products.

Gaming consoles and action cameras accounted for approximately three-quarters of incremental revenue in 2025. Gaming console displays grew 101% year-on-year, while action camera panels expanded 23%. The gaming segment typically employs 7- to 8-inch panels running at 120Hz refresh rates, with product requirements emphasizing lightweight construction, slim form factors, and high drop resistance.

New display technology adoption also contributed to revenue expansion by lifting average selling prices. Mini-LED backlight solutions found traction in marine and drone applications, adding premium-tier products to the industrial mix.

AMOLED penetration in industrial displays is expected to rise significantly over the coming years, with panel makers positioning the technology as a next-generation option for high-specification applications. In gaming console panels, AMOLED held a modest 19% share in 2025, but the technology’s advantages in weight, thickness, and contrast align with segment requirements.

As AMOLED production experience accumulates, panel performance and reliability improvements have enabled evaluation for demanding military applications. Target products include avionics cockpit displays for fighter aircraft, armored vehicle displays, helicopter instrumentation, and military-grade notebooks and rugged tablets—all requiring high brightness and wide operating temperature ranges that historically favored LCD architectures.

Military Display Demand Intensifies

Geopolitical tensions are accelerating military procurement cycles globally, boosting demand for military-grade displays. Omdia estimates military-like display shipments reached 965,000 units in 2025, a 5.9% year-on-year increase, with AUO Display Plus leading the segment followed by Tianma and BOE. The research firm forecasts 6.5% shipment growth in 2026.

Supply chain dynamics in military displays face significant restructuring. The December 2025 US Defense bill mandated that military procurement—including optical glass and computer displays—phase out reliance on Chinese display technologies by 2030. The requirement is expected to reshape supplier relationships and accelerate adoption of new display technologies from non-Chinese sources.

Panel makers are increasingly expanding beyond display modules into set business operations, seeking to capture additional value chain margin. This vertical integration strategy combines with technology adoption—AMOLED, mini-LED backlighting, and electrophoretic displays—as the primary levers for revenue growth in a segment where unit volumes remain constrained by application diversity.

“As industrial display panel makers aim to drive revenue growth through gaming consoles, action cameras, and military-grade devices, they are expanding from display modules into set businesses and adopting new technologies such as AMOLED, mini-LED backlight and EPD,” said Omdia Principal Analyst TzuYu Huang. “Amid geopolitical tensions and market uncertainty, supply chain participants must demonstrate their ability to manage diverse opportunities and challenges.”