Corning delivered strong results in Q4 and full year 2024. The company’s core sales grew across its portfolio, with the Display Technologies segment playing a significant role in the overall performance. In Q4 2024, Display Technologies recorded net sales of $971 million compared to $869 million in Q4 2023, marking a 12% YoY increase. Net income for the segment rose from $232 million in Q4 2023 to $262 million in Q4 2024, reflecting a 13% YoY increase. For the full year 2024, the display segment achieved net sales of $3,872 million versus $3,532 million in 2023, a 10% improvement, while full-year net income increased by 19%, reaching $1,006 million compared to $842 million the previous year.

| Display Technologies | Q4 2024 | Q4 2023 | YoY Change | FY 2024 | FY 2023 | Y0Y Change |

| Net Sales | $971M | $869M | 12% | $3,872M | $3,532M | 10% |

| Net Income | $262M | $232M | 13% | $1,006M | $842M | 19% |

Corning’s strategic implementation of double-digit price increases in the second half of 2024 was instrumental in maintaining stable US dollar net income despite a weaker yen. This pricing strategy supported profitability in a competitive market, even as the retail and glass markets experienced growth, driven by larger average television screen sizes. Increased utilization rates among panel makers and higher orders from set makers, spurred by government stimulus in China, further bolstered the segment’s performance. Looking ahead, management expects segment net income for 2025 to fall in the range of $900 million to $950 million, with a target net income margin of 25%. Additionally, panel makers are anticipated to maintain current utilization rates into Q1 2025, suggesting stable near-term performance.

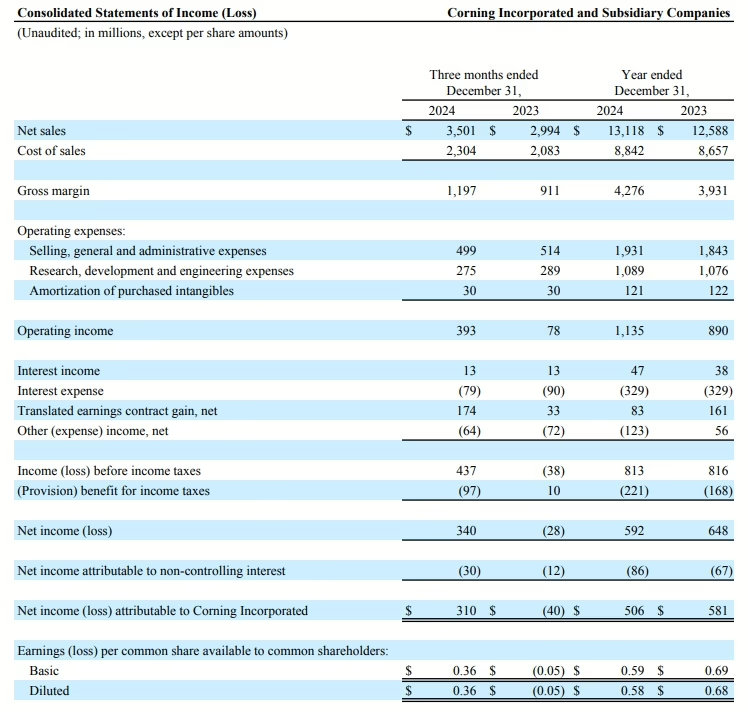

Overall, Corning posted record core sales of $3.9 billion in Q4 2024, representing an 18% YoY increase, while full-year core sales reached $14.47 billion, up 7% from the prior year. The company also achieved an expansion of its core operating margin by 220 basis points to 18.5% in Q4 and generated robust free cash flow of $1.25 billion over the full year, a 42% increase over the previous period. Looking ahead to Q1 2025, Corning anticipates a 10% growth in core sales to $3.6 billion. GAAP measures further support the company’s performance, with Q4 GAAP sales reported at $3.50 billion and full-year GAAP sales at $13.12 billion.