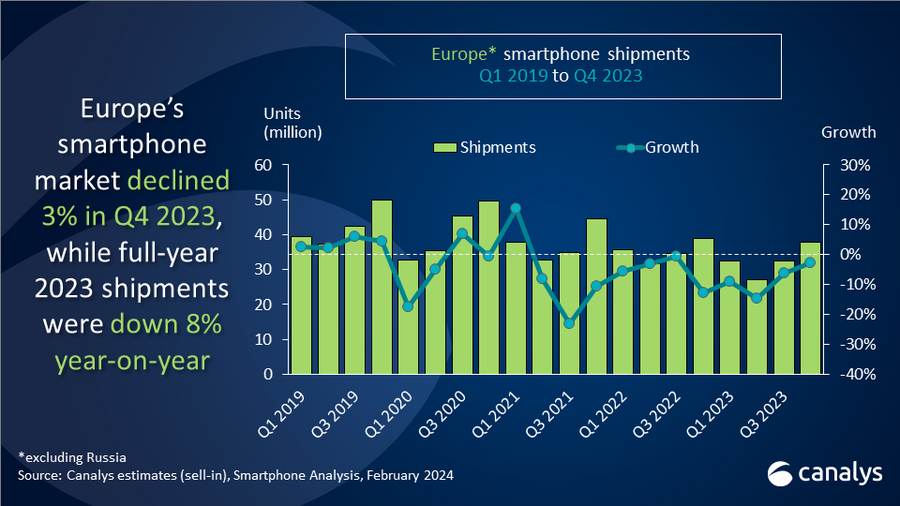

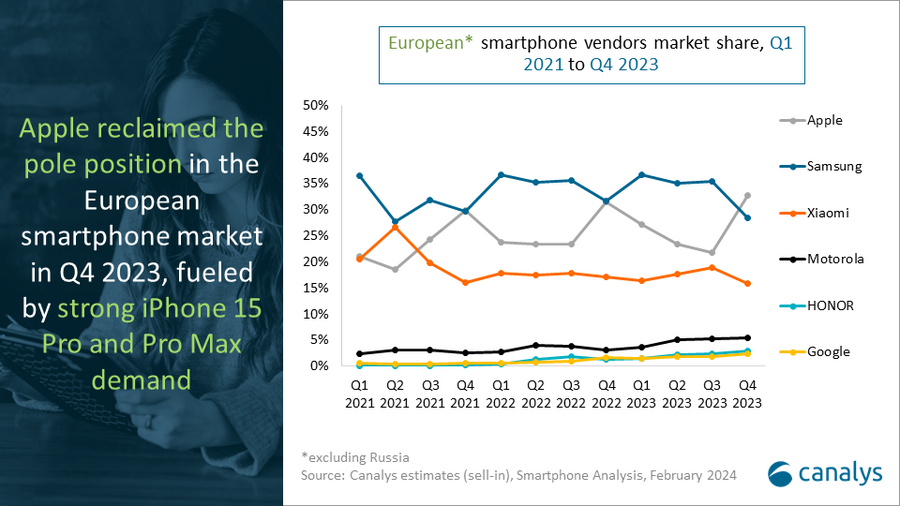

The European smartphone market witnessed a 3% decline in shipments in the fourth quarter of 2023, totaling 37.8 million units. This downturn, as reported by Canalys, comes during a reshuffling of positions where Apple has overtaken Samsung to reclaim the top spot after trailing for seven consecutive quarters. Apple’s shipments saw a modest year-on-year increase of 1%, reaching 12.4 million units, signaling strong demand for its high-end models, particularly the iPhone 15 Pro.

