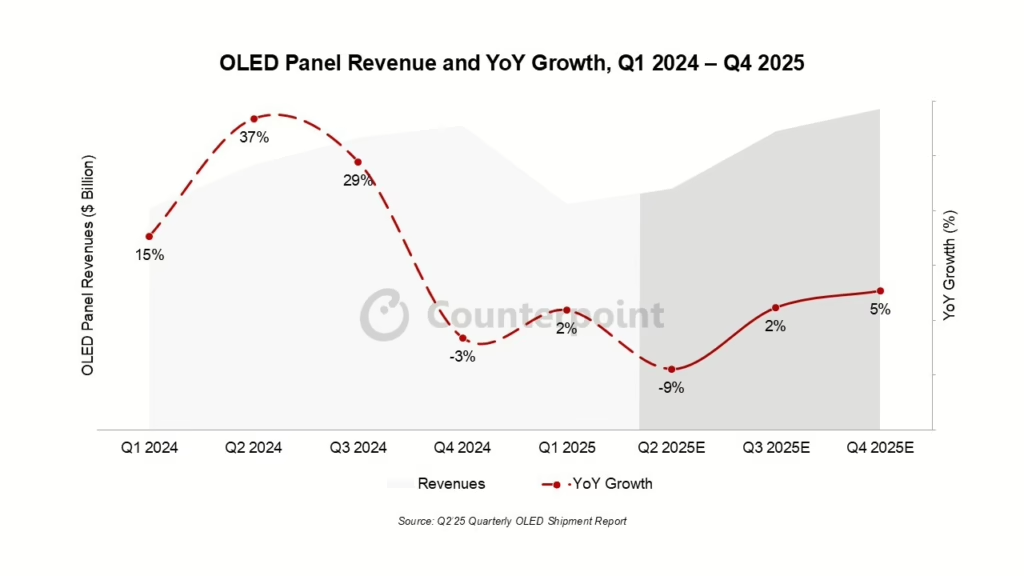

OLED panel revenues grew modestly at 2% YoY in Q1 2025, but the industry faces headwinds from declining average selling prices (ASPs) that will keep full-year revenue growth flat despite healthy unit shipment increases. Revenue growth of 2% YoY in Q1 2025 represented a recovery from a 3% decline in Q4 2024, while unit shipments showed strong 4% YoY growth driven by TVs, tablets, monitors, and smartphones. The full-year outlook anticipates 4% unit growth, but revenues will remain flat due to falling ASPs.

The smartphone segment, which represents the largest portion of OLED sales, saw unit shipments increase 1% YoY while revenues remained flat. This reflects the broader challenge of declining ASPs, with smartphone panel prices dropping 2% YoY. The flexible OLED smartphone segment performed better with 4% unit growth, while foldable units remained unchanged.

Samsung Display maintains its leadership position, particularly in iPhone supply, followed by LG Display and the rapidly expanding BOE. Interestingly enough, BOE has overtaken Samsung Display in the foldable OLED segment, indicating shifting competitive dynamics in this emerging category.

TV sales showed 8% unit growth and 3% revenue growth, though the segment faces competition from MiniLED LCD TVs. In notebooks, overall PC sales declined 18% YoY, but OLED display adoption surged 68%. Emerging categories including AR glasses, automotive, and smartwatches also contributed to growth.

The second quarter of 2025 is expected to be challenging, with recovery anticipated in the second half driven by new foldables and flagship device launches ahead of the holiday season. However, Counterpoint Research’s David Naranjo notes this won’t be sufficient to overcome the year’s flat revenue trajectory. The industry needs significant adoption of newer OLED-driven form factors like foldables and rollables to reach mainstream markets and revitalize revenue growth, as the previous growth driver of OLED adoption in AI PCs and tablets has slowed compared to last year.