Worldwide smartphone shipments are expected to reach 1.45 billion units with a year-over-year growth rate of 0.6% in 2016 according to the latest forecast from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker. Although growth remains positive, it is down significantly from the 10.4% growth in 2015.

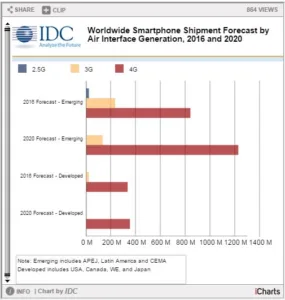

However, 4G smartphones are still expected to show double-digit uptake at 21.3% year-over-year growth globally for 2016, reaching 1.17 billion units, up from 967 million in 2015. Much of this growth is coming from emerging markets (Asia/Pacific excluding Japan, Latin America, Central and Eastern Europe, and Middle East and Africa), where only 61% of 2015 smartphone shipments were 4G-enabled compared to IDC’s 2016 projection of 77%. Mature markets (USA, Canada, Japan, and Western Europe) are further along the 4G adoption curve with 85% in 2015 and a projected 94% in 2016, respectively.

“It’s been a long slog for 4G uptake in many emerging markets as 4G data tariffs have long been very expensive compared to 3G, while 4G handsets themselves have also been relatively pricey across the board,” said Melissa Chau, associate research director with IDC’s Worldwide Quarterly Mobile Device Trackers. “We are quickly seeing this change in key growth markets like India where new operator Reliance Jio is aggressively trying to shake up the market by handing out free 4G SIM cards and launching own-branded low-cost 4G-enabled smartphones.”

The push to 4G is not only limited to smartphones, but will also provide a temporary boost to the shrinking feature phone market where 4G is a selling point in an even more cost-competitive space. In IDC’s short-term forecast, 4G feature phones will feature in emerging markets as well as in mature markets like the U.S. until smartphone prices drop further.

“As we approach the holiday quarter smartphone marketing has picked up significantly across almost all regions as expected,” said Ryan Reith, program vice president with IDC’s Worldwide Quarterly Mobile Device Trackers. “In North America and Western Europe, Google has been putting a significant amount of marketing dollars behind the new Pixel and Pixel XL, although early supply chain indications are that volumes are not at the point where Samsung or Apple should see a significant impact for Q4. Of course, as we head into 2017 this can change, but many eyes will be on Google to see how serious they are about pursuing the hardware play.”

Platform Highlights:

Android: It is no secret that Google’s Android OS has been and will remain the majority share platform in smartphones for the foreseeable future. It will also be at the core of the aforementioned 4G growth expected in emerging markets as low-cost Android players are not using newer, faster low-cost chips. The biggest focus point in regard to Android is Google’s recent entry into the hardware space. It is too early to tell if this will negatively impact relations with other hardware partner OEMs, but it is a move similar to Microsoft’s entry into the hardware space with Surface and, on the surface, it does not seem to be disruptive. However, the move is also aided by the lack of viable mobile platform alternatives.

iOS: All signs point to 2016 being the first full year of declining shipments for Apple’s iPhone. The iPhone 7 and 7 Plus have done well, but three quarters of year-over-year declines, as well as a projected fourth quarter decline by IDC, will account for negative growth. By no means is this doomsday for Apple in this category and 2017 marks the tenth year of iPhone, so it is hard to believe Apple doesn’t have something big up its sleeve. Challenges of low-cost competition remain, and Google getting into the premium space certainly doesn’t make things any easier. Look for Apple to mix things up with whatever version(s) they bring to market in the coming year to hopefully rebound shipment growth.

Windows Phone: Microsoft’s mobile platform remained largely a non-story in 2016 other than HP’s reentry into the smartphone space with the X3 product. IDC projects Windows Phone shipments to decline 79.1% in 2016 as the number of OEMs supporting the platform continue to diminish. Rumors of a Surface Phone from Microsoft continue to linger, but the drawn out hurdle of a much needed mobile ecosystem has not gone away. Unless Microsoft has a way to get around this, IDC anticipates a tough road ahead for the platform.

|

Worldwide Smartphone Shipments by OS, Market Share, and Annual Growth (shipments in millions) |

|||||||

|

Platform |

2016 Shipment Volume* |

2016 Market Share* |

2016 YoY Growth* |

2020 Shipment Volume* |

2020 Market Share* |

2020 YoY Growth* |

5 Year CAGR* |

|

Android |

1,228.8 |

85.0% |

5.2% |

1,464.7 |

85.6% |

4.2% |

4.6% |

|

iOS |

206.1 |

14.3% |

-11.0% |

243.6 |

14.2% |

2.5% |

1.0% |

|

Windows Phone |

6.1 |

0.4% |

-79.1% |

1.0 |

0.1% |

-19.3% |

-48.6% |

|

Others |

4.5 |

0.3% |

-50.0% |

1.0 |

0.1% |

-7.3% |

-35.3% |

|

Total |

1,445.4 |

100.0% |

0.6% |

1,710.3 |

100.0% |

4.8% |

3.5% |

|

Source: IDC Worldwide Quarterly Mobile Phone Tracker, November 29, 2016 |

|||||||

* Table Note: All figures are forecast projections.