The SID Business Conference took place during Display Week in May 2025 and covered all the key market segments for displays. Ross Young, VP of Counterpoint Research (Ross has announced his retirement recently), gave an in-depth presentation about the market and technology trends in TV, smartphone, automotive, and IT displays with forecasts for the future. Presentations from display industry executives and Counterpoint Research’s analysts at the Business Conference also gave detailed information about current and future trends.

According to Ross’s keynote presentation:

Display Revenues Rebounded in 2024 – Up 11%

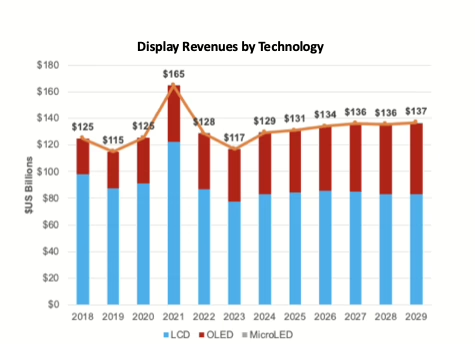

- OLEDs rose 17% in 2024 to $46B while LCDs rose 7% to $83B.

- OLEDs rose 9% from 2021 on rapid growth in monitors, tablets, AR/VR, and automotive.

- LCDs fell 32% on lower prices and units.

- Only automotive grew over this period for LCDs.

Display Revenues by Technology:

- 1% CAGR forecasted from 2024 to 2029 to $137B. Tariffs are slowing down the 2025 market after 11% growth in 2024.

- LCDs flat on loss of share to OLEDs. Market share only expected to fall from 64% to 61%, helped by MiniLEDs and 85″+ TVs.

- OLEDs expected to grow at a 3% CAGR to $53B and a 39% share, up from 36%, on gains across most applications.

- MicroLEDs expected to see >100% CAGR but only expected to see a 0.5% share in 2029.

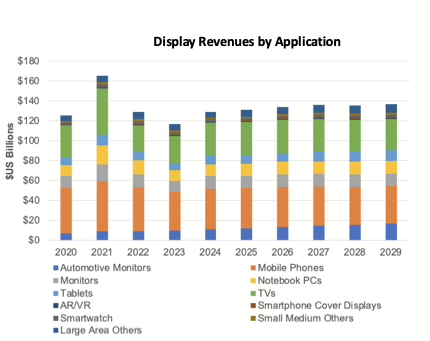

Display Revenues by Application:

- Mobile phones and TVs to remain the 2 largest applications, but losing share to most other segments which are experiencing faster OLED growth.

- Automotive is expected to overtake laptops in 2025 and monitors in 2026 to become the #3 category, rising at an 8.5% CAGR on gains by LTPS, OLEDs, and MiniLEDs.

- AR/VR to enjoy the highest growth at a 13% CAGR.

- IT markets expected to maintain a 26% share.

Richard Kim, SVP of BOE Tech, said in his keynote presentation, “Empowering IoT with display drives premium growth, and 68% of IoT devices have displays.” BOE, the leading LCD supplier, is continuing to develop high-end LCD technology (ADS Pro) solutions and using AI+ for image quality refinement of the display. Eric Cheng, CEO of Tianma America, in his keynote presentation discussed how generative AI is driving changes across the industry, especially in automotive. ChatGPT and DeepSeek are already being used in many cars.

