The high-end tablet market’s growth trajectory has dimmed, as market research firm DSCC has reduced its 2024 outlook for OLED-based tablets. Weaker-than-anticipated demand for Apple’s OLED iPad Pro and slower innovation in foldable and slidable devices are contributing to more modest gains than previously forecasted.

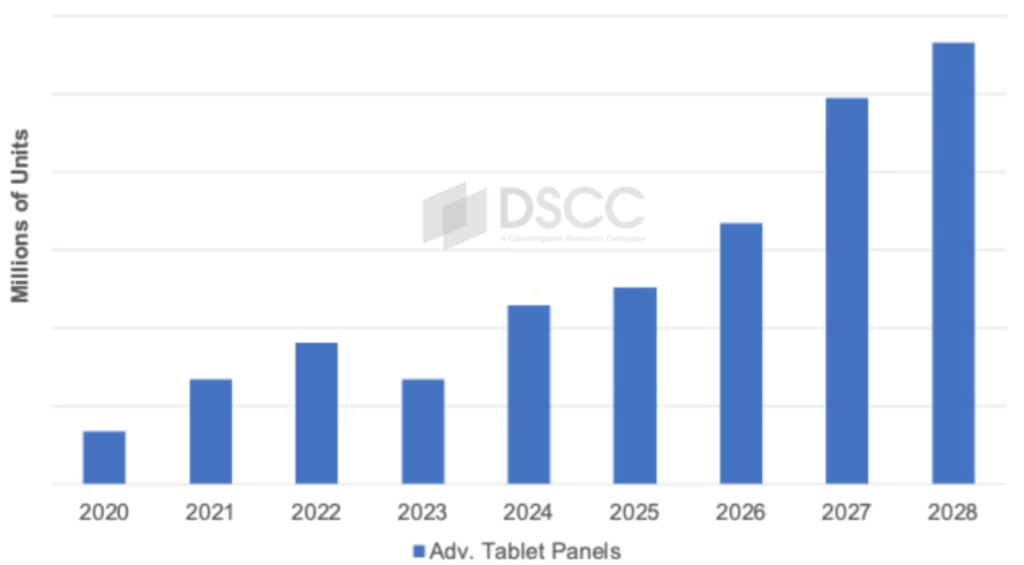

DSCC now projects that OLED and MiniLED tablet panel shipments will total just over 11 million units in 2024, representing a 71% YoY increase but falling 15% short of the firm’s forecasts from the previous quarter. This shortfall largely stems from Apple’s reduced OLED iPad Pro panel procurement. Initial expectations of 8–10 million units have given way to projections below 5.7 million units, as consumers appear hesitant to invest in high-priced tablets.

Though Apple is still expected to expand its share of the advanced tablet market from 38% in 2023 to 51% in 2024, the latest estimate is down from the previously anticipated 56%. Apple’s upcoming lineup—which includes an OLED iPad Mini in 2026, and new OLED-based iPad Air models and a foldable variant in 2027—positions the company to drive future growth in the sector. However, the softer-than-expected start may serve as a cautionary note that there are limits to how far consumers will stretch their budgets in this category.

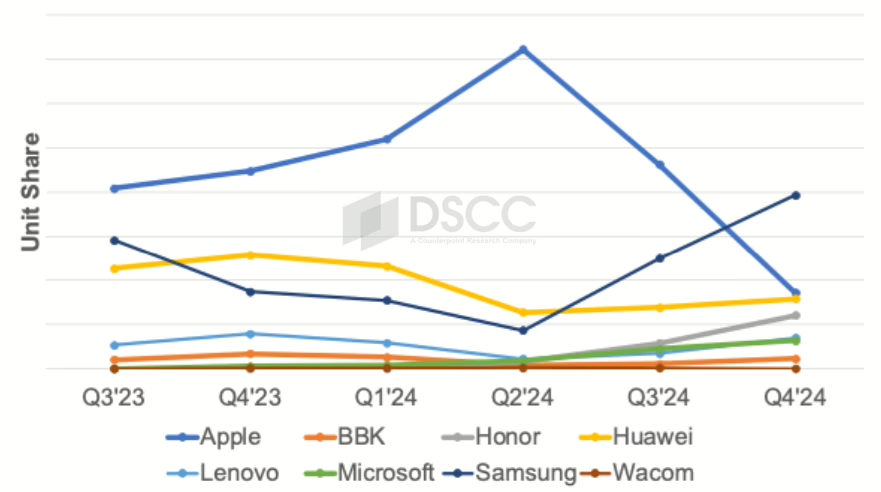

In contrast to Apple’s underperformance, Samsung’s latest high-end Android tablets are experiencing stronger-than-expected traction. The Galaxy Tab S10+ and S10 Ultra models have each outpaced their predecessors, with the S10 Ultra’s shipments running 41% above last year’s Tab S9 Ultra performance at the same point. The S10+ is showing even greater gains, up 64% over its predecessor, and Samsung’s older S9 series continues to sell at robust levels.

While Apple is projected to hold the top spot for much of 2024, DSCC forecasts that Samsung will overtake Apple in the fourth quarter. This late-year leadership shift is anticipated as Samsung’s advanced tablet line solidifies its position in the premium segment.

Despite tempered expectations, the advanced tablet market remains on a growth path. DSCC foresees a 33% compound annual growth rate through 2028, reaching more than 28 million units. While this is a drop from the previously predicted 39% CAGR, it still represents substantial long-term potential. The lack of imminent rollouts for foldable or slidable tablets—formats that have stirred excitement in smartphones and laptops—also dampens the near-term outlook.

Longer term, several catalysts promise to reinvigorate the OLED tablet space. Apple’s future OLED expansions, cost reductions from next-generation manufacturing processes, and advancing OLED technologies that enhance battery life and brightness could all help stimulate consumer demand. By 2026 and 2027, with an OLED iPad Mini, new iPad Air models, and a foldable iPad Pro on the horizon, the industry may find fresh impetus for accelerated growth.

For now, however, the tablet market’s top-tier segment is navigating a slowdown, as premium pricing gives some buyers pause and industry players adjust their strategies to match evolving consumer appetites.