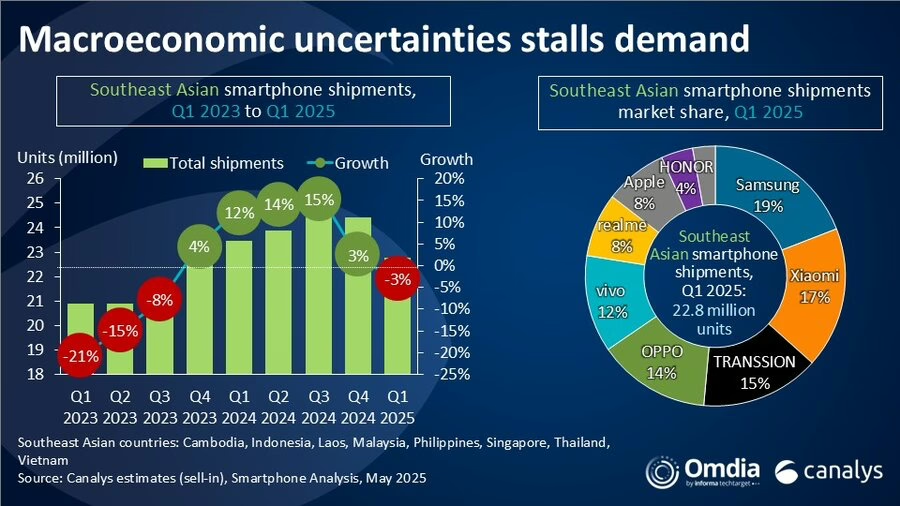

Southeast Asia’s smartphone market has contracted for the first time after five consecutive quarters of growth, according to the latest research from Canalys (now part of Omdia). Shipments declined 3% YoY to 22.8 million units in the first quarter of 2025.

| Vendor | Q1 2025 shipments (million) | Q1 2025 market share | Q1 2024 shipments (million) | Q1 2024 market share | Annual growth |

| Samsung | 4.3 | 19% | 4.5 | 19% | -3% |

| Xiaomi | 4 | 17% | 3.8 | 16% | 4% |

| TRANSSION | 3.3 | 15% | 4.2 | 18% | -20% |

| OPPO | 3.2 | 14% | 3.8 | 16% | -16% |

| vivo | 2.7 | 12% | 2.8 | 12% | -3% |

| Others | 5.2 | 23% | 4.4 | 19% | 18% |

| Total | 22.8 | 100% | 23.5 | 100% | -3% |

Samsung reclaimed its leadership position with a 19% market share, shipping 4.3 million units. However, the South Korean giant was not immune to market pressures, recording a 3% decline in shipments compared to the same period last year. Xiaomi emerged as the quarter’s surprise performer, becoming the only top-five vendor to achieve growth. The Chinese manufacturer increased shipments by 4% to reach 4 million units and captured a 17% market share, its strongest position since Q2 2019, before the pandemic disrupted global markets.

Tranission secured the third position with a 15% market share despite experiencing the steepest decline among major vendors at 20%. Analysts attribute this drop to new product launches being scheduled earlier in 2024. Oppo and vivo rounded out the top five positions with 14% and 12% market shares respectively. OPPO faced challenges in the entry-level segment, resulting in a 16% decline in shipments. Meanwhile, vivo maintained relative stability with just a 3% decrease, buoyed by strong performance in its V-series, which grew 34% compared to its previous generation.

Analysts point to inflationary pressures weakening consumer demand, particularly in entry-level and mid-range segments. This has contributed to a 5% increase in average selling prices (ASPs), reaching their highest level since 2023.

Vendors employing flexible strategies have navigated the challenging environment more successfully. Xiaomi’s strategic acceleration of its Note series launch helped maintain momentum during traditionally slower months. Similarly, Honor achieved 88% YoY growth by expanding its product portfolio across price segments, reaching 893,000 shipments, its highest quarterly performance to date.

Channel diversification has proven critical for vendors seeking to reduce exposure to market volatility. Samsung’s focus on improving value propositions and strengthening telecommunications partnerships has paid dividends, with its 5G-capable A-series growing 47% despite ongoing challenges in ultra-low-end segments.

Looking ahead, analysts expect continued headwinds from global trade tensions, currency fluctuations, and domestic challenges including political uncertainty and inflation. These factors, combined with rising smartphone costs, may further dampen consumer demand in price-sensitive markets.

Vietnam is highlighted as a market to watch in 2025, potentially benefiting from regional supply chain shifts. Its stable governance, improving infrastructure, and proximity to component suppliers position it as an attractive destination for smartphone production investment. Other Southeast Asian countries, including Malaysia, Indonesia, and Thailand, are also enhancing their roles in the smartphone value chain, leveraging their respective industrial strengths.

Analysts suggest these regional developments could help maintain price stability and navigate global uncertainties as the smartphone market adapts to changing economic conditions.