Flexible AMOLED displays are expected to become the dominant technology in the smartphone display market by 2024, according to a recent report from Omdia. Shipments of these displays are projected to reach 631 million units next year, a 24% increase compared to 2023.

This surge positions flexible AMOLED displays to capture a 42% share of the smartphone display market, surpassing the long-standing leader, a-Si LCD, which is anticipated to hold a 37% share.

The market will feature four primary display technologies sourced from different production lines: flexible AMOLED, rigid OLED (expected to hold 12% of the market), a-Si LCD, and LTPS LCD, which is projected to have a 10% share. The rapid adoption of flexible AMOLED displays is largely attributed to a notable decrease in their average selling price (ASP). In 2023, the ASP for these displays dropped by 14.3%, encouraging more smartphone manufacturers to transition from traditional LCDs to OLED technologies.

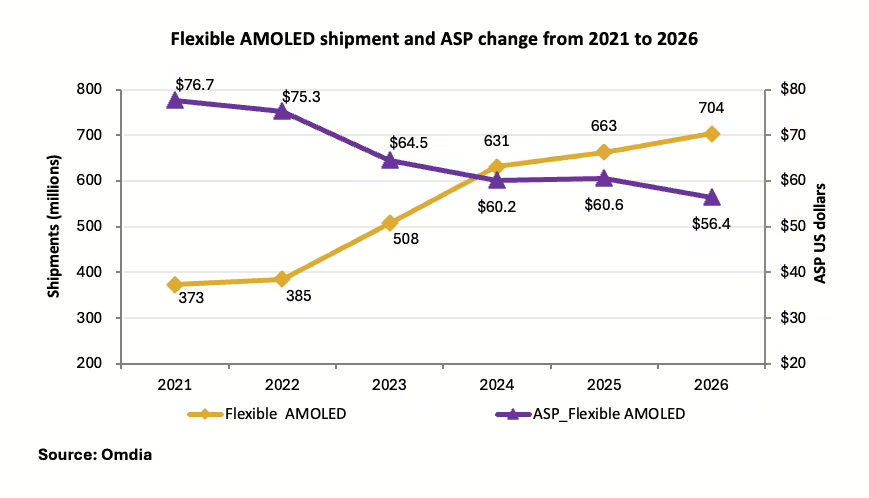

Flexible AMOLED shipments saw a significant rise of 31.8% in 2023, reaching 508 million units. This upward trend is expected to continue, with AMOLED technology—including both flexible and rigid variants—set to account for 53% of the smartphone display market in 2024, thereby overtaking LCDs as the primary display technology.

Despite Chinese OLED manufacturers increasing prices for low-end products in early 2024, the ASP for flexible AMOLED displays is still anticipated to decline by 6.7% this year, with a more gradual decrease expected in 2025. Omdia’s analysis suggests that supply and demand for flexible AMOLED displays will remain balanced in 2025, based on smartphone makers’ purchasing plans and OLED producers’ business strategies. However, the market may require additional seasonal and structural adjustments to maintain this equilibrium.

“Flexible AMOLED prices are expected to remain stable or see only slight declines over the next two years, though seasonal price fluctuations are anticipated,” said Joy Guo, Principal Analyst at Omdia’s Displays practice. “Unlike the double-digit price drops we witnessed in 2023, prices are unlikely to decrease as sharply due to limited new production capacity in the coming year.”

Guo further explained that the landscape is expected to change in late 2026 with the introduction of Gen8.6 OLED production capacity and the completion of depreciation costs for Chinese OLED manufacturers. “OLED prices are expected to experience a rapid decline once again,” she noted. “This shift will accelerate the transition from LCD to OLED displays in 2027.”