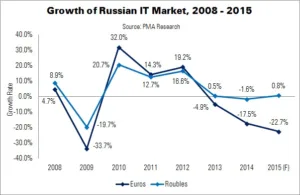

The value of IT product sales in Russia last year totalled RUB700 billion ($12.3 billion), says PMR Research. In rouble terms, the market fell 1.6% YoY – although in terms of the euro, the contraction reached 17.5%. PMR says that the euro-based valuation better shows the market’s current performance.

In the second half of 2014, the devaluation of the rouble caused rising prices for foreign hardware and software. This inflated the value of the entire IT market in rouble terms. However, even excluding exchange rate fluctuations, a sharp decline in demand would have been recorded – even compared to the post-financial crash fall in 2009.

Several factors constraining the Russian IT market – such as political and economic issues and exchange rate fluctuations – did not begin in 2014. They have been gathering pace for some time. In 2013, the companies that PMR questioned said that they needed to adapt their business strategies to deal with slow growth, or even stagnation, that they expected in 2014 and 2015. Several also said that they expected the recovery of the IT market to take place under the condition of overall economic restructuring in Russia; the economy based on exporting natural resources and importing consumer products was said to no longer be supporting IT growth.

There is still uncertainty over the development of Russia’s IT market, in 2015 and over the next five years. PMR writes, ‘[A] number of unknown factors do not allow identifying even key market development trends’. For example, despite sanctions imposed on Russian banks and companies, as well as the economic confrontation between the country and those in the West, Russia’s economy is still operational. Uncertainty has been diminishing or even blocking new IT investments.

Future economic development depends on many factors. However, the role of the government in managing economic growth is higher than in other countries. Investments are largely driven by the government sector and state-owned companies. The government’s challenge is to facilitate the investment activity of smaller private companies, and to assist households in gathering capital.