The notebook display panel market is navigating a difficult period of declining demand and ongoing inventory challenges. According to analysis from Omdia, global notebook PC panel shipments are estimated to fall 13% YoY to 188.5 million units in 2023. This follows consecutive years of market contraction after the pandemic boom.

In the first half of 2023, excess inventory led brands to curtail new panel procurement. While inventory burdens have partially eased, stagnant end-market demand persists. With little clarity on near-term consumer appetite, notebook OEMs and panel makers alike are taking conservative approaches.

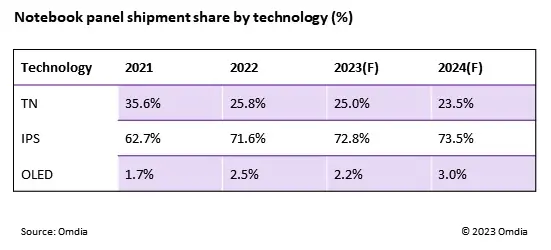

OEMs are reviewing product roadmaps and prioritizing profitability over volume growth. Low-cost display specifications are seeing stronger relative demand than high-end options. For example, share of basic TN technology panels remains resilient at 25% in the notebook market. Panel makers are also tightly controlling fab utilization rates to stabilize pricing amid the demand slowdown. As a result, the transition from TN to higher-end IPS technology has been limited, with IPS share hovering around 72-73%.

Looking ahead, the industry is exploring ways to spur demand through judicious specification upgrades. For instance, phasing out 1366×768 HD panels for baseline 1920×1080 FHD resolution. Boosting minimum brightness from 250 nits to 300 nits is another potential measure. Higher 16:10 aspect ratio adoption could also increase by moving more entry-level notebooks to IPS. Overall, strategic upgrades beyond bottom-barrel configurations may help reinvigorate middle and low-end price bands.