2015 is likely to have been the last year of double-digit smartphone growth, IDC has forecast. 2015 shipments were up 10.4% YoY, to 1.44 billion units. Although projections for 2016 are higher (1.5 billion units), this will only represent 5.7% YoY growth. This trend of single-digit growth is expected to continue through the forecast period. Volumes will reach 1.92 billion by 2020, shifting to favour the low end. ASPs will drop from $295 in 2015 to $237 in 2020.

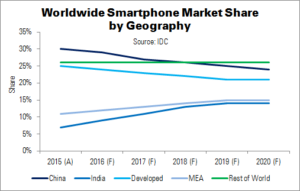

Mature markets such as the USA, China and Western Europe were already in single-digit growth last year. Developing regions like India and MEA, though, remained healthy.

Ryan Reith, programme director for IDC’s Quarterly Mobile Phone tracker, said that the weakening of mature markets is bad news for Apple and the high-end Android space. “I believe Apple’s move into the trade-in business with its ‘Trade Up with Instalments’ programme is aimed at further increasing churn in some of its most lucrative markets, despite the high penetration rates”, he said. “By entering this space, Apple can more tightly control the trade-in offerings, as well as monitor the demand for where these perfectly functioning 1-year old iPhones end up. The latter is just as important as the trade-in location as it will give Apple a strong pulse on areas of high demand but perhaps less disposable income”.

IDC believes that many of 2016’s new devices will continue with the existing large-screen trend. Research manager Anthony Scarsella said, “Phablets [accounted] for 20% of all smartphone volumes in 2015, with expectations that volumes will grow to 32% in 2020, or 610 million shipments”.

Android phablet growth is expected to be in-line with the growth from 20% to 32%. Apple’s phablet devices are expected to grow from a 26% share in 2015 to 31% in 2020.

IDC’s predictions for the Android platform are much the same as the previous forecast. Shipments are expected to grow from 1.17 billion (2015) to 1.62 billion (2020). Smartphone share will rise to 85%, from 81%, over the same period.

Android’s largest volume opportunity is in the low-cost space, an area on which it is already capitalising: only 14% of Android shipments were of devices costing $400 or more. This also poses the largest challenge for Android OEMs, as margins on low-cost models are thin at best. Competition in the segment also continues to rise.

2015 was a ‘tremendous’ year for Apple, with a new shipment record of 231.5 million units, and 20.2% YoY growth: almost double that of the overall smartphone market. The company also managed to grow its ASPs, from $663 in 2014 to $713. The primary catalyst was continued upgrades to new, more expensive iPhones.

IDC expects 2016 to be largely flat for iPhone shipments. However, growth is expected to resume in 2017 and beyond, as Apple’s trade-in programmes will expand to markets outside of North America.

Windows Phone continued to be challenged in 2015, with shipments falling 18% YoY to 11.1 million units. Roughly 95% of volume from Microsoft- or Nokia-branded devices. There were a few new Windows Phone products shown at the recent MWC show, ‘although it remains unclear how serious the Windows Phone offerings will be from OEMs’, said IDC.

| Worldwide Smartphone Forecast by OS (Shipments in Millions) (Forecast Data) | |||||||

|---|---|---|---|---|---|---|---|

| Operating System | 2016 Shipments | 2020 Shipments | 2016 Share | 2020 Share | 2016 YoY Change | 2020 YoY Change | 5-Year CAGR |

| Android | 1,254.6 | 1,624.4 | 82.6% | 84.6% | 7.6% | 4.6% | 6.9% |

| iOS | 231.2 | 269.0 | 15.2% | 14.0% | -0.1% | 3.2% | 3.0% |

| Windows Phone | 23.8 | 17.8 | 1.6% | 0.9% | -18.5% | -5.7% | -9.4% |

| Others | 9.5 | 9.2 | 0.6% | 0.5% | -15.1% | 4.8% | -3.9% |

| Total | 1,519.0 | 1,920.4 | 100.0% | 100.0% | 5.7% | 4.3% | 6.0% |

| Source: IDC | |||||||

Analyst Comment

We believe that Microsoft will reposition Windows Phone as a B2B platform soon. The Continuum feature and integration with existing Windows systems have had an enthusiastic response from vendors, and were the main highlights of Microsoft’s MWC presence. However, the company must also be careful not to become too niche and ‘do a Blackberry’.

Expanding the app selection is key to keeping consumers (and enterprise users) interested in the platform, and Microsoft has previously discussed solutions including adding the Android app store, or making it easy to port Android and iOS apps to Windows Phone. However, the Android version of the tool, dubbed ‘Astoria’, appears to have been put on hold (Windows-Android Integration Hits Delay). (TA)