In 2023, there is an anticipated comprehensive downturn in global economic growth, with an outlook of transitioning into a phase of “moderate recovery” projected between 2024 and 2025. That’s according to Chinese research firm, Sigmaintell. The company has done a comprehensive update on the general semiconductor market, the display market, and has specifics on TV panel pricing that paint a solid picture of what to expect in the coming year, and into 2024.

What we know is that following a span of 12 months dedicated to inventory reduction efforts, the stock levels of display components and semiconductor core devices have now normalized. As a result, analysts are seeing reduced prices on display panels, semiconductor devices, and lower transportation expenses, establishing a basis for sustained consumer price declines and a revival in demand during 2024.

The pricing trajectory between display panels and semiconductor devices is diverging, though. While certain panel prices have reached a plateau or exhibited an upward trend, semiconductor device prices are still on a downward trajectory. 2024 will mark the start of a robust cycle within the technology industry with double-digit growth in display panel sales and single-digit growth in semiconductor device sales.

Consumer electronics demand is foreseen to remain relatively consistent in 2024 as compared to 2023. However, the numbers are expected to fall considerably short of their historical peak in 2015. Nevertheless, the utilization rate of panels has undergone a marked escalation, while the utilization rate of semiconductor wafers is expected to decelerate. Sigmaintell is advising caution with regard to medium- and long-term investment strategies for wafer production capacity. While the convergence of AI and next-generation operating systems promises a substantial increase in hardware performance and specifications, low power consumption is anticipated to evolve into the most sustained and enduring trend.

TV Panel Pricing Trends as of August 2023

On TV panel sales, in August, Sigmaintell is reporting a shift in the dynamics between the different components of the supply chain, specifically between the upstream and downstream segments. The dynamics are centered around bargaining power and competition.

Upstream and downstream refer to different stages in the production and distribution process. Upstream involves the production of raw materials, components, and parts, while downstream involves assembling the final products and distributing them to customers. In this context, the upstream part of the TV industry supply chain includes activities like manufacturing panels (the screen component of a TV), while the downstream includes brand manufacturers who assemble and sell the final TVs to consumers.

The situation described indicates that there are changes in pricing strategies and negotiations between these different segments:

- Upstream price increases: Panel manufacturers, who are a part of the upstream segment, have increased the prices of their panels. This puts pressure on the downstream brand manufacturers who use these panels to assemble TVs. The increased costs for panels might lead to higher prices for finished TVs, which could potentially make it difficult for brand manufacturers to increase prices for consumers.

- Downstream price increases: Brand manufacturers, who operate in the downstream segment, are facing a challenge when it comes to raising the prices of their TVs. This could be due to various reasons, such as market competition, consumer preferences, or economic conditions. As a result, brand manufacturers are trying to find ways to avoid passing on the entire increase in panel costs to consumers.

To address these challenges, both segments are taking specific actions:

- Brand OEMs: They are working on strategies to counter the dominant trend of rising panel prices. One approach they are using is targeted procurement reductions. This means they are trying to negotiate with panel manufacturers for better prices or favorable terms to reduce their procurement costs.

- Panel manufacturers: In response to brand manufacturers’ efforts to reduce costs, leading panel manufacturers are taking steps to manage their production and control the supply of panels. They are also adjusting their production based on the demand they see from brand manufacturers.

The information provided by Sigmaintell, a market research firm, suggests that the trend of rising panel prices is expected to continue from July to August, but the rate of increase will start to slow down. This means that the rate at which panel prices are going up is becoming less steep.

Sigmaintell has also provided specific data regarding the performance of different panel sizes:

- 32″ panels: The price increased by $2 in July and is expected to increase by $1 in August. This suggests a slowing down of the price increase.

- 50″ panels: The price rose by $6 in July, but the increase is expected to narrow to $4 in August. Again, this indicates a decrease in the rate of price increase.

- 55″ panels: Similar to the 50″ panels, the price increased by $6 in July, and it’s expected to narrow to $4 in August.

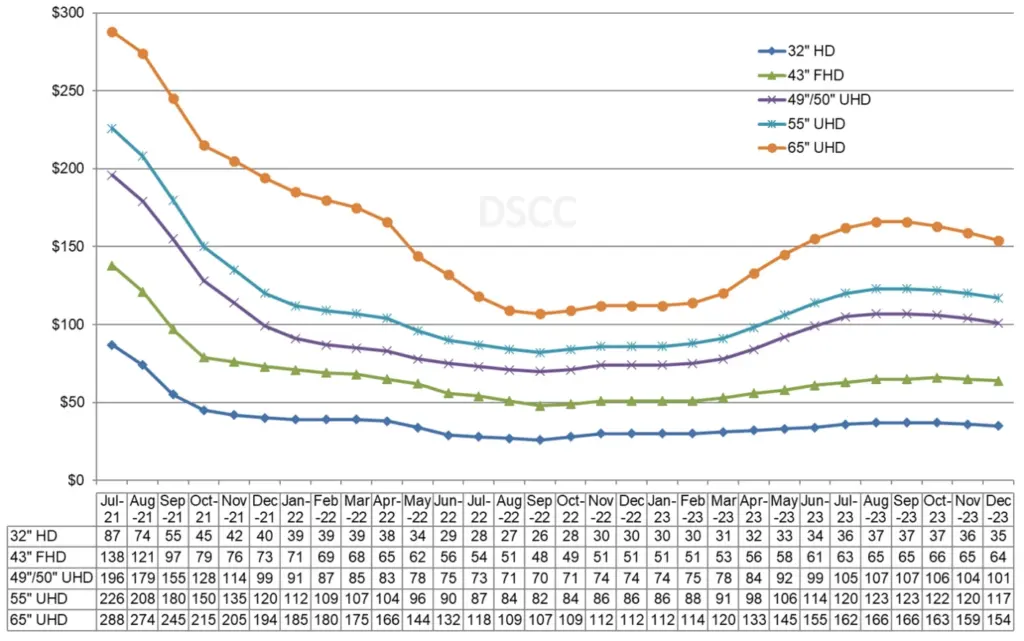

The DSCC Outlook on LCD TV Panel Prices

If you subscribe to the DSCC blog, you will have a deeper discussion of TV panel prices. The latest post by Bob O’Brien highlights the rally in panel prices that began in February and has continued into the third quarter due to increased supply as LCD makers boost their production. This has brought many panel makers into positive margins and the TV supply chain is building up inventory for the fourth-quarter sales season. However, DSCC says that panel prices will peak in September due to an abundance of supply, leading to a decline in prices in the fourth quarter. Price dynamics vary across panel sizes, with the largest (65″) experiencing a significant 25% increase in Q2, while smaller sizes had single-digit hikes. These trends continue in Q3, with price increases more evenly distributed among sizes from 40″ to 65″.

The post’s analysis extends to area-based pricing, revealing shifts in price trends. Although the 65″ panel size had the lowest area prices from August 2022 to March 2023, recent months have elevated its prices, particularly for 49″/50″ panels. The report also underscores that while larger screen sizes (85″) still command a premium over smaller sizes, the premium has diminished. Despite these positive price trends, concerns persist about industry overcapacity, leading to a supply glut in Q3 and projected Q4, causing prices to peak in September and subsequently decline.

So, there you have it: flux, undulating pricing curves, and consumer buying pressures. It’s not quite the second half of the 2023 recovery that everyone was expecting, more like riding the waves to the end of this year and hoping for a more stable, relatable environment in 2024.