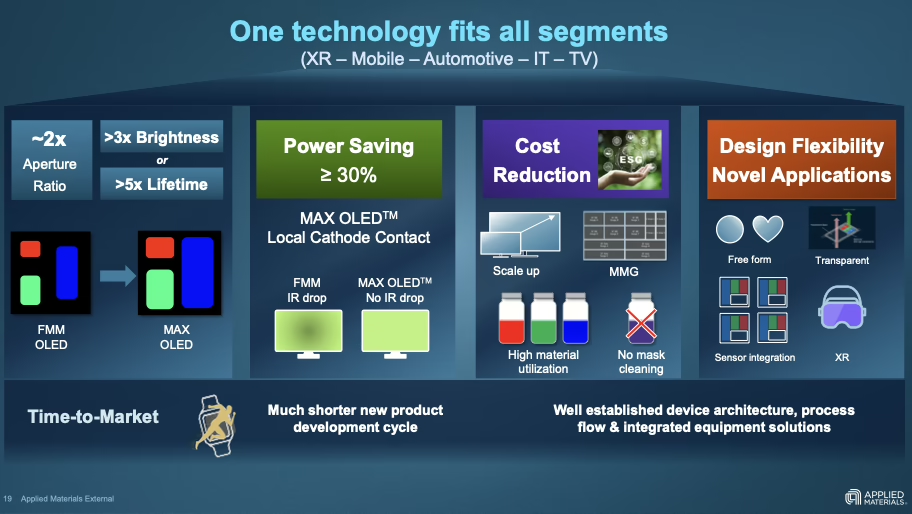

OLED Technology Adoption – Needs Manufacturing Scaling

Indrajit Lahiri, Corporate VP of Applied Materials, presented in his keynote, “OLED is primarily adopted in smartphones which have small screens and high ASPs. Breakthrough in OLED scaling is needed to bring OLED to additional markets.” He pointed out that FMM has challenges for small PDL (pixel definition layer) which is needed for higher aperture ratio, and lithography process can deliver it. Applied Materials has introduced MAX OLED solution, a maskless patterning solution using lithography which can enable higher aperture ratio resulting in more than 30% power saving, cost reductions, and design flexibility. It can enable faster time to market as FMM lead time is in months vs. photomask lead time in weeks.

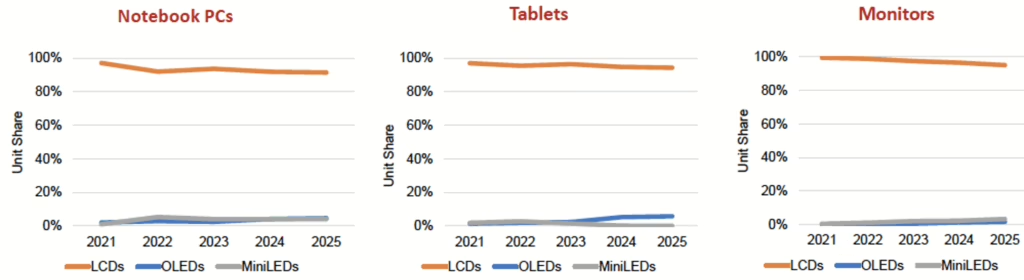

OLED has been gaining only modest unit shares in the IT applications. Cost has been a big challenge. OLED suppliers are planning to shift from Gen 6 to higher Gen 8.7 fabs to lower costs.

As Ross pointed out in his presentation:

- FMM VTE suppliers can only build two 7.5K/month tandem tools per year, so the industry’s ramp will be slow as well as expensive.

- FMMs haven’t been scaled beyond ½ G6 due to sag issues. ½ G8.7 involves a 116% increase in FMM size.

- Photo patterning eliminates FMMs and FMM VTE equipment at G8.7.

- JDI and Visionox, SDC is getting an alpha evaporation system from AMAT in mid-2025 to evaluate this technology.

Suppliers are now considering photo lithography patterning technology. It has the potential to be used for all applications from MicroOLED to large TV; it could also scale up to Gen10.5 fab. New manufacturing processes will take time to scale and improve yields to reduce costs.

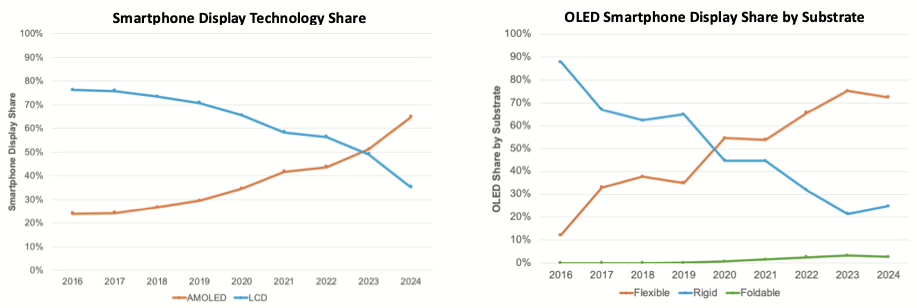

Smartphone – OLED Dominant & Growing, LCD Losing Share

The evolving US tariff situation is impacting smartphone market outlook. Gerrit Schneemann, Senior Analyst at Counterpoint Research, said that “Global smartphone shipment outlook for 2025 was lowered from 4% growth to 1% decline. The primary driver for this decline is the anticipated lower volume in the US.” The situation has reignited efforts to diversify manufacturing away from China. As per Ross Young’s presentation, Smartphone Display Shipments trends:

