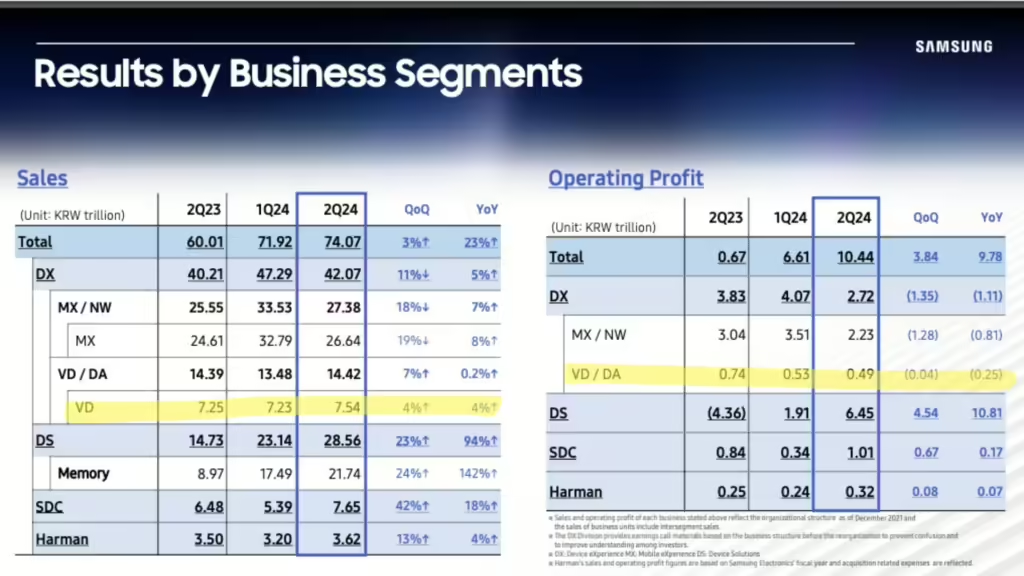

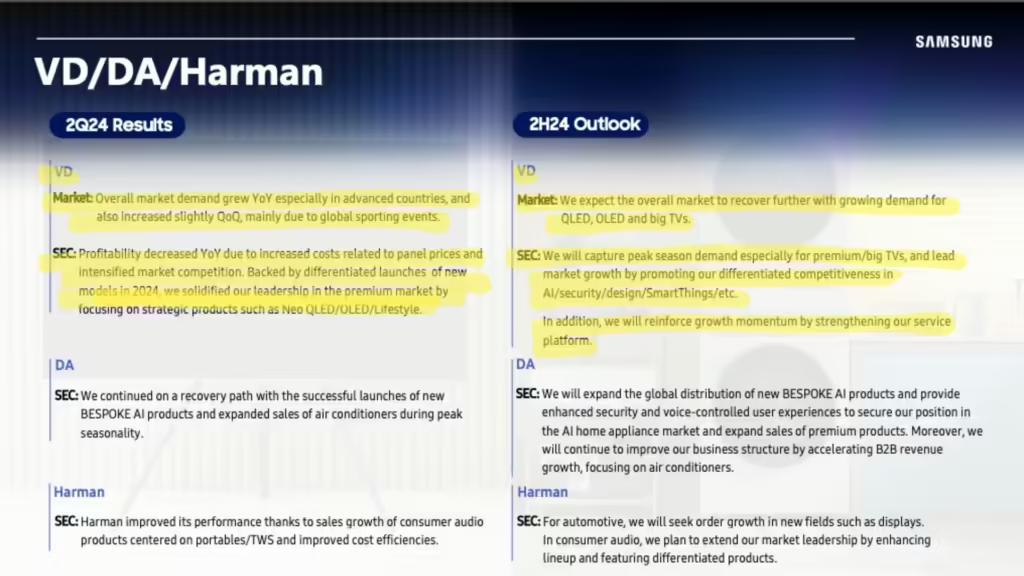

The Q2 2024 results are out for Samsung and the company did well. We’ll kick it off by looking at the stuff that matters to the display industry. The Visual Display and Digital Appliances businesses posted KRW 14.42 trillion ($10.5 billion) in consolidated revenue and KRW 0.49 trillion ($357 million) in operating profit in the second quarter. Overall TV market demand saw a year-on-year increase — primarily in developed markets — as well as a quarter-on-quarter increase mainly due to global sporting events like the Olympics being held in Paris.

However, profitability decreased year-on-year as costs increased due to higher panel prices and intense competition. In the second half of 2024, Samsung expects overall market demand to recover further and with growing demand for QLED, OLED, and larger screen TVs. The Visual Display Business will start to get aggressive with sales and pricing tactics on premium and large-size TVs.

Samsung Display Corporation (SDC) posted KRW 7.65 trillion ($5.6 billion) in revenue and KRW 1.01 trillion ($736 million) in operating profit for the second quarter. The mobile display business posted sales growth, driven by solid demand for flagship products, along with effectively supporting new smartphone launches from key customers. IT OLED products also contributed to higher results with sales of high-resolution, high-refresh-rate monitor products expanded, mostly in the gaming monitor market.

In the second half of the year, the release of new smartphones from major customers and potential replacement demand with the adoption of AI is expected to lead to an increase in mobile display sales. However, Samsung expects competition among panel makers to be more intense than in the first half. For the large display business, SDC plans to increase sales and improve profitability by focusing on high-value-added products and introducing new monitors with various refresh rates.

The System LSI Business posted record-high sales for the first half of the year as it saw earnings improve in the second quarter due to increased supply of key components such as systems on chips (SoCs), image sensors, and display driver ICs (DDIs). The initial response to the new SoC for wearables, using leading-edge 3nm technology, has helped Samsung create new opportunities. The company also plans to ensure a stable supply of the Exynos 2500 for flagship models. The System LSI Business will focus on expanding the application of 200-megapixel sensors from main wide cameras to telecameras and plans to expand sales of DDI products with the start of mass production of new models for a customer based in the US.

In general, Samsung Electronics reported consolidated revenue of KRW 74.07 trillion ($53.45 billion) and an operating profit of KRW 10.44 trillion ($7.6 billion) for the second quarter. Memory market conditions drove higher average sales prices (ASP). Driven by strong demand for HBM as well as conventional DRAM and server SSDs, the memory market as a whole continued its recovery. This is all happening because of the continued AI investments by cloud service providers and growing demand for AI from businesses for their on-premise servers.

In the second half of 2024, AI servers are expected to take up a larger portion of the market as major cloud service providers and enterprises expand their AI investments. As AI servers equipped with HBM also feature high content-per-box with regards to conventional DRAM and SSDs, Samsung expects demand to remain strong across the board from HBM and DDR5 to server SSDs. With capacity being concentrated on HBM, server DRAMs, and server SSDs for AI applications, conventional bit supply of cutting-edge products for PC and mobile is expected to be constrained.