Global TV shipments experienced a significant rebound in the third quarter of 2024, growing 11% year-over-year (YoY) to 62 million units, marking the second consecutive quarter of YoY growth. According to Counterpoint Research, this resurgence is attributed to a shortened replacement cycle and growing consumer interest in high-definition, large-screen models.

While the recovery was seen globally, Eastern Europe led the charge with a 24% increase in shipments, followed by strong performances in North America and Western Europe. Japan, however, lagged behind other regions.

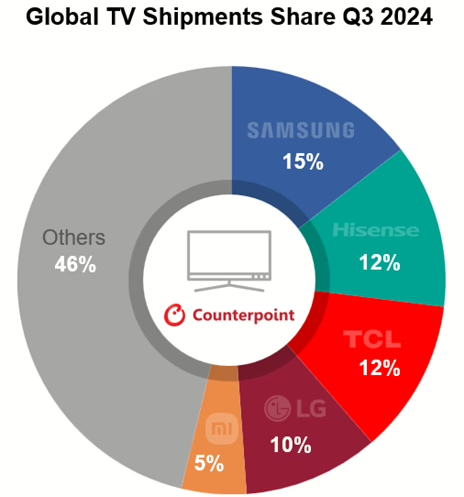

Samsung Electronics maintained its position as the global market leader with a 15% market share. However, its dominance has been slightly dented, with a decline in market share compared to the previous quarter. Chinese brands, particularly Hisense and TCL, are rapidly gaining ground. Hisense reclaimed second place, shipping 19% more TVs than in Q3 2023, while TCL settled in third place. LG, ranked fourth, recorded a 7% YoY increase, buoyed by strong performance in Europe, bringing its market share back into the 10% range.

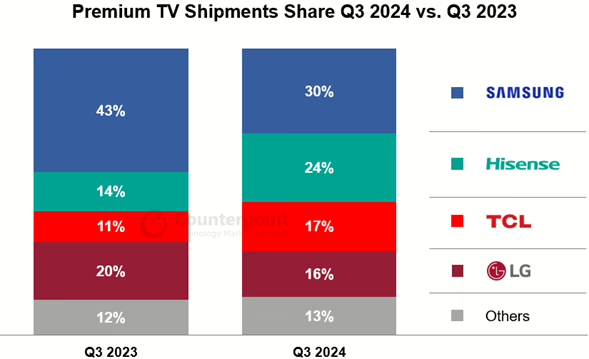

The premium TV segment—encompassing OLED, QD LCD, and MiniLED LCD models—surged by 51% YoY, reaching an all-time high. MiniLED LCD TVs, in particular, saw a remarkable 102% YoY growth, surpassing OLED shipments for the first time. Shipments of QD LCD TVs also climbed over 50%, with quarterly shipments exceeding 4 million units. OLED TVs recorded a modest 13% YoY growth.

The competitive dynamics in this segment have shifted dramatically. Samsung, historically a leader in premium TVs, saw its market share plummet by 13 percentage points over the past year to 30%. Meanwhile, Chinese brands Hisense and TCL more than doubled their premium TV shipments, overtaking LG to claim second and third place, respectively. This marks a significant shift in a segment once dominated by Samsung and LG.

The competition in the premium TV market is expected to intensify as brands continue innovating with advanced technologies and larger screen sizes to attract consumers. As researcher Lim Soo-jung observed, “The consecutive YoY growth suggests a shortened replacement cycle, driven by new high-definition models that stimulate consumer interest.”