- LCDs were down 25% in 2024, losing significant share to rigid OLEDs. Premiumization has contributed to reduced interest in LCDs. LCDs are moving away from LTPS to a-Si for cost reasons.

- OLEDs now at a 65% share.

- Rigid OLEDs rebounded in 2024, up over 50% Y/Y, as Samsung shifted much of its LCD volume to rigid OLEDs.

- Flexible also enjoyed strong growth in 2024 and should gain share in 2025 as Apple shifts SE volume from LCD to OLED and all flagships continue to use flexible.

- Foldables stall and should decline the most in 2025. Apple’s entry in 2026 will be a major catalyst.

- Flexible OLEDs remain one of the hottest areas of the display market, rising at least 25% Y/Y in 4 of the past 5 years.

According to Dr. Mike Hack, VP of Business Development for Universal Display (UDC)’s presentation, “Key performance metrics of PHOLED is lifetime. Continuously improving OLED longevity is driving product innovation, from smartphones and TVs to automotive displays and beyond.” He presented that UDC’s red and green PHOLED with fluorescent blue has resulted in 72% reduction in energy consumption for smartphones in 2025 compared to 2015. Full red, green, and blue PHOLED is projected to have additional ~25% performance improvement in energy consumption for smartphones compared to prior devices containing fluorescent blue.

LG Display’s press release in May 2025 said: LG Display has become the world’s first company to successfully verify the commercialization-level performance of blue phosphorescent OLED panels on a mass production line, 8 months after partnering with UDC. LG Display is using a hybrid two-stack Tandem OLED structure, with blue fluorescence in the lower stack and blue phosphorescence in the upper stack. The company reported that it consumes about 15% less power. Ross pointed out in his presentation that besides Phosphorescent Blue, companies are also working on hyperfluorescence (HF) solutions. Visionox has launched high-efficiency blue OLED using HF solution with a fluorescent blue dopant and a TADF sensitizer (10% increase in luminous efficiency and 22% increase in lifetime). BOE has demonstrated a tandem TADF HF green solution. Tianma has shown HF green.

Under-panel facial ID and under-panel camera are expected to come in next-generation smartphones. According to Michael Helander, CEO of OTI Lumionics presentation, “OTI has developed optimized panel design using Cathode Patterning to enable under-display 3D facial recognition. Rapid advances in Generative AI are driving the need for better authentication. OTI’s CPM technology is mass production qualified for mobile display manufacturing by multiple leading panel suppliers.” Technology innovations are needed to drive market demand.

