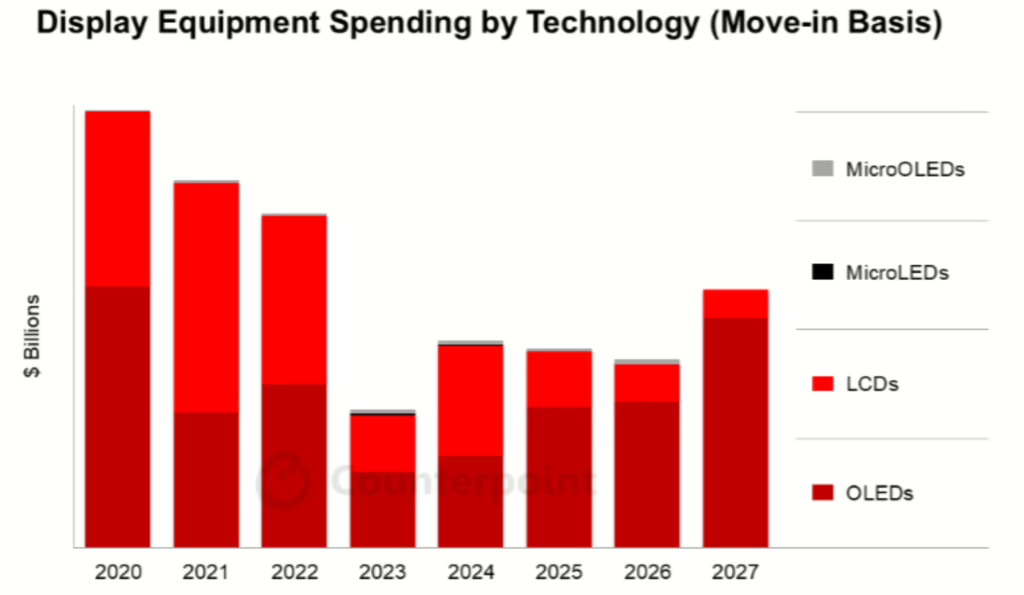

Counterpoint has just bumped up its 2020–2027 display equipment spending forecast by 2%, now projecting $77 billion in total investment. The upward revision is largely due to continued growth in OLED demand, particularly flexible OLED conversions and expansions at G6 and G8.7 lines. While IT OLED uptake is softer than expected, mobile OLED and large-size OLED TV panel investments (especially >85”) are driving the forecast up, with OLED equipment spending set to hit $8.3 billion in 2027.

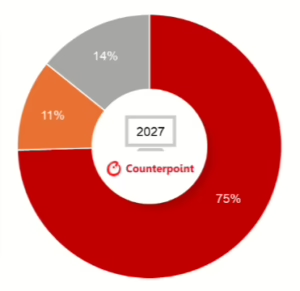

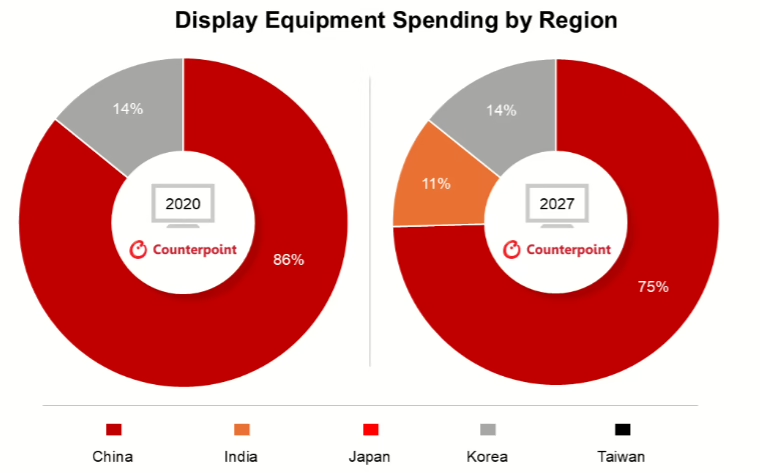

China remains the key player, expected to account for 83% of total capex over the period, dominating in LCD (93%), OLED (77%), and Micro OLED (85%) spending. South Korea maintains a 13% share, while India and Taiwan trail at 2% and 1%, respectively.

Despite a dip in IT OLED demand, some G8.7 lines may prioritize smartphone production, reflecting shifting demand profiles. OLED is now forecasted to take up 58% of total display capex, with LCDs holding 40%, mainly due to ongoing >85” LCD TV fab conversions from 2024 through 2027.