The MicroLED industry will find itself at a critical juncture in 2025, grappling with uncertainty after Apple’s high-profile exit from the market in February, 2024. Long considered a trailblazer, Apple’s investment and development efforts had provided the industry with unparalleled momentum. However, the company’s decision to cancel its MicroLED smartwatch project in February 2024 has left stakeholders reevaluating the path forward, as well as removing MicroLED development from Apple’s roadmap. While the industry faces significant hurdles, optimism remains, fueled by ongoing advancements and increasing interest from other players.

Apple’s acquisition of Luxvue in 2014 marked the genesis of the modern MicroLED industry. Over the next decade, the tech giant invested more than $3 billion into developing the technology, spurring a wave of activity across the sector. The anticipation of Apple’s MicroLED-powered smartwatch motivated companies like ams-Osram to make significant investments, including a $1.4 billion commitment to a dedicated 200mm fab for MicroLED chip production.

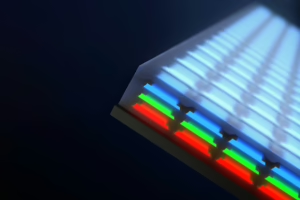

Apple’s involvement established MicroLED as a beacon of innovation, offering superior brightness, longevity, and energy efficiency compared to traditional LCD and OLED technologies. However, the company’s withdrawal has undermined confidence, causing many firms to pause and reconsider their strategies.

Apple’s exit leaves the industry facing its foundational hurdles: achieving cost-efficient mass production and securing substantial investments. The high manufacturing costs associated with MicroLED have long been a barrier to widespread adoption. Industry players now need to focus on reducing die sizes, enhancing yield, and improving manufacturing processes to make MicroLED competitive with OLED technology.

Key challenges include transferring millions of microscopic LEDs onto display backplanes remaining one of the most complex and costly steps in production. The existing tools are adequate for pilot projects but insufficient for large-scale consumer products. A new generation of faster, larger, and more efficient tools is necessary.

High defect rates on MicroLED wafers significantly drive up costs. Effective testing and repair solutions are under development but need further refinement for commercial scalability.

While microdrivers have the potential to unlock superior performance and integrate sensors into displays, their added complexity complicates an already challenging production landscape.

The challenges are being addressed consistently and there have been a number of developments that may find mainstream adoption in 2025. Companies like TCL are demonstrating the viability of MicroLED for AR applications, as seen in the TCL RayNeo X2 smart glasses, which leverage full-color MicroLED projectors. Revenue from monolithic MicroLED displays is expected to grow steadily, reaching $162 million by 2028, according to DSCC, and smart glasses are a major driving force in market dynamics.

Lumileds has introduced polychromic LED technology, a breakthrough that enhances production efficiency and reduces costs, particularly through its compatibility with mass production methods. AUO has established itself as a leader with significant advancements, such as the world’s first flexible and transparent MicroLED displays, alongside its development of a one-campus mass production facility. Mojo Vision’s use of QD technology for RGB MicroLEDs is another example of innovation, simplifying manufacturing processes while achieving industry-leading brightness and efficiency. Q-Pixel’s TP-LED technology offers a streamlined approach by eliminating the need for traditional RGB emitters, providing unmatched pixel densities for AR/VR applications. Morphotonics has further contributed with Nano Imprinting Lithography (NIL), enabling cost-effective production of complex optics for next-generation displays.

VueReal’s core innovation lies in its unique Micro Solid Printing process, which addresses one of the most critical challenges in MicroLED manufacturing: the mass transfer of microscopic LEDs onto a display backplane. Unlike conventional mass transfer methods, VueReal’s solution ensures high yield, precise placement, and minimal damage during the transfer process. This breakthrough significantly reduces defect rates and improves overall efficiency, positioning the company as a leader in advancing scalable MicroLED production.