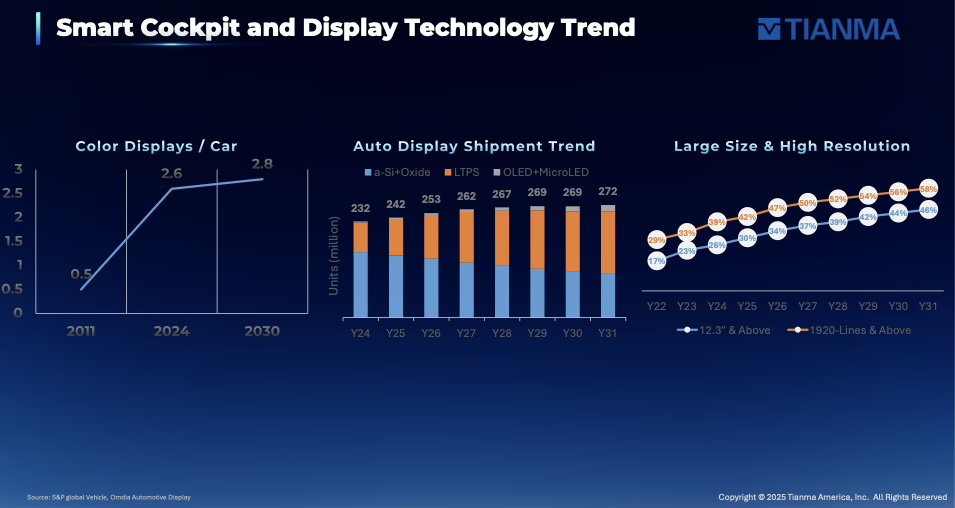

Automotive – Shifting to Larger Size, More Advanced Display, LCD Dominant

Eric Cheng, CEO of Tianma America, in his keynote presentation said, “Rapid development of AI accelerates intelligent car evolution. Automotive intelligence plus AI creates new scenarios for in-vehicle display applications.” These changes are opening up new application opportunities for automobile displays requiring bigger and better displays. Tianma has established itself as the top supplier for automotive-grade displays. It is focusing on TFT-LCD, OLED as well as MicroLED displays and offering a multitude of products to serve the auto market.

Presentation from Greg Basic, Associate Director at Counterpoint Research, showed that in 2025 global vehicle sales are uncertain due to geopolitics. He pointed out:

- In-car infotainment functions are supported by larger displays, typically LCD, though some automakers have deployed OLED displays in their models.

- OEMs are also deploying HUDs in more models to both differentiate their models and provide drivers with key information in a less-distracting way.

- As of year-end 2024, CID (Center Information Display) penetration in cars was closing in on 100%, with nearly every car sold having one.

- The average global CID size continued to increase in 2024, from 9 inches in 2022 to 9.7 inches.

- Nearly all CIDs in cars sold in 2024 are touchscreens, at 98.8%.

Yuichi Motohashi from Global Foundries said there are an increasing number of displays in the auto cabin: Driver Instrument Display (Cluster), Center Information Display (CID), Lower Control Display, Co-driver Display, Side e-mirror, Heads-Up Display, Rear Seat Entertainment, and Rear e-mirror. As he pointed out, “Automotive display requirements are higher compared to consumer display products, for examples: 800 to 1000 Nits brightness (consumer 250 to 450 Nits), operating temperature -30 to 85°C in some applications 105°C (consumer 0 to 70°C), product lifetime 5 to 10 years (consumer 1 to 2 years), and custom form factors instead of standard panels.” Integrated CID enables immersive cabin experience. However, current in-production vehicles have small individual displays or small individual displays under one lens. Some luxury cars are adopting one large integrated panel with more immersive CID design.

Ross Young presented in his keynote:

- Automobiles are increasingly shifting from a single analog cluster to bigger, better, and more digital displays. The move toward hybrids, EVs, and autonomous vehicles is accelerating this shift.

- Due to gains by larger sizes and more advanced displays (LTPS, MiniLED, OLED), growth is faster on an area basis and revenue basis, up ~12% and ~5% respectively.

- Edge-lit LCDs dominate the automotive display market due to their low cost and acceptable performance at 99% on a unit basis, 98% on an area basis, and 92% on a $US basis.

- OLEDs accounted for a smaller unit and share than MiniLEDs, but a higher revenue share due to their higher prices. Tandem structures can help with brightness, durability, and lifetime concerns, but increase cost even more.

Reza Chaji, CEO and Founder of VueReal, presented that MicroLED can have very high impact on automotive:

- Higher performance

- Simplifying integration

- Reducing the cost of ownership

- Managing supply chain constraints

- Enabling new functions and designs

- Enhancing safety

- Enabling extra functionalities

MicroLED manufacturing challenges have been a barrier for mass production. As Reza Chaji presented, VueReal has introduced MicroSolid Printing platform and MicroLED reference design kits for faster, more reliable path for design, development, and production.

LCD is losing share to OLED for most applications. LCD is reinventing itself with new backlight technology such as MiniLED and reducing the performance gap. OLED displays are already dominant for the smartphone market. OLED performance improvements have to be combined with manufacturing scaling and cost improvements to increase adoption rates in TV, IT, Auto, and other applications.

