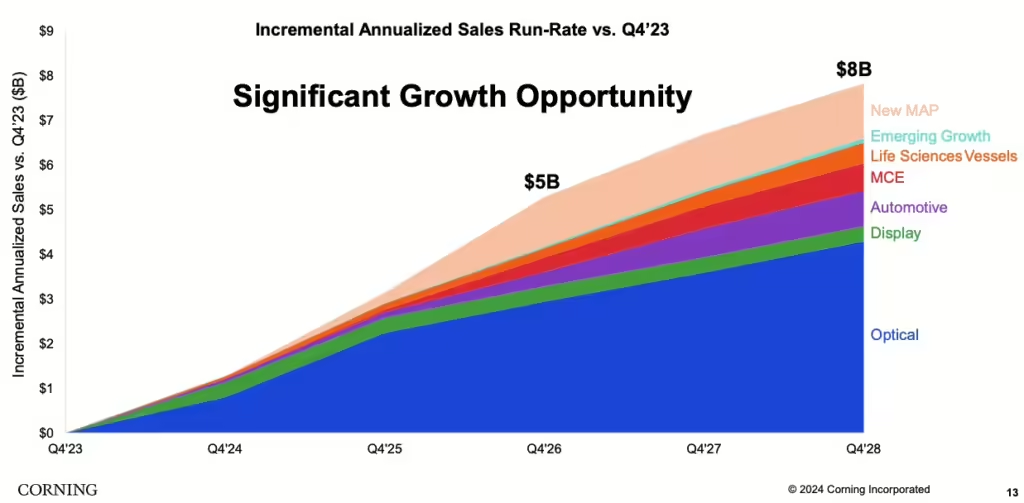

Corning has unveiled ambitious plans to accelerate growth and innovation across its key business segments, focusing on optical communications. The company’s recently announced Springboard plan aims to generate more than $3 billion in annualized sales over the next three years, with the potential for $8 billion in incremental sales by 2028.

The Springboard plan is designed to capitalize on both cyclical and secular growth opportunities across Corning’s market platforms. The company anticipates substantial growth, particularly in its Optical Communications segment, driven by the increasing demand for generative AI (Gen AI) applications. This segment is expected to achieve a 25% compound annual growth rate from 2023 to 2027, as data centers require more sophisticated networking solutions.

In the Display Technologies sector, Corning reported second-quarter sales of $1 billion, marking a 16% sequential increase and a 9% year-over-year rise. This growth is largely attributed to the ongoing trend towards larger screens, with expectations of about an inch of screen size growth per year driving low to mid-single-digit volume increases.

| Q2 2024 | Q1 2024 | Q2 2023 | QoQ Growth | YoY Growth | |

| Net Sales | $1,014 | $872 | $928 | 16% | 9% |

| Net Income | $258 | $201 | $208 | 28% | 24% |

Corning is currently implementing currency-based price adjustments to maintain appropriate returns and has hedges in place for 2025 and beyond. The combination of currency-based price adjustments and hedges is expected to deliver an appropriate level of profitability for the display business. Corning is not relying on TV unit growth but is capitalizing on the trend of larger screens, with an expectation of about an inch of screen size growth per year to drive low to mid-single-digit volume growth.

Panel maker utilization rates in Q3 are expected to be at or slightly below Q2 levels, which ran hotter than expected. During its investor conference call, the company said it aims to hold its market share with the currency-based upward price adjustment, and discussions with customers are ongoing regarding pricing strategies.

Corning’s Specialty Materials segment also showed impressive performance, with second-quarter sales reaching $501 million, an 18% increase year-over-year. The net income for this segment surged by 91%, driven by strong demand for premium glasses used in mobile devices and semiconductor-related products.

| Q2 2024 | Q1 2024 | Q2 2023 | QoQ Growth | YoY Growth | |

| Net Sales | $501 | $454 | $423 | 10% | 18% |

| Net Income | $63 | $44 | $33 | 43% | 91% |

Corning expects continued strong demand for Specialty Materials, as advancements in mobile devices and the semiconductor industry drive the need for high-quality, innovative glass products.