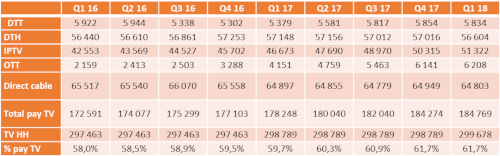

Following Dataxis’ latest research, the European pay TV market reached 185 million subscribers during the first quarter of 2018 and grew only by 0,3% compared to Q4 2017. This is the lowest net add ever observed by Dataxis.

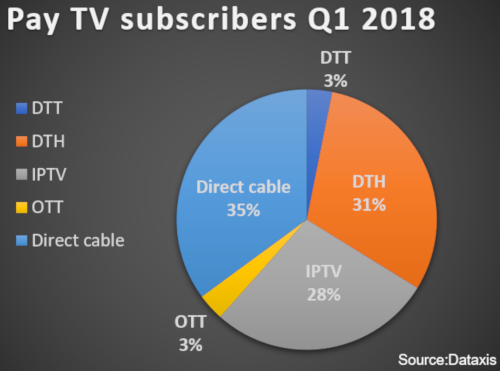

35% of the Pay TV subscribers receive direct cable, 31% satellite and 28% IPTV. OTT and DTT both represents only 3% of the subscribers’ total.

Direct cable1 is still the most used technology in Europe and represents almost 65 million subscribers, including 42 million for only digital cable, but decreased slightly in Q1 2018. Liberty Global/ Vodafone accounts for 31% of the subscribers. The indirect cable market amounts to 18 million customers.

The satellite (DTH) market decreased more substantially in Q1 2018, with 400 000 fewer subscribers than in Q4 2017 (-0,72%). Dataxis estimates that Sky Group and Tricolor (Russia), which together hold 50% of the market, have lost 140 000 and 80 000 customers respectively.

The DTT market remained stable in Q1 2018, losing only 0,35% of its subscribers, but tends to decline despite the launch of Freenet in Germany in 2017, which accounts for 18% of the DTT subscribers and gained 47 000 customers during the last quarter.

On the other hand, the IPTV market in Europe continued its growth in Q1 2018, with 1 000 000 more subscribers compared to Q4 2017 (+2,0%). The main players in this market are Orange (France) and Rostelecom (Russia), which account for respectively 10% and 13% of the IPTV subscribers.

Despite representing only 3% of the pay TV market, OTT grew significantly in terms of subscribers, especially when compared to Q4 2016 (+47%). Play Now (Poland) holds 25% of the total OTT subscribers.

1 A distinction is made between cable service directly provided by an operator to a customer and cable distributed via landlords to the tenants of a building. According to Dataxis, the indirect cable market amounts to 18 million customers.