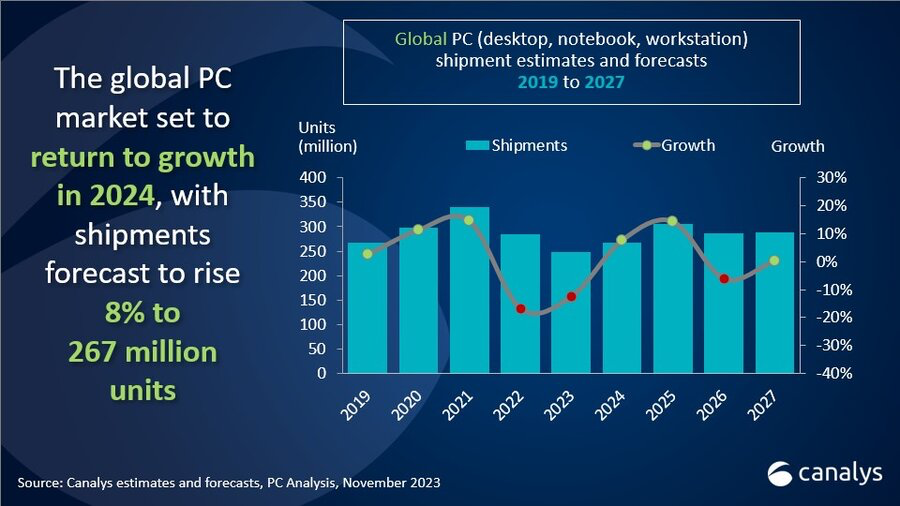

The latest forecasts from Canalys reveal that the worldwide PC market is gearing up for a rebound after facing seven consecutive quarters of downturn. Growth is anticipated to resume in Q4’23, with a 5% increase, spurred by a robust holiday season and an improving economic landscape. The projections for 2024 are even more promising from the research firm, with an 8% increase in shipments, reaching 267 million units. This uptick is attributed to factors such as the Windows refresh cycle and the introduction of AI-capable and Arm-based devices.

| Region | 2022 Shipments (million) | 2023 Shipments (million) | 2024 Shipments Projected (million) | Annual Growth (2022/2023) | Annual Growth (2023/2024) |

|---|---|---|---|---|---|

| Asia Pacific | 55.1 | 49.7 | 53.8 | -9.8% | 8.3% |

| Europe | 62.3 | 52.8 | 56.7 | -15.2% | 7.4% |

| Greater China | 53.2 | 43.6 | 45.5 | -18.0% | 4.3% |

| Middle East and Africa | 13.0 | 12.9 | 14.4 | -0.1% | 11.6% |

| Latin America | 20.1 | 17.1 | 19.2 | -14.8% | 12.2% |

| North America | 80.2 | 72.3 | 77.6 | -9.7% | 7.3% |

| Total | 283.7 | 248.5 | 267.3 | -12.4% | 7.6% |

Canalys’s analysis indicates that the global PC market is on track to match 2019’s shipment levels by next year. The integration of AI in the PC industry is expected to have a significant impact, especially with top industry players focusing on launching new AI-capable models in 2024. This advancement is likely to stimulate refresh demand, especially in the commercial sector. AI-capable PCs, including M-series Mac products and upcoming Windows-based models, are projected to make up about 19% of total PC shipments in 2024. As AI becomes a standard feature and more compelling use-cases emerge, a rapid increase in the development and adoption of AI-capable PCs is anticipated.

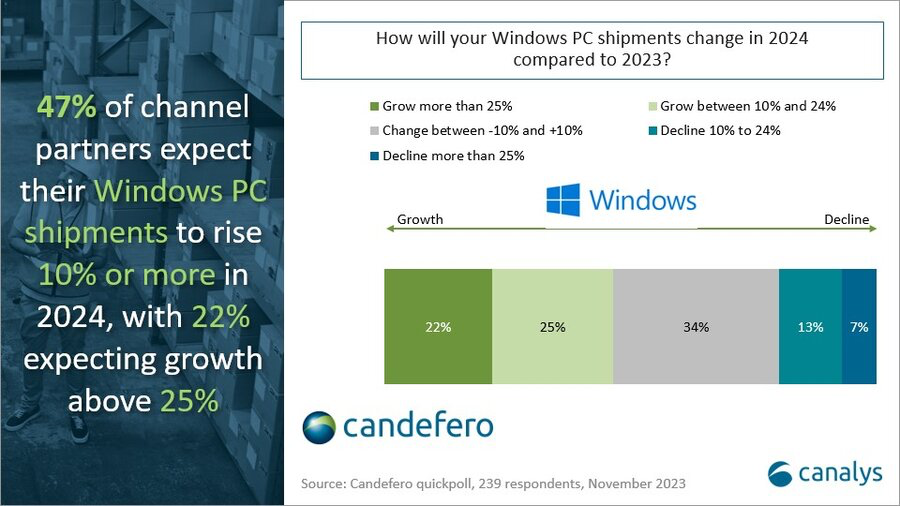

The commercial segment is also preparing for a surge in demand in 2024, following a period of postponed purchasing. Channel feedback is optimistic about PC business prospects next year, with nearly half of the partners surveyed expecting a 10% or more increase in their Windows PC shipments. Small and medium-sized businesses (SMBs) are seen as a key area for growth, having been more significantly impacted by recent economic challenges in terms of budgeting for PC procurement. The upcoming year is also expected to witness a rise in Arm-based PCs, mainly due to Qualcomm’s X Elite chip. While initial uptake in commercial settings might be moderate, the advantages in power efficiency and battery life these PCs offer are poised to enhance the options available to customers.