Total panel area for QD-OLED and QD-LCD is set to grow by nearly 15% next year, according to DSCC’s latest Quantum Dot Display Technology and Market Outlook Report. TV is by far the biggest segment for quantum dot displays, not just in terms of panel area but also in units, with 15.6M TV sets expected to contain quantum dots in 2023.

According to DSCC Director of Display Research, Dr. Guillaume Chansin, “Quantum dots have become very common in premium LCD TV ever since Samsung decided to adopt the technology to counter OLED TVs. These so-called “QLED” TVs integrated a quantum dot film in front of the backlight to produce more vivid colors. The cost of the film has dropped considerably over the years, which has enabled QD-LCD panel makers to add other premium features, such as local dimming with MiniLEDs.”

MiniLED backlights started to appear in 2019 and have since been adopted by most brands, including Samsung and LG. All MiniLED TVs currently on the market also have quantum dots. In some models, the quantum dots are directly inside the diffuser plate instead of a separate film, but the overall working principle remains the same. With the addition of MiniLED backlights to QD-LCD TVs, both the brightness and contrast can be increased at the same time.

The latest display technology to be commercialized is QD-OLED. This technology uses a Quantum Dot Color Conversion (QDCC) layer that is inkjet-printed on top of an OLED panel. QD-OLED TVs and monitors have been available since last year and have been praised for their excellent image quality. A key difference with other OLED TVs is there is no white sub-pixel, so the colors do not get washed out at high brightness.

QD-OLED TVs are currently available in three sizes: 55”, 65” and 77”. There are also 34” and 49” panels produced for high-end monitors.

