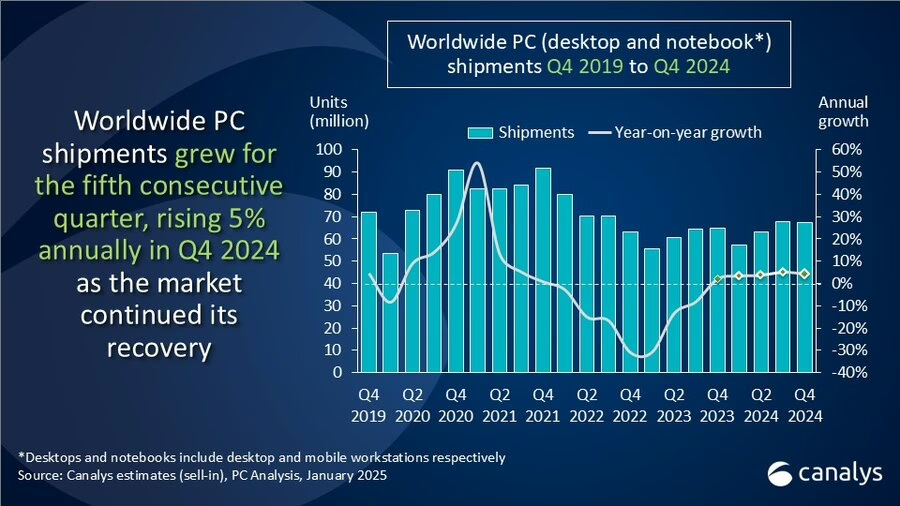

The global PC market saw modest recovery in 2024, achieving 3.8% overall growth for the year and ending with its fifth consecutive quarter of growth in Q4 (up 4.6% YoY). Total shipments reached 67.4 million units in Q4, driven primarily by a 6.2% rise in notebook shipments (53.7 million). Desktop shipments declined slightly, by 1.4%, to 13.7 million units.

| Vendor | Q4 2024 Shipments | Q4 2024 Market Share (%) | Q4 2023 Shipments | Q4 2023 Market Share (%) | Annual Growth (YoY) |

| Lenovo | 16,884 | 25.00% | 16,094 | 24.90% | 4.90% |

| HP | 13,724 | 20.30% | 13,945 | 21.60% | -1.60% |

| Dell | 9,898 | 14.70% | 9,914 | 15.40% | -0.20% |

| Apple | 5,934 | 8.80% | 5,756 | 8.90% | 3.10% |

| Asus | 4,977 | 7.40% | 4,092 | 6.30% | 21.60% |

| Others | 16,038 | 23.80% | 14,711 | 22.80% | 9.00% |

| Total | 67,455 | 100.00% | 64,512 | 100.00% | 4.60% |

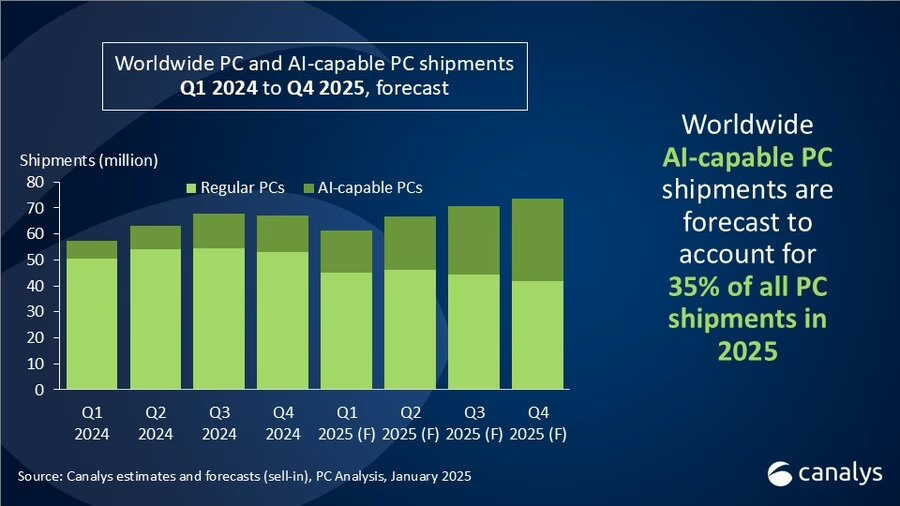

Looking ahead to 2025, market momentum is expected to accelerate as businesses begin replacing devices ahead of the October Windows 10 end-of-support deadline. This, alongside the rising prominence of AI-capable PCs (which are projected to make up 35% of worldwide shipments in 2025), underscores a strong commercial refresh cycle.

| Vendor | 2024 Shipments | 2024 Market Share (%) | 2023 Shipments | 2023 Market Share (%) | Annual Growth (YoY) |

| Lenovo | 61,871 | 24.20% | 59,106 | 24.00% | 4.70% |

| HP | 52,991 | 20.70% | 52,900 | 21.50% | 0.20% |

| Dell | 39,096 | 15.30% | 39,979 | 16.20% | -2.20% |

| Apple | 22,820 | 8.90% | 22,382 | 9.10% | 2.00% |

| Asus | 18,334 | 7.20% | 16,524 | 6.70% | 11.00% |

| Others | 60,422 | 23.60% | 55,369 | 22.50% | 9.10% |

| Total | 255,534 | 100.00% | 246,261 | 100.00% | 3.80% |