TV Market: The Premium Display Battle Intensifies

The conference also examined the television market in detail, where LCD technology continues to dominate while facing increasing competition from advanced display technologies. According to Ross Young’s comprehensive market analysis, “2024 display revenues rose 11% to $129B with LCDs up 7%, OLEDs up 17%, and MicroLEDs up 53%. It was the first year of growth since 2021 and is the 3rd best year on a revenue basis.”

TVs – MiniLED Gaining Ground Over OLED in Ultra Large Sizes

Bob O’Brien, Research Director at Counterpoint Research, said in his presentation, “In the mainstream TV market, LCD has vanquished all other technologies (CRT, Plasma, projection) and reigns supreme. In the premium TV market, we see a three-way battle between MiniLED LCD, White OLED, and QD-OLED.” MiniLED LCD TVs have the advantage of wide choices of panel and backlight suppliers, range of performance options with multiple price points, and availability of ultra-large sizes and 8K resolution. However, they may sometimes have “Halo” issues and can be expensive for high-end products. WOLED TV and QD-OLED TV both have the disadvantage of having a single panel supplier (WOLED-LG Display, QD-OLED-Samsung Display), limited or no 8K resolution, high prices, and limited size of products. Both technologies excel in terms of picture performance due to pixel-level contrast but lack cost competitiveness.

As per Bob O’Brien’s presentation: Global TV Revenue shares by Display Technology:

- Revenues for TVs with an Advanced display technology increased 47% YoY in Q4 2024, increasing their share of the overall market.

- The biggest increases were in Advanced LCD technologies. MiniLED LCD revenues increased 153% YoY and QD-LCD revenues increased 39% YoY.

- White OLED TV revenues increased 16% YoY while QD-OLED TV revenues decreased 29% YoY. Total OLED TV revenues increased 4% YoY.

A subsidy program in China that is continuing in 2025 led to an increase in TV sales. China market demand also drives ultra-large size TV sales. US TV imports are largely safe from tariffs’ impact.

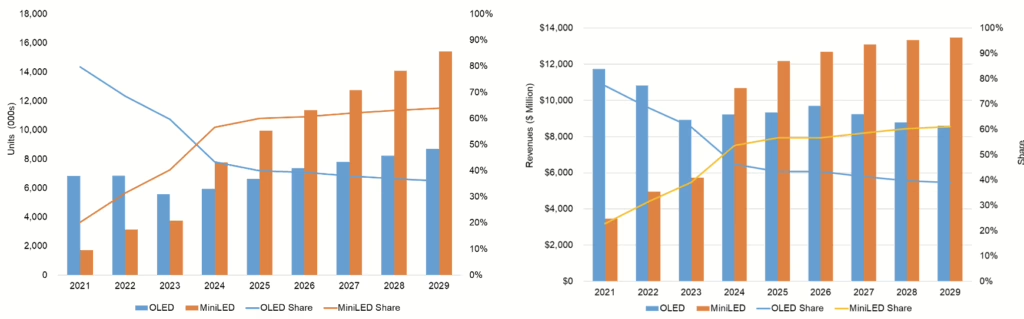

As Bob pointed out for MiniLED vs. OLED TV:

- In the “super premium” category composed of OLED + MiniLED TV, MiniLED passed OLED in 2024 and is expected to continue to gain share in both units and revenue.

- MiniLED TV shipments are expected to increase at a 15% CAGR from 2024-2029, as compared to OLED TV with an 8% CAGR.

- MiniLED TV revenues are expected to continue to increase with a 5% CAGR from 2024-2029, while OLED revenues decline from 2026-2029.

MiniLED plus Quantum Dot (QD) has helped LCD TVs reduce the performance gap with OLED. LCD has multiple panel suppliers and very high capacity including 10.x Gen Fabs. Gen 8.5 fab has 95% efficiency for 98″ (2 up) and Gen 8.6 fab has 93% efficiency for 100″ (2-up) size TV panels. This has enabled super-large size LCD TVs to be cost competitive. A 98-inch 4K QLED TV is now available for $1599 in the US market in 1H 2025. According to Bob O’Brien’s presentation, “The average MiniLED TV was 72″ for $1284. The average OLED TV was 65″ for $1478.” Up to now, Samsung Display and LG Display have not announced any plan for OLED TV or QD-OLED TV panel capacity expansion as profitability has been an issue.

