The computer industry is very warranty-intensive – the most intensive, after automotive, in fact. Despite the fact that the industry accounts for a quarter of all warranty spending in the USA, the warranties provided are not long-lasting, and warranty reserves are not well-funded – so, Warranty Week notes, ‘When something goes wrong, it really goes wrong’.

Warranty Week has just released its annual report on the 2015 US computer industry, which also includes data storage and peripherals makers. Over the past 13 years, most of the companies in these spaces have consistently cut their warranty costs – they have a record of living ‘on the edge’.

25 computer OEMs are tracked (including Dell, Sun, Palm – all now defunct or privately-held – and Apple, HP and IBM), as well as 44 data storage firms and 89 peripheral makers. For each company, Warranty Week recorded claims paid; accruals made (money set aside against future warranty expenses); the year-end balance in their warranty reserves fund; and warranted product sales reported. We will focus on computer OEMs.

Warranty Claims

Claims payments were up last year, compared to 2014 – all of which came from Apple’s iPhone. HP and IBM’s claims both fell ‘dramatically’ ($200 million and $100 million, respectively), but Apple’s rise – $886 million – more than offset these. Most of HP and IBM’s claims reductions were from falling sales, rather than increased reliability.

Warranty Accruals

As mentioned, warranties in the computer industry tend to be short, so there is little lag time between claims and accruals. The result is that both metrics tend to move in the same direction at the same time.

All of the top OEMs saw accruals fall dramatically – even Apple ($288 million), although HP led with a combined $333 million decline. IBM’s decline was $67 million. Again, most of these were tied to sales declines.

Warranty Expenses Rates

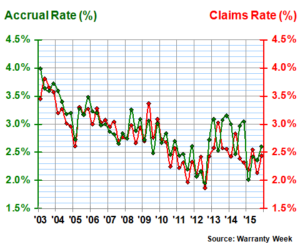

Below, Warranty Week divides its claims and accruals data by warranted product sales data; this produces a pair of percentage rates, which reflects the amount of revenue going towards warranty expenses. It shows that expense rates have generally been declining over time.

The figure below shows declining expenses from 2003 to 2012, with jumps in 2013 and 2014. This is mostly due to Apple getting a little ‘boisterous’ with its iPhone warranty expenses, but these were back under control last year.

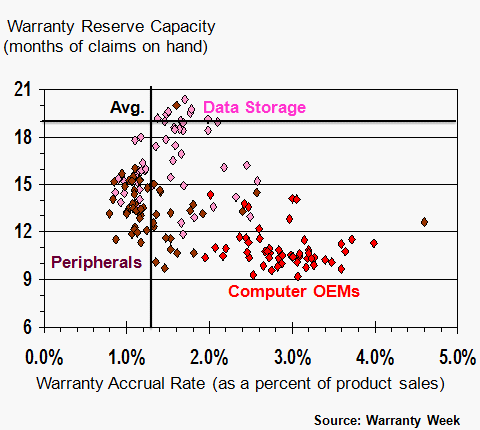

For all manufacturers in all industries, the average ratio between claims and reserves in 19 months. This means that the average warranty reserve fund contains an amount of money equal to 19 times what the company paid per month in claims. This strongly suggests that the average warranty in 19 months long – although some companies do not fully fund their liabilities, so it could be higher. Anything that falls below this (the horizontal ‘Avg.’ line on the below chart) reflects shorter-than-average warranty durations and/or lighter-than-average funding levels.

The average accrual rate for all manufacturers in all industries is 1.3% – meaning that, on average, these companies put aside 1.3% of their revenues to fund anticipated liabilities. Anything to the right of the vertical line on the chart reflects higher-than-average accrual rates, and anything to the left is lower-than-average.

Although there are outliers, but the chart shows that computer OEMs tend to keep less than a year’s reserve on hand. Meanwhile, their warranty expense rates range from 2% to 4%. This has much to do with the average length of warranties – one year is standard – so computer OEMs just don’t need any more in their fund.

Although there are outliers, but the chart shows that computer OEMs tend to keep less than a year’s reserve on hand. Meanwhile, their warranty expense rates range from 2% to 4%. This has much to do with the average length of warranties – one year is standard – so computer OEMs just don’t need any more in their fund.

Among the largest warranty providers Warranty Week examines, Apple sets the pace. The firm kept 12 months of reserves on hand at the end of 2015. HP Enterprise is a little above and HP Inc. a little below (perhaps reflecting the business/consumer split of their business areas). IBM and EMC are at 11 months, while Daktronics, Diebold, NetApp, Seagate, and Western Digital are each close to 17 months.

The outliers are not generally among computer OEMs. SanDisk is currently at 44 months (reflecting low expense rates and long warranties), for example, while Lexmark is just four months (a dangerous situation to be in, says Warranty Week, but one that Lexmark has maintained for several years).