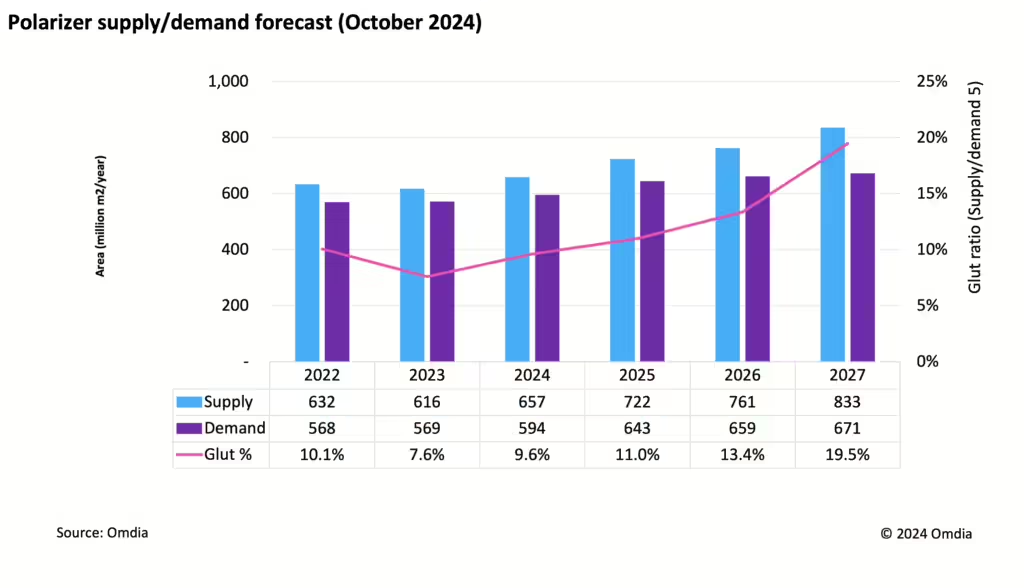

The global demand for polarizers is set to rise, with projected growth from 594 million square meters in 2024 to 682 million square meters by 2027, reflecting a compound annual growth rate (CAGR) of 3.4%, according to Omdia. This increase is attributed to the popularity of larger televisions, spurred by decreasing prices in larger formats.

China has emerged as a major center for polarizer production following Shanjin Optoelectronics’ acquisition of LG Chem’s LCD polarizer division in 2020. Since then, Chinese companies, including Shanjin, Sunnypol, and HMO (Heongmei Optoelectronics), have heavily invested in expanding polarizer production, though recent delays in capacity expansion plans reflect ongoing concerns about oversupply. The surplus, currently around 10%, is expected to increase to 19.5% by 2027.

The shift has led Japanese and Korean firms like LG Chem, Samsung SDI, and Sumitomo Chemical to streamline or divest polarizer operations. According to Omdia’s Principal Analyst Irene Hao, these adjustments may stabilize the supply until 2025. However, if delayed Chinese factories start production in late 2026, an oversupply situation could reemerge, potentially impacting global polarizer markets.