According to Dr. Zhongsheng Luo, VP of Sales at Nanosys’s presentation, “QD TV is leading in most picture quality related scores (showed data from RTINGS). QD Technology provides the best ambient saturation due to better color volume and HDR luminance. QD Solution Provides the Best Visual Experience in Bright Room. QD can tune to match any panel for best color performance.” Combining with Shoei Chemical’s manufacturing capability, Nanosys’s QD Foundry capacity has already increased to >40 million TVs per year. James Murphy, Chief Scientist and Consultant from Edison Innovations, said, “KSF gives best reliability & brightness-color gamut combination for red color conversion.” It is very versatile and currently being used in TVs, laptops, monitors, tablets, smartphones, and other products.

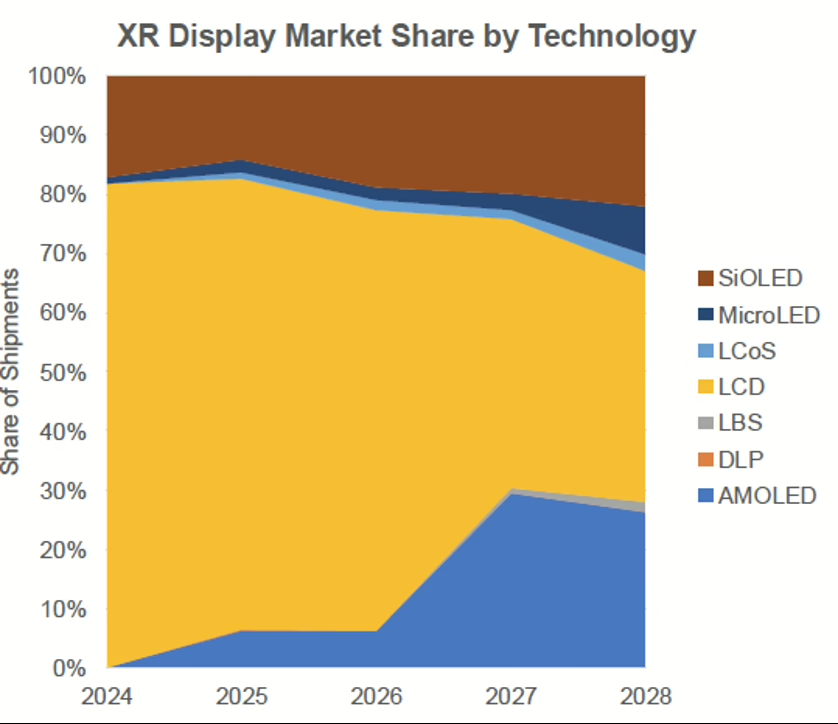

AR/VR – SiOLED Dominates AR, MicroLED Expected for Future

Guillaume Chansin, Associate Director at Counterpoint Research, reported at the conference, “The global VR headset market remains weak, with 2024 estimated shipments declining by 12% YoY and further contraction expected in 2025. Global AR smart glasses market is expected to experience over 30% YoY growth in 2025, driven by the potential entry of tech giants Meta and Samsung and OEMs’ efforts to commercialize AR+AI glasses. Total XR panel revenues decreased 9% in 2024 and are expected to fall 15% in 2025.” VR market demand is shrinking as the market is waiting for a new generation of cost-competitive headsets, possibly from Apple. AR market is growing but remains relatively niche. As he pointed out, “For VR/MR headsets and smart viewers, Micro OLED delivers high contrast and high resolution for media consumption. For AR headsets and AR smart glasses, MicroLED promises high brightness and efficiency.” He summarized the market condition as below:

- SiOLED dominates in AR but is too expensive for mainstream VR due to large size requirements.

- AMOLED on glass went almost extinct in VR but came back in the PlayStation VR2. Apple is now considering using AMOLED in future headsets.

- MicroLED is still a strong candidate for next-gen AR glasses, but there are challenges to get full-color displays.

