According to Cinno Research, the first half of 2024 saw a significant boost in global AMOLED smartphone panel shipments, reaching approximately 420 million units, a 50.1% increase compared to the same period last year. The growth momentum continued into the second quarter, with shipments rising by 55.3% year-over-year (YoY) and 13.1% quarter-over-quarter (QoQ).

The surge in demand is attributed to the global smartphone market’s recovery and the increasing production capacity of AMOLED panels, particularly in China. Flexible AMOLED panels made up 71.0% of the total shipments, though this represents an 8.8 percentage point decline from last year.

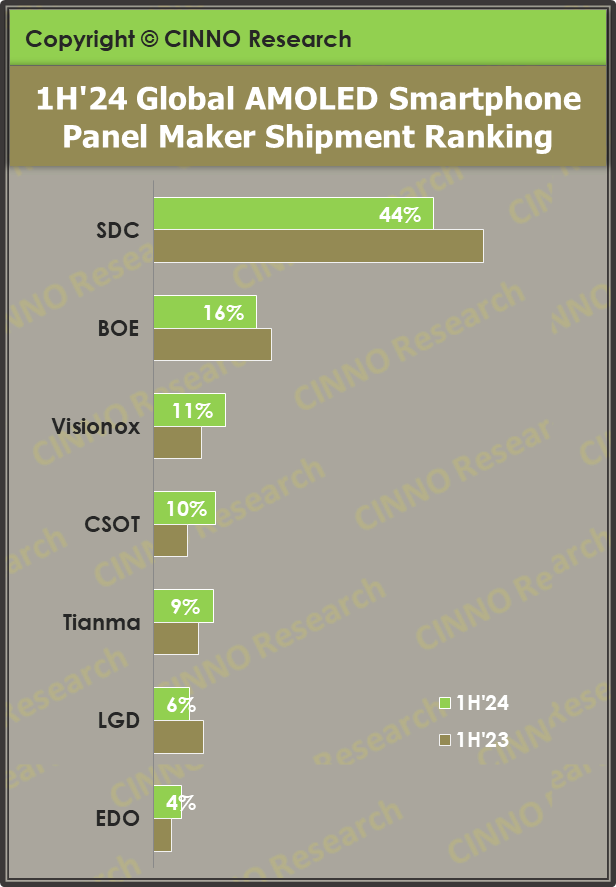

Breaking down the data by region, South Korea held a 49.3% market share, falling below the 50% mark, while Chinese manufacturers captured 50.7% of the market, up by 10.1 percentage points YoY.

In terms of market dynamics, Samsung Display (SDC) saw its shipments grow by 27.3% YoY, although its market share dropped to 43.8% from 51.6% last year. BOE Technology (BOE) increased its shipments by 31.4%, securing 16.1% of the market, making it the second-largest supplier globally and the largest in China. Visionox experienced a 129.3% surge in shipments, taking an 11.3% market share, while TCL CSOT recorded a remarkable 179.3% increase in shipments, reaching a 9.7% market share.

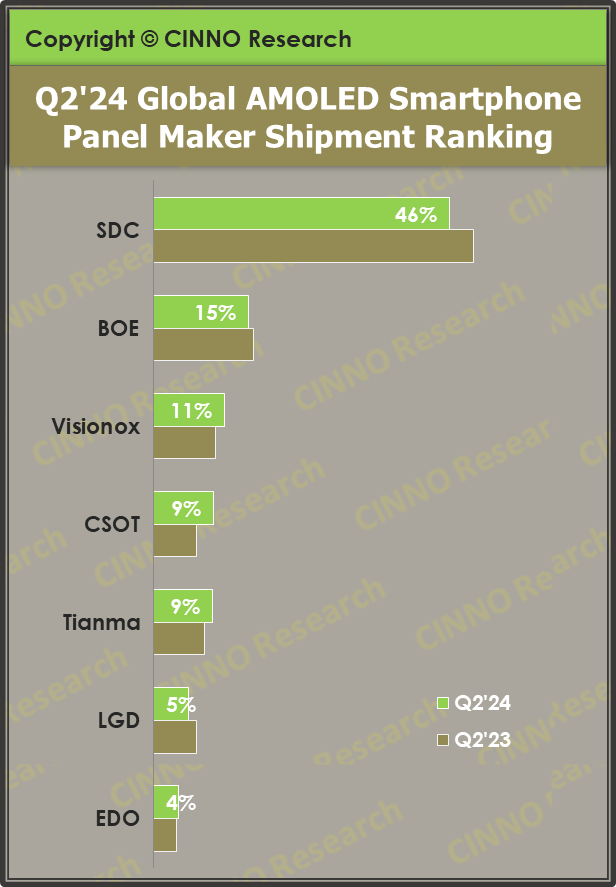

The second quarter of 2024 alone saw 220 million AMOLED panels shipped globally. South Korea’s market share rebounded to 51.6%, driven by increased orders from Apple, while Chinese manufacturers accounted for 48.4%, up 5.0 percentage points YoY but down 5.0 percentage points QoQ.

Samsung Display’s shipments rose by 43.7% YoY and 27.5% QoQ, holding 46.2% of the market. BOE’s shipments grew by 48.0% YoY but declined by 4.4% QoQ, capturing 14.8% of the market. Visionox’s shipments increased by 78.1% YoY and 10.9% QoQ, with an 11.1% market share. TCL CSOT saw the largest growth, with a 118.9% YoY and 5.6% QoQ increase, achieving a 9.4% market share.