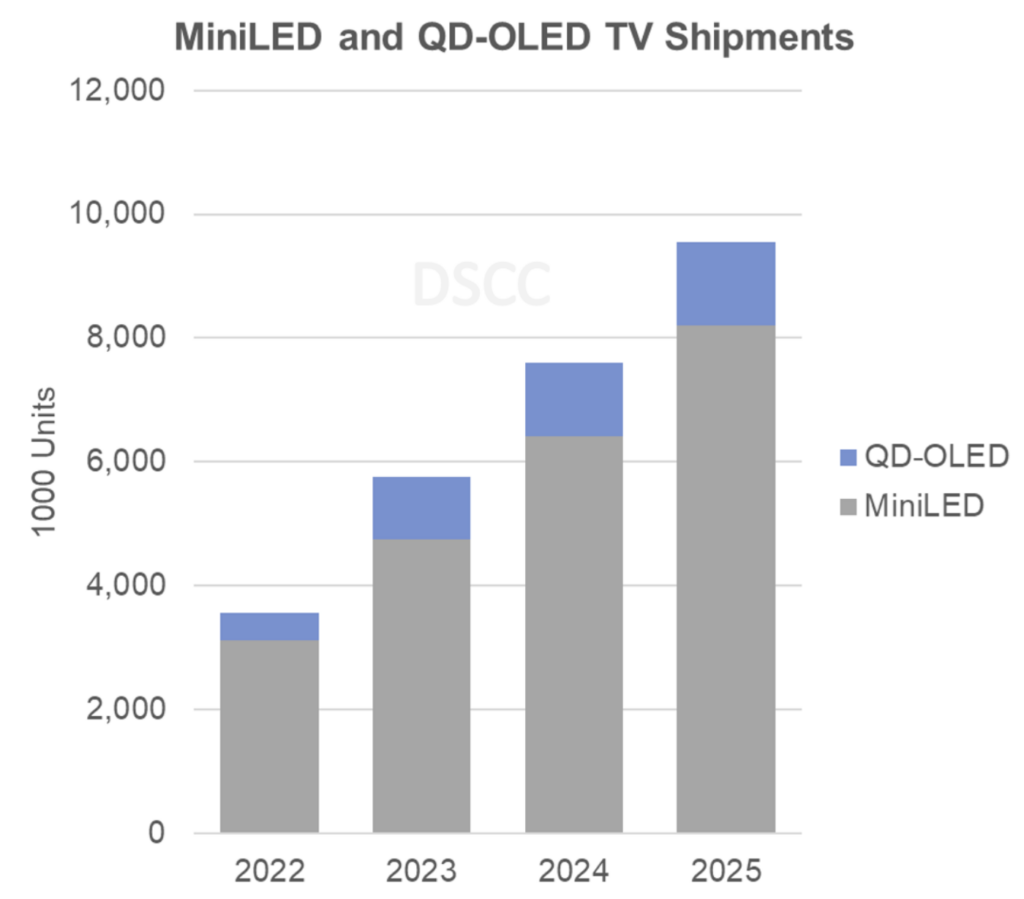

QD-OLED is still a novelty and production capacity is limited. DSCC forecasts shipments of QD-OLED TVs to grow from less than 0.5M in 2022 to over 1.3M units in 2025. For MiniLED TVs, shipments will increase from 3.1M to 8.2M units during the same period.

All QD-OLED panels are currently produced by one fab. Samsung Display has converted an LCD line to QD-OLED and plans to reach a capacity of 45,000 G8.5 substrates per month by 2025. Without further investment, QD-OLED capacity will plateau. Samsung Display has yet to make a decision on whether to build a second QD-OLED line or invest in other display technologies.

QD-OLED is a relatively expensive technology, requiring an OLED stack with one green and three blue layers. The green OLED layer was added to boost brightness, since the current generation of green quantum dots have a low photon conversion efficiency. With higher performance materials, it should be possible to simplify the stack. First, remove the green OLED layer by using a more efficient green QDCC. Then, reduce the number of blue layers by adopting the phosphorescent emitter.

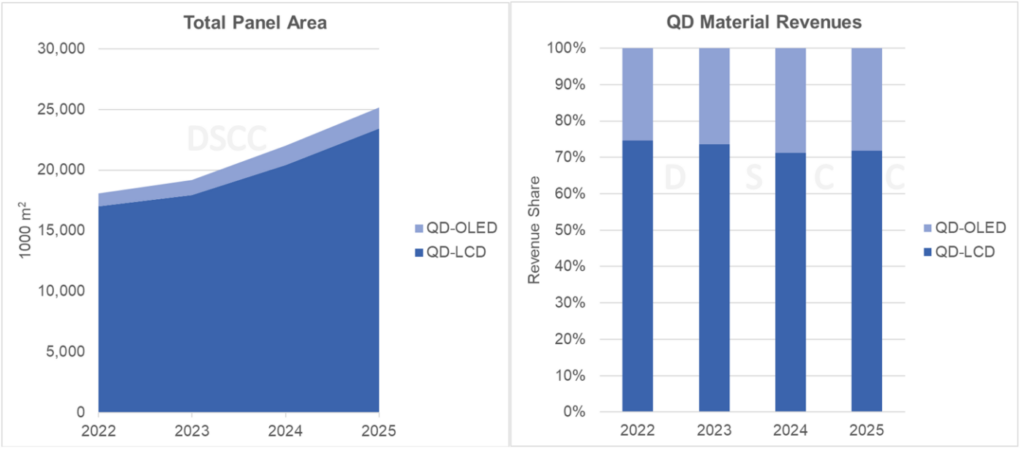

If we look at total panel area, across all applications, QD-OLED will reach 1.7M m2 in 2025. For comparison, QD-LCD panel area will be 23M m2 the same year, more than 13× the area of QD-OLED. However, QD-OLED still represents a significant opportunity for material suppliers, since it consumes a larger quantity of quantum dots per area. The report estimates that 28% of revenues for quantum dot materials will come from the QD-OLED supply chain.

What will be the next display technology after QD-OLED? There has been a lot of progress in electroluminescent quantum dots (EL-QD) in recent years. This technology removes the need for a blue OLED stack as the quantum dots emit light directly instead of converting colors. Leading display manufacturers, including Samsung Display, TCL, Sharp and BOE, have demonstrated EL-QD prototypes recently. However, there are still no plans for mass production in the near future.

MicroLED displays can also make use of quantum dots. During SID Display Week last year, we saw several demos of MicroLED displays with QDCC. Color conversion is seen as a solution to address the low efficiency of red MicroLEDs. It is also considered for small monolithic MicroLED displays. Recently, Mojo Vision decided to put on hold the development of its smart contact lens to focus on MicroLED displays for smart glasses. The challenge for quantum dots in AR/VR is to support the high brightness required, without a detrimental effect on lifetime.