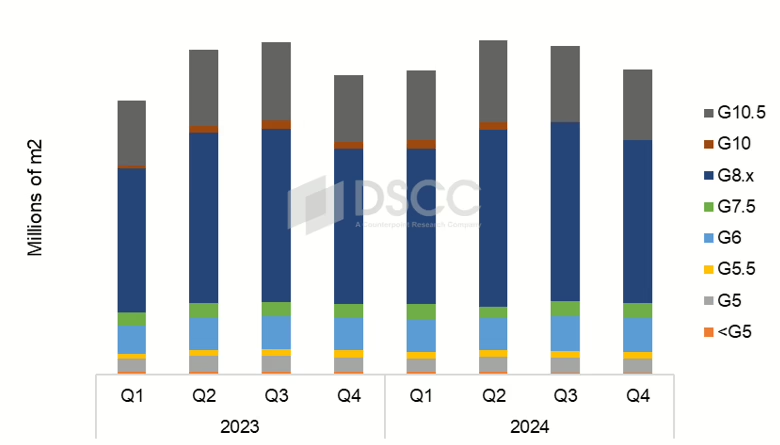

In what’s shaping up to be a fascinating story of market dynamics, the display glass industry is navigating through choppy waters in late 2024. I’ve got to tell you, folks, the numbers are telling quite a tale here.

We’re seeing glass shipments take a hit, down 2% QoQ and 1% year-over-year in Q3’24m, according to the latest data from DSCC. And hold onto your hats – Q4 is expected to see an even steeper 7% drop. But here’s where it gets interesting: Corning, the industry heavyweight, isn’t taking this lying down. They’ve responded with a bold move – announcing price hikes to counter the weakening Japanese yen.

Over in China, domestic glass makers are flexing their muscles, ramping up their Gen 8.5 capacity. It’s like watching a changing of the guard in slow motion. Remember when Korea was the big player in this game? Well, they’re now sitting at just 7% market share – quite the fall from grace from their market-leading position a decade ago.

While the industry’s seeing a 13% revenue jump in yen terms for 2024, once you convert that to US dollars, it shrinks to a modest 5% increase. Even with all this capacity expansion, some production lines are sitting idle.

The peak moment for 2024 was actually back in Q2, when panel makers were rushing to build up TV panels for those big summer sporting events. But even that couldn’t match the industry’s golden moment back in Q1’22.

And with another 4% price hike expected in Q1’25, this story is far from over.