China’s annual “11.11” shopping festival saw a surge in online sales this year, propelled by government incentives and evolving consumer trends, according to data from IDC. Ecommerce channels outpaced offline sales, with the electronics sector benefiting directly from a national policy package aimed at boosting consumption.

The government’s Action Plan for Promoting Large-scale Equipment Renewal and Consumer Goods Trade-in encouraged spending across three key areas and 11 product categories. Discounts of up to 15%-20% on select items—offered through major ecommerce platforms and manufacturer websites—helped stimulate consumer purchases.

The August release of the blockbuster video game Black Myth: Wukong generated heightened interest in gaming PCs, helping sustain demand through September and October. Coupled with back-to-school shopping and a global device replacement cycle, the shopping festival started earlier than usual, with many promotions kicking off as early as October 15.

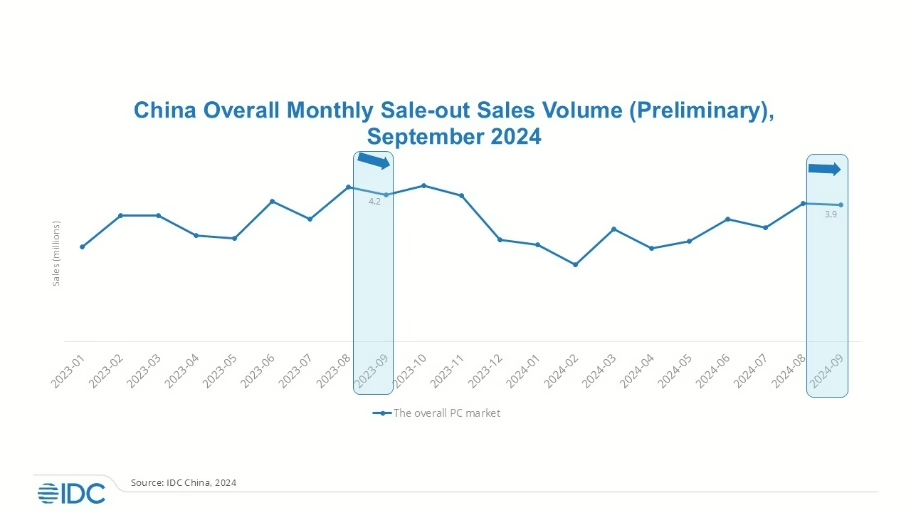

PC shipments in September remained stable compared to August, bucking the seasonal slowdown typically observed during that period. JD.com reported a 100% surge in online shipments for some manufacturers in Beijing during early September.

China’s PC market is projected to reach 40.3 million units in 2024, with 45% of shipments conducted through online channels. Business buyers also favored ecommerce for streamlined procurement processes.

Mobile phones outperformed PCs during the festival, with brands like Huawei, Honor, vivo, and Oppo launching new products in October. This preemptive marketing strategy boosted smartphone sales, leading to a 5% YoY growth in shipments for 2024. 48.6% of smartphone sales were conducted online during the quarter.

Tablets also benefited from ecommerce-driven growth, with shipments through online channels accounting for 47.5% of the market in Q4. Leading ecommerce companies sustained a 5% YoY increase in tablet shipments during October, outperforming the PC market.

IDC identified three standout trends for this year’s shopping festival. First, the market saw an accelerated growth cycle, peaking in mid-to-late October and tapering off in November. Second, online sales surged ahead of offline channels due to the convenience of ecommerce platforms. Finally, while mobile phones, tablets, and PCs all gained from policy incentives, smartphones and tablets posted stronger growth rates than PCs.