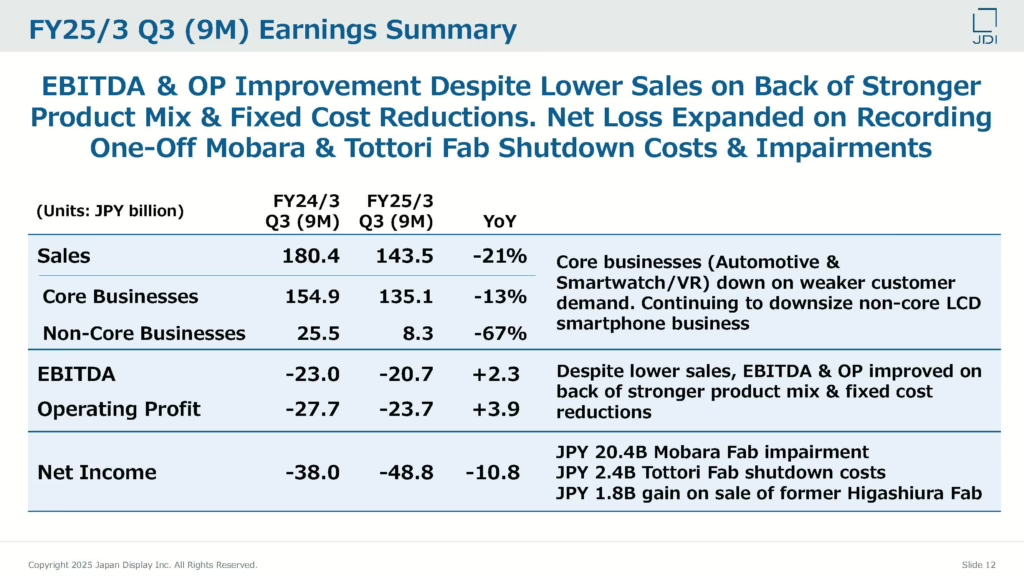

JDI (Japan Display Inc.) is going through significant restructuring while facing challenging financial performance. Their Q3 FY25/3 results show overall sales declined 20.5% YoY to 143.5 billion yen ($936 million), driven by decreased LCD smartphone and VR shipments. Despite lower sales, the company managed to improve EBITDA and operating profit by 10% and 14% respectively through better product mix and fixed cost reductions.

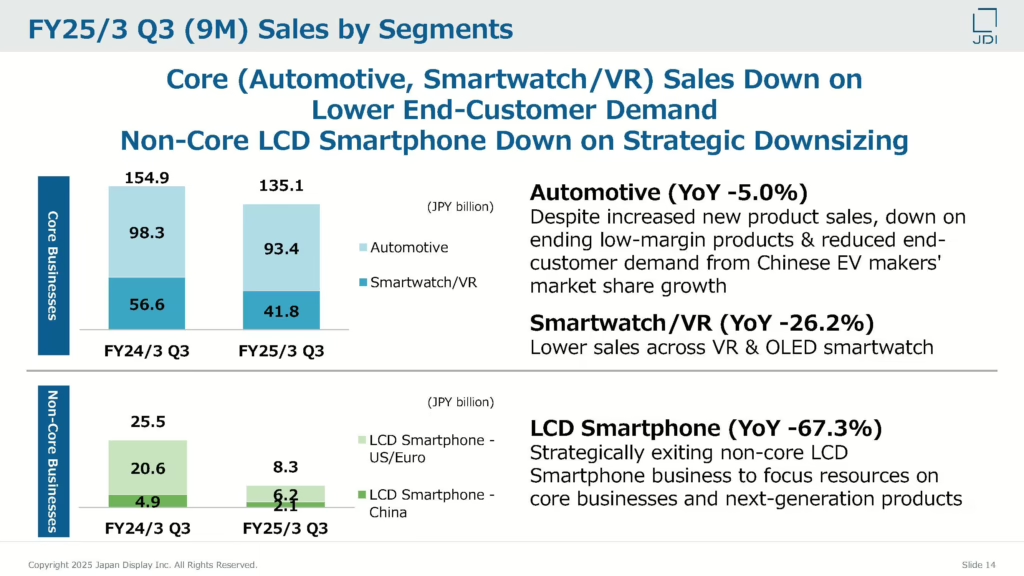

The company’s core businesses, the automotive and smartwatch/VR segments, saw sales decline 13% to 135.1 billion yen ($887 million). The non-core LCD smartphone business saw a planned 67% reduction to 8.3 billion yen ($54 million) as part of a strategic exit from this segment. The automotive segment, while showing some resilience, was impacted by reduced end-customer demand, particularly from Chinese EV makers gaining market share. The smartwatch/VR segment experienced a 26.2% decline due to lower sales across VR and OLED smartwatch products.

JDI’s net loss increased significantly, primarily due to one-off impairment charges of 20.4 billion yen ($134 million) related to the planned closure of their Mobara Fab facility and 2.4 billion yen ($12 million) in shutdown costs for their Tottori Fab. Their balance sheet shows declining cash positions and increasing debt, with shareholders’ equity ratio dropping to 20.9% from 38.1%.

At the heart of this restructuring is the planned closure of JDI’s Mobara facility in Chiba Prefecture by March 2026. The Mobara Fab, which currently employs 1,323 people and specializes in LCD and OLED display development, design, and production, will cease operations as JDI explores converting the site into an AI data center. The company is in active discussions with potential buyers requiring AI infrastructure.

Production operations will be consolidated at JDI’s Ishikawa facility, which will be transformed into a state-of-the-art Multi-Fab. The Ishikawa site will use both G4.5 and G6 substrate technologies, with plans to relocate Mobara’s G6 LCD cell process machinery while sourcing G6 array substrates from foundry partners. The smaller G4.5 substrate size at Ishikawa is particularly well-suited for producing higher-profitability advanced semiconductor packaging and sensors.

The consolidation makes strong financial sense for JDI, as the Ishikawa facility operates at just one-quarter of Mobara’s fixed costs. The company projects annual fixed cost savings of approximately 25 billion yen ($164 million) following the Mobara closure.