| The Players | |

| Display and Panel Makers | Samsung (KR) |

| BOE (CN) | |

| Konka (CN) | |

| TCL-CSOT (CN) | |

| Extremely PQ (CN) | |

| LG (KR) | |

| PlayNitride (TW) | |

| Tianma (CN) | |

| Vistar/Visionox (CN) | |

| AUO (TW) | |

| Sitan Technology (CN) | |

| Japan Display (JP) | |

| Jade Bird Display (CN/HK) | |

| HKC (CN) | |

| Sharp (JP) | |

| Innolux (TW) | |

| Leyard (CN) | |

| Century Display (CN) | |

| StrataCache (US) | |

| Startups | Luxvue (acquired by Apple) |

| Aledia (FR) | |

| X-Display (US) | |

| eLux (US) | |

| Mojo Vision (US) | |

| Q-Pixel (US) | |

| VueReal (CA) | |

| InZiv (IS) | |

| Pixelligent | |

| LED Companies | ams-Osram (DE-AT) |

| Epistar (TW) | |

| Lumileds (US) | |

| Sanan (CN) | |

| HC SemiTek (CN) | |

| Saphlux (US) | |

| Porotech (UK) | |

| Raysolve (CN) | |

| Seoul Semiconductor (KR) | |

| Lextar (TW) | |

| Lattice Power (CN) | |

| OEM and Consumer Electronics | Apple (US) |

| Foxconn (TW) | |

| Meta (US) | |

| Google (US) | |

| Tag Heuer (partnered with AUO) | |

| Garmin (partnered with AUO) | |

| Sony (JP) | |

| Meizu | |

| Lenovo | |

| Rokid | |

| Bigscreen | |

| Snap | |

| Continental | |

| Vuzix (US) | |

| Equipment Makers | Applied Materials (US) |

| ASMPT (SG) | |

| Kulicke & Soffa (SG) | |

| Toray Engineering (JP) | |

| Morphotonics | |

| Veeco (US) | |

| Aixtron (DE) | |

| KLA (US) | |

| Oxford Instruments (UK) | |

| SPTS (US) | |

| Component and Material Suppliers | |

| Shinetsu (JP) | |

| Smartkem (UK) | |

| eMagin (acquired by SDC) | |

| SeeYa | |

| Semiconductor Companies | Intel (US) |

| TSMC (TW) | |

| GlobalFoundries (US) |

Despite Apple’s departure, the MicroLED industry is not stagnating. Close to 30 fabs and pilot lines are in progress or completed, signaling strong momentum. Over 20 mass transfer tools from more than 15 equipment manufacturers are available, and MicroLED patent activity remains robust, albeit plateauing after years of exponential growth.

Micro OLED

Micro OLED, often referred to as SiOLED, has emerged as a leading technology for AR and VR displays. Its compact size and high pixel density make it ideal for immersive applications. Apple’s integration of Micro OLED in its Vision Pro headset exemplifies its potential to deliver exceptional performance in AR and VR devices. Samsung’s acquisition of eMagin in 2023 further underscores the industry’s focus on this technology. By investing $218 million, Samsung is pushing the boundaries of high-brightness displays using RGB direct patterning, signaling a commitment to remaining competitive in this space. The scalability and investment in Micro OLED foundries suggest that it will dominate the AR/VR markets in the near term.

Emerging Applications and Market Potential

MicroLED technology’s unique attributes—transparency, modularity, and superior performance—position it for transformative applications across industries. While the consumer market faces cost and scalability hurdles, other sectors are driving growth:

- MicroLED’s small form factor and high brightness make it ideal for AR applications, particularly LEDoS microdisplays.

- Retail, transportation, avionics, and military simulators are exploring customized MicroLED solutions for their specific needs.

- Integration of sensors into displays could revolutionize user interfaces and enhance functionalities in ways OLED and LCD cannot match.

The coming years will be critical for the MicroLED industry as it transitions from proof-of-concept to volume production. Success will hinge on addressing technological bottlenecks, achieving economies of scale, and reducing manufacturing costs. While Apple’s departure creates a vacuum, it also provides an opportunity for other players to step up as industry leaders.

2025 may be a watershed year for the MicroLED market, determing whther it is poised for significant growth, particularly in specialized applications. Whether the industry can fulfill its potential depends on its ability to overcome current challenges and attract the investments needed to scale up production. Right now, it doesn’t look like the appetite for MicroLED has diminished and the fallout of Apple’s opting out of future MicroLED development seems to have subsided. Then there’s Samsung with Micro OLED. Maybe we should add LCOS. The more the merrier for the industry.