In the third quarter of 2024, PC shipments in the United States (excluding tablets) reached 17.9 million units, marking a 7% YoY growth, according to the latest research from Canalys. The growth was primarily driven by notebooks, which saw a 9% annual increase in shipments. Despite this positive momentum, analysts caution that the market’s recovery is likely to slow in the coming years due to headwinds from macroeconomic policies and weaker demand for Windows device refreshes.

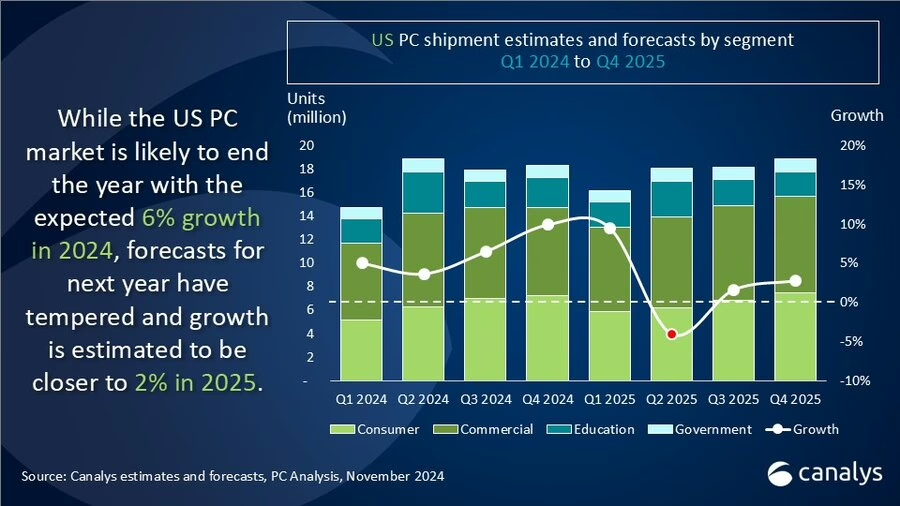

Canalys projects total PC shipments in the US to grow 6% in 2024, reaching just under 70 million units. However, growth is expected to decelerate to a modest 2% annually in both 2025 and 2026. The forecast reflects uncertainties tied to macroeconomic policies, including changes in import tariffs and public sector budget cuts.

| Q3 2024 Shipments | Q3 2024 Market Share | Q3 2023 Shipments | Q3 2023 Market Share | Annual Growth | |

| HP | 4,336 | 24.20% | 4,145 | 24.60% | 4.60% |

| Dell | 3,996 | 22.30% | 4,089 | 24.30% | -2.30% |

| Lenovo | 3,089 | 17.20% | 2,759 | 16.40% | 12.00% |

| Apple | 2,825 | 15.80% | 2,499 | 14.90% | 13.00% |

| Acer | 1,181 | 6.60% | 1,021 | 6.10% | 15.60% |

| Others | 2,486 | 13.90% | 2,306 | 13.70% | 7.80% |

| Total | 17,913 | 100.00% | 16,819 | 100.00% | 6.50% |

Commercial demand was a standout segment in Q3, with shipments increasing by 12% year-on-year. The Windows 11 refresh has been a key driver in this space, as businesses, both large and small, ramped up PC fleet upgrades. Analysts expect commercial strength to continue into early 2025, as businesses transition from Windows 10 ahead of its October 2025 end-of-service deadline.

Despite efforts by Microsoft and its partners to encourage upgrades, a significant portion of PCs remain on Windows 10, with only 10 months left before support ends. Canalys expects many fleet refreshes to occur after the October 2025 deadline, reflecting the relatively slow pace of transition.

The US PC market faces further uncertainties following the 2024 presidential election. According to Davis, “With the 2024 US Presidential election coming to a close, macroeconomic conditions in the US are not expected to be as stable in the near-term as they have been over the last year or two.” Reports of potential import tariffs could significantly impact the market, with a Consumer Technology Association study indicating that device prices could rise as much as 46%.

| Segment | 2024 Shipments | 2025 Shipments | 2026 Shipments | 2024 Annual Growth | 2025 Annual Growth | 2026 Annual Growth |

| Consumer | 25,750 | 26,416 | 27,210 | 1.60% | 2.60% | 3.00% |

| Commercial | 29,735 | 31,158 | 32,102 | 9.40% | 4.80% | 3.00% |

| Government | 4,062 | 4,355 | 4,319 | 6.40% | 7.20% | -0.80% |

| Education | 10,371 | 9,468 | 9,472 | 10.00% | -8.70% | 0.00% |

| Total | 69,918 | 71,396 | 73,103 | 6.30% | 2.10% | 2.40% |

Anticipation of these tariffs may lead to stockpiling in early 2025, disrupting the usual seasonal shipment patterns. Additionally, proposed federal budget cuts could impact government and education procurement of PCs beyond 2025, potentially reducing public sector spending on technology.

While the US PC market remains robust in 2024, uncertainties surrounding macroeconomic conditions and public policy are casting shadows over the long-term outlook. With challenges ranging from tariff impacts to constrained public sector budgets, industry players will need to navigate a complex landscape to sustain growth.