- LCoS currently offers better performance and costs.

Many companies have announced or shown prototypes of full color on a single panel with Quantum Dot color conversion (Mojo Vision, Playnitride, Sitan, Saphlux, Raysolve), stacked epi (Sundiode, Jade Bird, Q-Pixel), and dynamic pixel tuning (Porotech). There are many challenges in MicroLED display manufacturing including mass transfer and rapid detection of defects and repair. David Lewis, CEO of InZiv, presented that InZiv technology solves the critical inspection challenges for microLED display manufacturers by offering:

- A technological breakthrough in EL speed

- Damage free

- Improved yields and lowered costs

Pierre Laboisse, President & CEO of Aledia, said, “Hardware is the last bottleneck for AR adoption. Aledia’s micro-displays are targeting to meet customer needs of low power consumption, low manufacturing cost, and form factor with high image quality.” It showed a demo at SID 2025 and expects production to start in 2027.

MicroLED is seen as a promising technology for AR in the future. Industry needs advanced testing, repair, and mass transfer technology to improve yields and enable mass production.

IT – OLED Gaining Modest Share, Manufacturing & Cost Improvements Needed

David Naranjo, Associate Director of Counterpoint Research, gave an outlook of IT market trends at the Display Week Business Conference.

- In 2024, the total IT market increased 12% YoY after declining 8% YoY in 2023. The notebook PC display market increased 13% YoY in 2024 after declining 13% in 2023.

- In 2025, the total IT market to remain flat because of tariffs and demand uncertainty, with the notebook PC category increasing 1% YoY. The single-digit growth is the result of the tariff situation tempered by the improved demand from the commercial sector, the three-to-five-year replacement cycle, the Microsoft Windows 10 sunset, and AI PCs.

For Advanced (OLED and MiniLED) IT products:

- The Advanced monitor category is expected to grow 40% Y/Y with OLED monitors increasing 34% Y/Y and MiniLED monitors increasing 43% Y/Y.

- The Advanced notebook PC category to grow 8% Y/Y with OLED notebook PCs increasing 12% Y/Y and MiniLED notebook PCs increasing 3% Y/Y.

- The Advanced tablet category to grow 9% Y/Y.

2025 – 2029

- On a panel revenue basis, OLED and MiniLED notebook PC panel revenues are expected to grow by a 7% CAGR from 2022 – 2029 with OLED notebook PCs growing by a 36% CAGR for a 35% revenue share in 2029 and MiniLED notebook PCs declining by a 22% CAGR.

Apple is expected to fuel IT OLED demand. As per David Naranjo’s presentation, “An OLED iPad Mini is expected in 2026 with LTPS with rigid+TFE substrate and a single stack. OLED iPad Air is expected in 2027.” He pointed out that there are still many challenges for OLED in IT: high cost, higher power consumption, burn-in, and limited number of suppliers.

Standardization of MiniLED design such as number of LEDs, number of dimming zones, and Quantum Dots technology can shorten development period, lower costs, shorter lead time, and higher quality. That can result in more fierce competition between MiniLED-based and OLED-based IT products.

According to Ross Young’s presentation, “The IT display opportunity is around 600M units and $33B, down from peak of ~687M units and $47B during Covid. OLEDs are taking modest unit share in IT applications with tablets enjoying significantly higher revenue share on the OLED iPad Pro launch with its expensive LTPO, hybrid, tandem panel. However, we are seeing a smaller appetite for expensive tablets with the OLED iPad Pro’s falling below expectations. Notebooks are also trending upwards and should get a major boost from SDC’s G8.7 oxide IT OLED fab starting in 2026. OLEDs are having the least success in monitors and it remains to be seen if G8.7 fabs will target monitors or just focus on tablets, laptops, and automotive.”

Tariff uncertainty is expected to impact demand in 2025. Advanced TVs are growing and MiniLED TVs are gaining share. OLED TVs, despite high performance, are struggling due to high costs and low profitability. OLED technology innovations, capacity expansion for IT will contribute to driving demand leading to higher adoption in the future. MicroLED is seen as a promising technology for AR in the future, but manufacturing challenges need to be resolved to enable full-color microLED on a single panel.

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com.