The global tablet market recorded a 20.4% YoY increase in shipments for the third quarter of 2024, with total units reaching 39.6 million, according to preliminary data from IDC. It’s good news for the tablet makers following on from the market’s decline in 2023, bringing renewed optimism and heightened consumer interest, especially with the integration of artificial intelligence (AI) into tablet technology.

Several brands capitalized on back-to-school sales and upcoming holiday demand by releasing refreshed models and increasing inventory. As brands prepared for major seasonal promotions, interest in AI-enhanced tablet features has grown, promising a higher average selling price (ASP) for premium models.

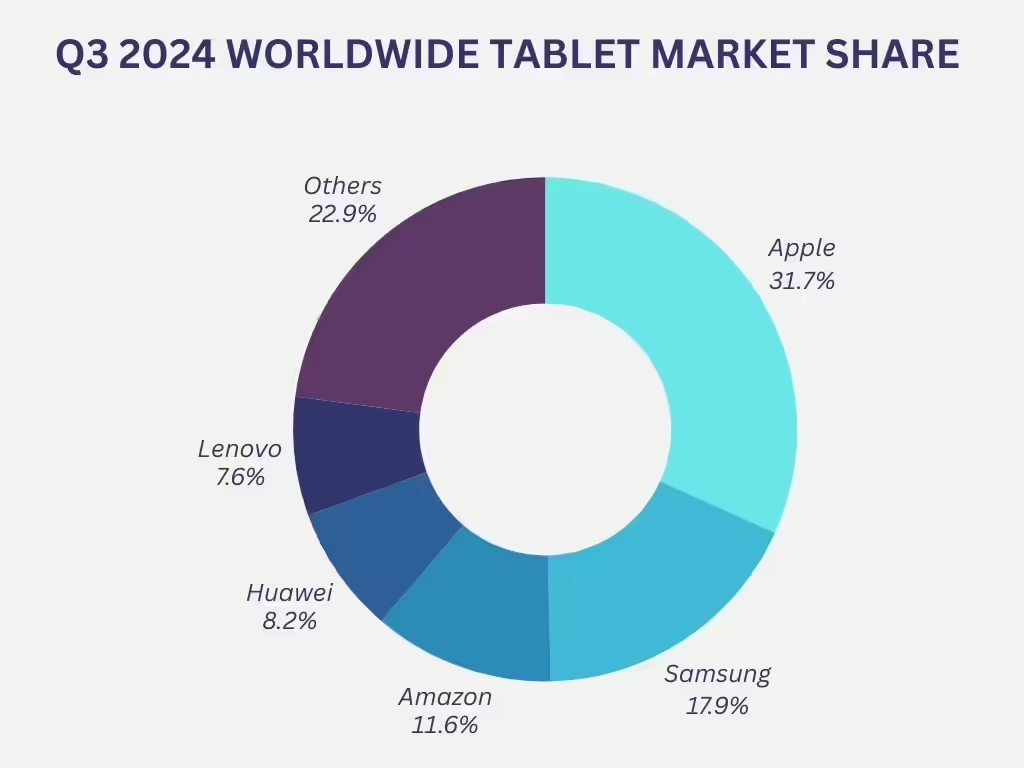

| Company | 3Q24 Unit Shipments | 3Q24 Market Share | 3Q23 Unit Shipments | 3Q23 Market Share | YoY Growth |

| 1. Apple | 12.6 | 31.70% | 12.4 | 37.70% | 1.40% |

| 2. Samsung | 7.1 | 17.90% | 6 | 18.20% | 18.30% |

| 3. Amazon | 4.6 | 11.60% | 2.2 | 6.60% | 111.30% |

| 4. Huawei | 3.3 | 8.20% | 2.3 | 6.90% | 44.10% |

| 5. Lenovo | 3 | 7.60% | 2.6 | 8.00% | 14.70% |

| Others | 9.1 | 22.90% | 7.4 | 22.60% | 21.80% |

| Total | 39.6 | 100.00% | 32.9 | 100.00% | 20.40% |

Apple retained its top position, shipping 12.6 million tablets in the quarter—a modest 1.4% YoY increase. The new iPad Air, launched in time for the academic season, saw stronger-than-expected demand. However, the premium-priced iPad Pro underperformed, facing lukewarm reception in emerging markets due to its high cost.

Samsung continued to solidify its position with 7.1 million units shipped, marking an 18.3% YoY growth. Their strategy included the launch of high-end models, the Galaxy Tab S10 Ultra and S10+ with AI capabilities, driving robust sales. In particular, Samsung’s affordable Galaxy A9 models attracted widespread interest across various regions, and the company benefited from an increase in commercial deployments.

Amazon returned to the top ranks, achieving 4.6 million units in Q3 and marking an impressive 111.3% growth from last year. Sales surged during the company’s two Prime Day events, which featured discounts on refreshed Fire HD 8 models equipped with new AI tools. Amazon’s market share rose by 6 percentage points, securing it the third position in global tablet sales.

Huawei held the fourth spot with a YoY growth of 44.1%, recording shipments of 3.2 million units. The MatePad SE 11, known for its competitive pricing, led Huawei’s sales in both consumer and commercial markets, reinforcing its position in the sector.

Despite moving to fifth place, Lenovo reported a 14.7% YoY growth with shipments of 3 million units. The company’s performance was especially strong in China and Western Europe, driven by an increased presence in commercial markets.