While the overall Tablet market contracts in 2015, 2-in-1 Detachable Tablets have become a bright spot.

According to a new Strategy Analytics’ Tablet & Touchscreen Strategies report, traditional PC vendors like Asus, Acer, and HP have found a niche in which they can credibly compete against mobile device heavyweights, as the segment is forecast to grow 91 percent over the next five years due to lower prices and better designs.

Click here for link to report:

Q3 2015: Tablet Customer Type, Channel Type & Form Factor Shipment Forecast by Region 2010 – 2019 (http://sa-link.cc/2in1Tablet2015)

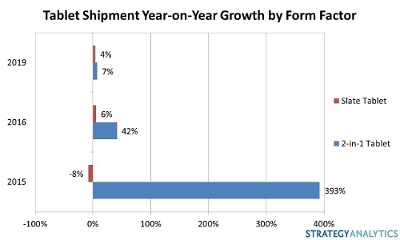

- By 2019, 2-in-1 Tablet growth will show a five-year compound average growth rate (CAGR) of 57 percent while Slate Tablet growth will amount to a 2 percent five-year CAGR

- The overall Tablet market is set to decline 4 percent in 2015, with modest growth returning in 2016 due to more innovative designs and enabling technology in 2-in-1 and Slate Tablets alike

- Microsoft has legitimized the Windows-based Tablet with the Surface Pro 3 and the lower-cost Surface 3; in combination with the boom in 2-in-1 Tablet sales, Windows Tablet market share will reach 10% in 2015

Source: Strategy Analytics’ Tablet & Touchscreen Strategies service

Quotes:

Peter King, Service Director, Tablet & Touchscreen Strategies, said, “The timing could not be better for 2-in-1 Tablets as Windows 10 makes the multi-mode computing experience smoother, Intel’s Skylake processors hit the market at the end of 2015, and Windows Tablets have become more cost-competitive with Android Tablets. Windows provides a familiar environment for traditional PC vendors to compete in the Tablet market and also gives CIOs a higher level of comfort when considering higher-end Tablets in the commercial setting.”

Eric Smith, Senior Analyst, Tablet & Touchscreen Strategies, added, “Vendors have refined 2-in-1 Tablet products in the last year to be affordable and functional and there is plenty of headroom for the segment to grow in the next five years as White Box vendors seek to differentiate their low-cost products. The growth rate among 2-in-1 Tablets will far outpace those of traditional Slate Tablets, though from a smaller base, as they compete for the spot of the secondary computing device in the home.”