Samsung, on the other hand, experienced a 12% decrease in shipments, falling to 10.8 million units despite steady sales of its S-series and mid-range A-series devices. Throughout 2023, Samsung maintained its status as the largest vendor in Europe, showcasing the competitive nature of the market.

| Vendor | Q4 2023 Shipments (million) | Q4 2023 Market Share | Q4 2022 Shipments (million) | Q4 2022 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Apple | 12.4 | 33% | 12.2 | 31% | 1% |

| Samsung | 10.8 | 28% | 12.3 | 32% | -12% |

| Xiaomi | 6.0 | 16% | 6.6 | 17% | -10% |

| Motorola | 2.0 | 5% | 1.2 | 3% | 73% |

| Honor | 1.1 | 3% | 0.5 | 1% | 116% |

| Others | 5.5 | 15% | 6.1 | 16% | -8% |

| Total | 37.8 | 100% | 38.9 | 100% | -3% |

Xiaomi secured the third place, with a 10% drop in shipments to 6.0 million units. Despite the decline, Xiaomi managed to maintain positive momentum in Central and Eastern Europe, indicating a resilient performance amidst challenging market conditions.

The European market landscape saw significant shifts beyond the top three, with Motorola and Honor demonstrating good growth. Motorola’s shipments surged by 73% to 2.0 million units, while Honor’s shipments leapt up by 116% to 1.1 million units, marking its first entry into the top five in Q4 2023.

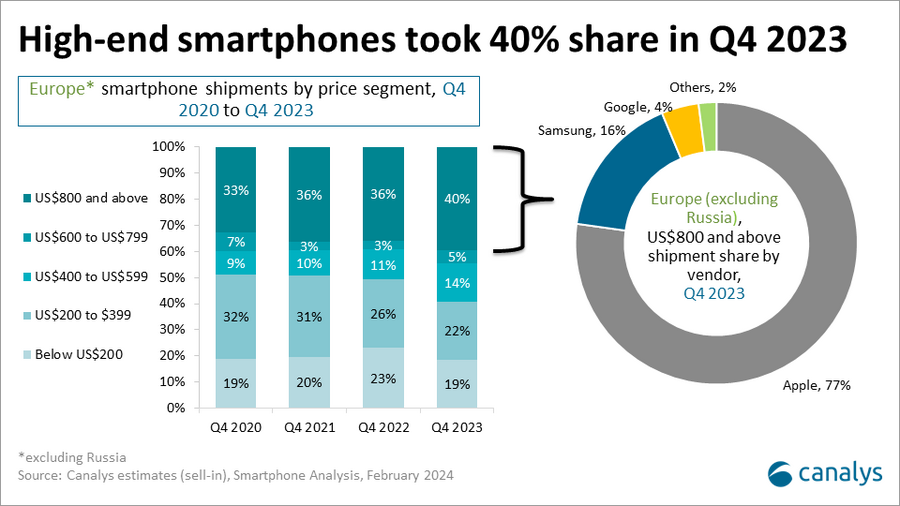

Canalys attributes the dominance of high-end smartphones, which accounted for nearly 40% of the market, to the strong demand for premium devices like the iPhone 15 Pro, consistent Galaxy S-series volumes, and a growing interest in Google Pixel. The market’s dynamics are further influenced by innovative sales strategies and a focus on premium and foldable devices, as well as subscription models.

Looking ahead in 2024, Canalys anticipate a return to single-digit growth driven by a refresh cycle of devices purchased during the pandemic. Vendors are advised to adopt a holistic approach that emphasizes innovation, reliability, backend logistics, regulatory compliance, and a clear brand message. The integration of AI in smartphones is highlighted as a key area for R&D, essential for enhancing the on-device user experience and maintaining long-term competitiveness.

The European smartphone market is poised for an increasingly competitive landscape, with vendors like Oppo, vivo, and realme looking to regain market share and new entrants like Nothing and Transmission’s brands seeking to make their mark. As the market evolves, consumer choices are expected to expand, offering a plethora of options in the coming years.

| Vendor | 2023 Shipments (million) | 2023 Market Share | 2022 Shipments (million) | 2022 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Samsung | 43.7 | 34% | 48.9 | 35% | -11% |

| Apple | 34.6 | 27% | 36.2 | 26% | -4% |

| Xiaomi | 22.2 | 17% | 24.7 | 18% | -10% |

| Motorola | 6.4 | 5% | 4.7 | 3% | 34% |

| Oppo | 3.7 | 3% | 6.7 | 5% | -45% |

| Others | 19.2 | 15% | 19.6 | 14% | -2% |

| Total | 129.8 | 100% | 140.8 | 100% | -8% |