PC graphics add-in board (graphics cards) shipments rose 0.8% YoY in Q2’16, and fell 20.8% QoQ, says Jon Peddie Research. Market shares also shifted, with AMD gaining share at the expense of Nvidia.

AIBs represent the higher-end of the graphics market. They carry discrete GPUs and private memory dedicated to the GPU. There are only three GPU suppliers in the market which also buy and sell AIBs, with the largest being AMD and Nvidia. There are 48 AIB suppliers (the OEM customers of the GPU suppliers).

| GPU Supplier Share Changes, Q2’16 | |||

|---|---|---|---|

| Vendor | Q2’16 | Q2’15 | Q1’16 |

| AMD | 29.9% | 18.0% | 22.8% |

| Nvidia | 70.0% | 81.9% | 77.2% |

| Total | 100.0% | 100.0% | 100.0% |

| Source: JPR | |||

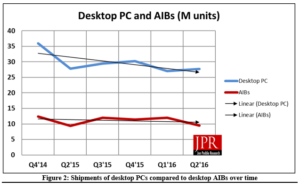

JPR reports that results for Q2 were ‘encouraging’. Although the AIB market was down QoQ, this was seasonally understandable. The 20.8% fall was below the 10-year average of -9.7%. However, the 0.8% YoY rise was greater than the result for desktop PCs, which were down 0.2%.

Overall GPU shipments (integrated and discrete) are higher than desktop PC shipments due to double-attach: adding a second or third AIB to a system to raise its performance. It is worth noting that the attach rate of AIBs to desktop PCs has fallen from its peak of 63% in Q1’08 to 34% this quarter. This is down 22.7% QoQ and up 1% YoY.